- United States

- /

- Hospitality

- /

- NYSE:YUMC

Yum China Holdings (NYSE:YUMC) Names Adrian Ding As New Chief Financial Officer

Reviewed by Simply Wall St

Yum China Holdings (NYSE:YUMC) recently appointed Adrian Ding as its Chief Financial Officer, a decision that likely influenced the company’s share price movement. Over the past month, YUMC's stock price increased by 3%, against a backdrop of generally declining markets due to concerns about U.S. tariffs and economic outlooks. This appointment brings a focused direction in corporate finance, juxtaposed against the broader market's 2% decline, which saw technology stocks particularly hard hit with the Nasdaq down nearly 6%. Despite the challenging environment, YUMC's relatively stable increase could reflect investor confidence in the company's new executive direction. While major indices and tech shares showed mixed performance, Yum China's effective leadership change may have acted as a stabilizing factor, contributing to its resilient performance in a volatile period.

Dig deeper into the specifics of Yum China Holdings here with our thorough analysis report.

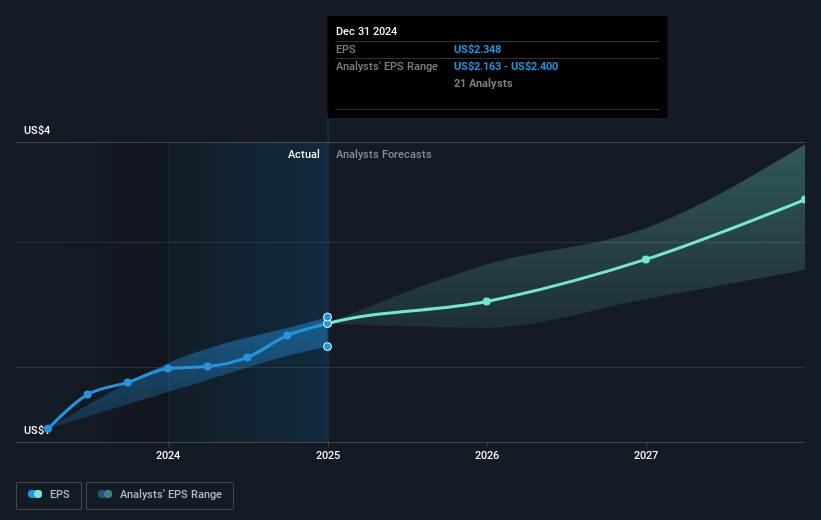

Yum China Holdings (NYSE:YUMC) has demonstrated a total return of 41.32% over the past three years. During this time, YUMC has exceeded the US market's performance over the last year, which returned 12.1%. A series of factors have supported its longer-term performance. Key earnings announcements revealed consistent revenue and net income increases, exemplified by Q4 2024 results showing sales of US$2.43 billion and a net income of US$115 million. Additionally, the company has actively expanded its footprint, with plans to open up to 1,800 new stores in 2025. These initiatives are buoyed by robust financial strategies, including share buybacks that highlighted confidence in its market valuation.

Furthermore, the company increased its cash dividend by 50% to US$0.24 per share in early 2025, underpinning a commitment to returning value to shareholders. Strategic internal changes like the appointment of new executives have also been aligned with earnings growth and operational efficiencies, such as launching a platform to enhance supplier engagement. These actions collectively highlight YUMC's comprehensive approach to sustaining growth amidst evolving market conditions.

- Learn how Yum China Holdings' intrinsic value compares to its market price with our detailed valuation report.

- Discover the key vulnerabilities in Yum China Holdings' business with our detailed risk assessment.

- Hold shares in Yum China Holdings? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YUMC

Yum China Holdings

Owns, operates, and franchises restaurants in the People’s Republic of China.

Solid track record with excellent balance sheet.