- United States

- /

- Hospitality

- /

- OTCPK:LKNC.Y

Luckin Coffee (OTCPK:LKNC.Y): How Current Valuation Stacks Up After Recent Share Price Volatility

Reviewed by Simply Wall St

Luckin Coffee (OTCPK:LKNC.Y) has been the subject of steady investor discussion following its recent stock performance. After experiencing some ups and downs over the past month, the company’s shares offer an interesting case for value watchers.

See our latest analysis for Luckin Coffee.

Luckin Coffee’s share price has been on a wild ride, with a 6.41% dip over the past month but a sharp 39.4% gain year-to-date. Investors clearly sense both risks and growth potential here. Over the past year, total shareholder return reached an impressive 60.5%. The three- and five-year total returns of 109% and 699% underline just how much momentum has built up behind the company.

If you’re watching Luckin’s rapid rise, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

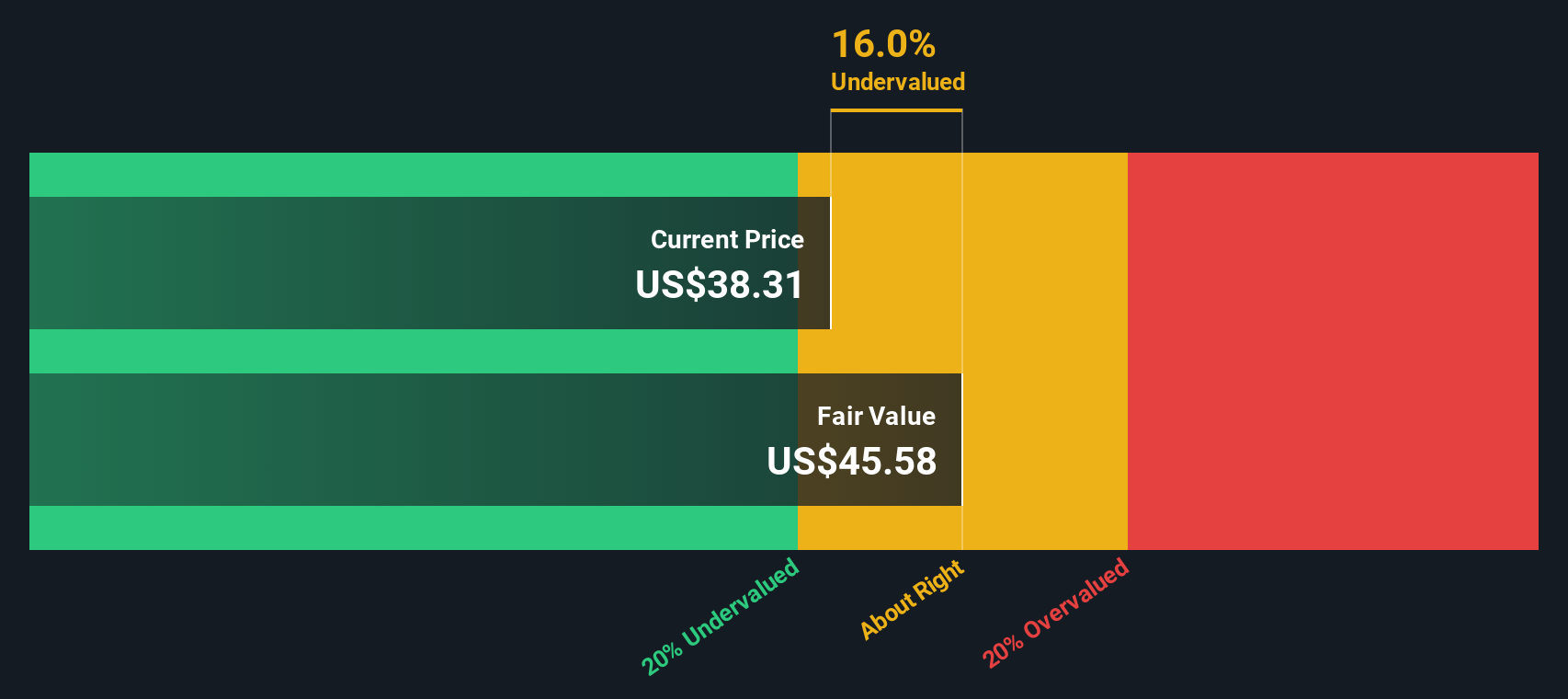

With Luckin Coffee’s fundamentals and recent performance in mind, the big question becomes clear: is the company’s current valuation a sign that there is still value to be unlocked, or has the market already factored in its next chapter of growth?

Most Popular Narrative: 22% Undervalued

The consensus valuation points to a fair value of $48.24 per share, which is well above the last closing price of $37.53. This creates the potential for significant upside if the narrative’s assumptions are accurate.

Accelerating customer acquisition and record-high monthly transacting users, supported by digital ordering, app-based engagement, and promotional campaigns, positions Luckin to benefit from the increasing preference for digital transactions and app-driven purchases. These trends may boost frequency per customer and thus contribute to higher recurring revenues and improved customer lifetime value.

Curious what supports this bold estimate? The narrative is based on Luckin’s ability to deliver strong earnings growth and achieve profit multiples that are uncommon outside of the technology sector. Interested in how aggressive these analyst forecasts might be? Explore the full narrative to learn more about the story behind this valuation.

Result: Fair Value of $48.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid store expansion or shifts in consumer preferences could threaten Luckin's growth story and challenge the current bullish valuation narrative.

Find out about the key risks to this Luckin Coffee narrative.

Another View: SWS DCF Model Suggests a Different Fair Value

While analyst consensus sees Luckin Coffee as undervalued, the SWS DCF model takes a more cautious approach. According to our DCF estimate, the current share price of $37.53 is above our fair value calculation of $29.54. This suggests the market might be a bit ahead of itself right now. Does this mean the optimism has run too far, or is there more to the story than the numbers show?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Luckin Coffee for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Luckin Coffee Narrative

If you see the story differently or want to dig into the numbers yourself, it's easy to build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Luckin Coffee.

Looking for more investment ideas?

Smart investors never stop searching for their next winning opportunity. Don’t miss your chance to uncover powerful trends, sector breakthroughs, and untapped value today.

- Tap into the potential of companies revolutionizing healthcare by checking out these 31 healthcare AI stocks with game-changing innovations and AI-driven breakthroughs.

- Supercharge your income strategy and gain access to a list of rock-solid picks by pursuing these 18 dividend stocks with yields > 3% with yields above 3%.

- Seize the moment and hunt for market mispricings across these 906 undervalued stocks based on cash flows, based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LKNC.Y

Luckin Coffee

Offers retail services of freshly brewed drinks, and pre-made food and beverage items in the People's Republic of China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)