- United States

- /

- Auto

- /

- NasdaqGS:LI

US Exchange Stocks Estimated Up To 29.8% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a period of mixed futures and weekly gains, investors are closely watching major indices like the Dow Jones Industrial Average and S&P 500 for signs of sustained recovery following recent fluctuations. In this environment, identifying undervalued stocks—those trading below their intrinsic value—can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $123.13 | $244.43 | 49.6% |

| Oddity Tech (NasdaqGM:ODD) | $43.12 | $85.73 | 49.7% |

| Business First Bancshares (NasdaqGS:BFST) | $27.95 | $55.08 | 49.3% |

| West Bancorporation (NasdaqGS:WTBA) | $24.07 | $46.84 | 48.6% |

| Afya (NasdaqGS:AFYA) | $16.26 | $31.49 | 48.4% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.58 | $63.90 | 49% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $112.53 | $219.21 | 48.7% |

| WEX (NYSE:WEX) | $181.73 | $345.51 | 47.4% |

| Marcus & Millichap (NYSE:MMI) | $40.58 | $78.67 | 48.4% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $450.37 | $859.69 | 47.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Li Auto (NasdaqGS:LI)

Overview: Li Auto Inc. operates in the energy vehicle market in the People’s Republic of China with a market cap of approximately $22.72 billion.

Operations: The company generates revenue primarily from its Auto Manufacturers segment, which reported CN¥141.92 billion.

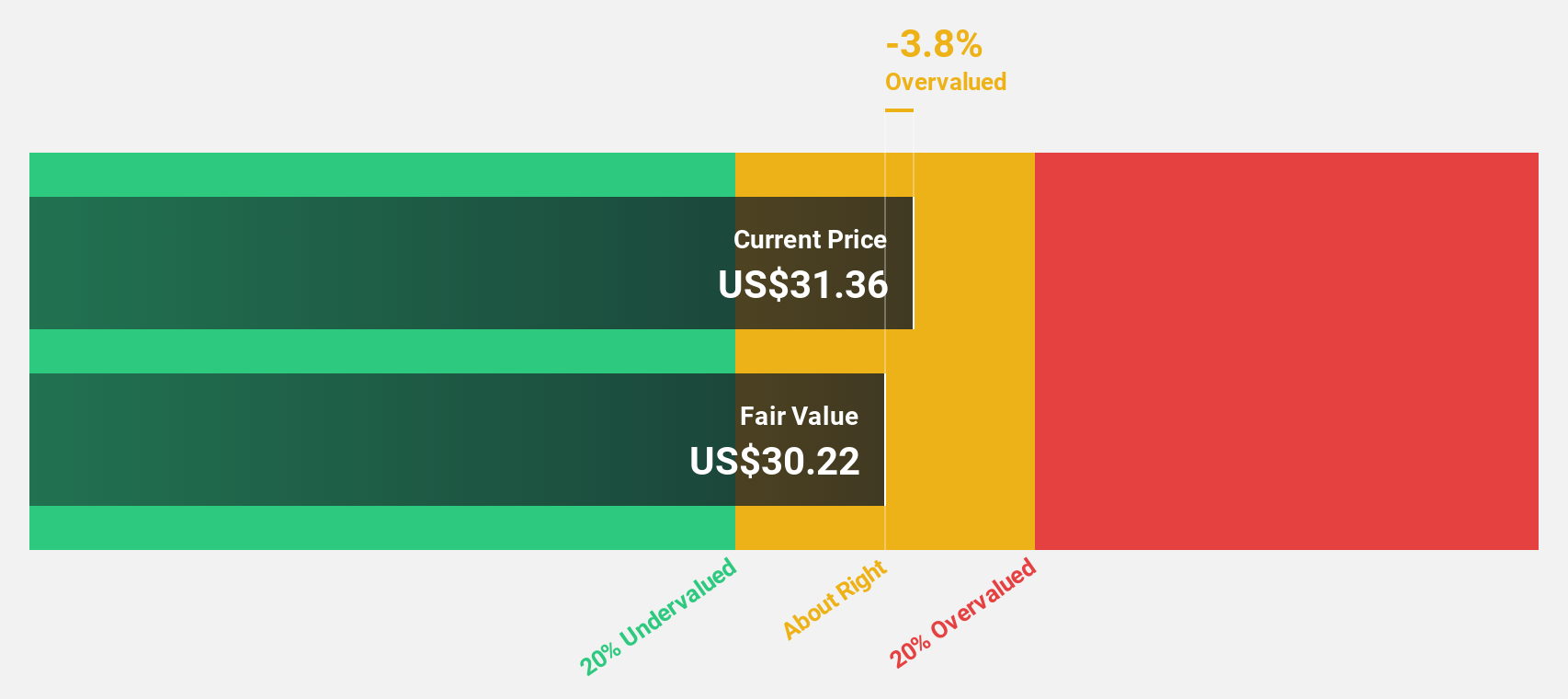

Estimated Discount To Fair Value: 28.7%

Li Auto is trading at 28.7% below its estimated fair value of US$31.69 and is considered highly undervalued based on discounted cash flow analysis. Earnings are forecast to grow significantly, outpacing the US market's growth rate, although revenue growth is slower than expected. Recent vehicle deliveries increased by 27.3% year-over-year in October 2024, with projected quarterly revenues between US$6.2 billion and US$6.5 billion, indicating solid operational performance despite a volatile share price recently.

- According our earnings growth report, there's an indication that Li Auto might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Li Auto.

Gulfport Energy (NYSE:GPOR)

Overview: Gulfport Energy Corporation is involved in the acquisition, exploration, development, and production of natural gas, crude oil, and natural gas liquids in the United States with a market cap of approximately $3.10 billion.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production segment, totaling $886.64 million.

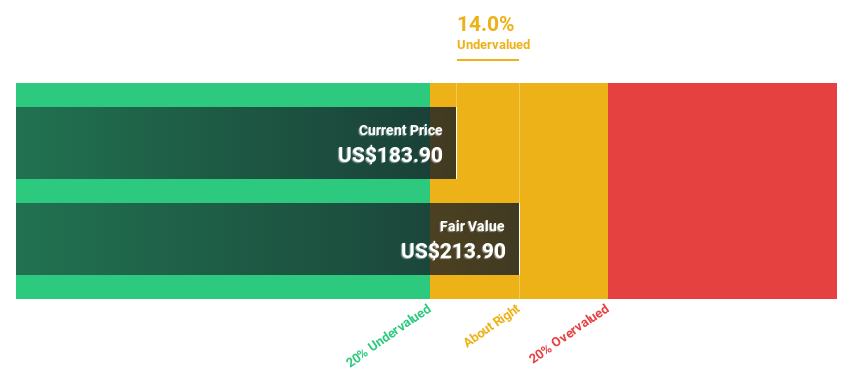

Estimated Discount To Fair Value: 16.2%

Gulfport Energy's stock trades at US$177.69, about 16.2% below its fair value estimate of US$212.06, suggesting it is undervalued based on cash flows. Despite a recent net loss of US$13.97 million for Q3 2024, earnings are expected to grow significantly faster than the market over the next three years. The company has expanded its share buyback program by US$350 million, reflecting confidence in its future financial outlook despite current challenges.

- Our growth report here indicates Gulfport Energy may be poised for an improving outlook.

- Navigate through the intricacies of Gulfport Energy with our comprehensive financial health report here.

Rush Street Interactive (NYSE:RSI)

Overview: Rush Street Interactive, Inc. operates as an online casino and sports betting company across the United States, Canada, Mexico, and the rest of Latin America with a market cap of approximately $2.76 billion.

Operations: The company's revenue is derived from its Casinos & Resorts segment, which generated $863.77 million.

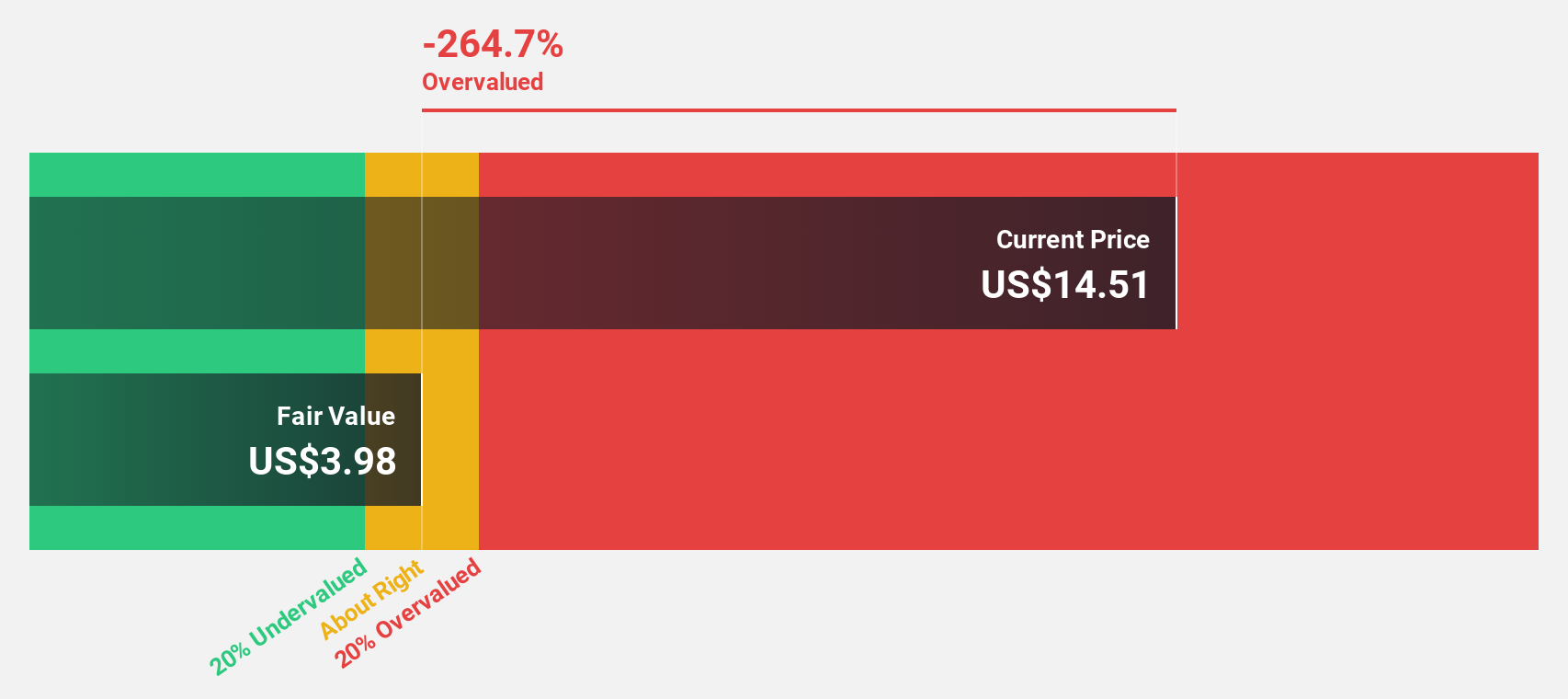

Estimated Discount To Fair Value: 29.8%

Rush Street Interactive is trading at US$13.48, about 29.8% below its estimated fair value of US$19.19, indicating undervaluation based on cash flows. The company reported a Q3 net income of US$1.19 million, reversing a loss from the previous year and expects revenue to reach up to US$920 million for 2024. With a new share repurchase program and innovative product launches like BetRivers Poker, RSI shows potential for strong future growth despite recent insider selling concerns.

- The analysis detailed in our Rush Street Interactive growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Rush Street Interactive stock in this financial health report.

Summing It All Up

- Access the full spectrum of 182 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Li Auto, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Flawless balance sheet and good value.