- United States

- /

- Hospitality

- /

- NYSE:RCL

Is Royal Caribbean Still a Good Value After Its 106% Jump in 2024?

Reviewed by Simply Wall St

If you are weighing what to do about Royal Caribbean Cruises stock right now, you are not alone. The share price has been a livewire, delivering a 106.3% jump over the past year and a remarkable 735.6% over the last three years, making those pandemic-era lows seem like ancient history. Even in the short term, Royal Caribbean is still riding some waves, up 4.5% in the last week but down 2.2% over the past month, as investors digest changing market sentiment and industry headlines.

Momentum like this makes Royal Caribbean hard to ignore, whether you are considering jumping aboard or double-checking your reasons to hold on. The cruise giant is a reopening comeback story, continuing to evolve as the company navigates shifts in consumer demand and broader economic trends. Notably, as travel appetite surges and operational constraints ease, investors seem willing to reprice the risk, driving Royal Caribbean’s stock to new heights. With a return of 50.6% just this year, there is a natural question on everyone’s mind: is the price still right?

This is where valuation comes in. Based on six different criteria, Royal Caribbean scores a 3, undervalued in half, not quite a slam dunk but certainly not a warning bell either. In the next section, I will break down how analysts assess whether the stock is undervalued using those traditional methods, and I will also share a fresh way to look at value that many investors overlook.

Royal Caribbean Cruises delivered 106.3% returns over the last year. See how this stacks up to the rest of the Hospitality industry.Approach 1: Royal Caribbean Cruises Cash Flows

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those back to today's value. This method helps determine what a business is really worth, independent of market hype.

Royal Caribbean Cruises currently generates Free Cash Flow (FCF) of $2.3 billion. Analysts project growth in the years ahead, with FCF expected to reach $6.1 billion by 2029. These forecasts are based on analyst estimates for the next five years, with additional projections extended by Simply Wall St to provide a longer-term outlook.

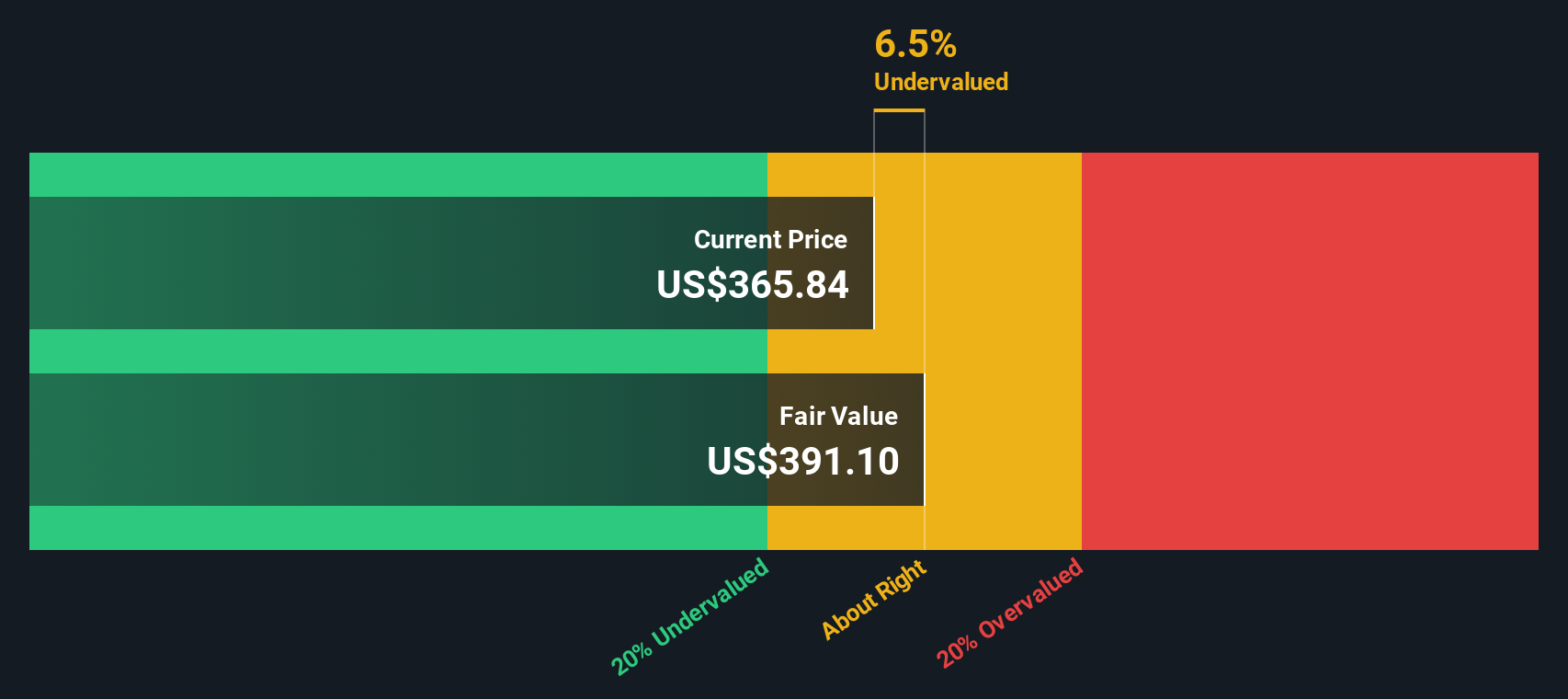

Using these projections and a standard discount rate, the DCF model calculates Royal Caribbean's intrinsic value at $391.79 per share. When compared to the current share price, the stock appears to be 12.0% undervalued.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Royal Caribbean Cruises.

Approach 2: Royal Caribbean Cruises Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies. It captures how much investors are willing to pay today for a dollar of future earnings. Since Royal Caribbean Cruises is generating consistent profits, the PE ratio offers a relevant snapshot of its valuation in the context of both its current performance and future outlook.

When comparing PE ratios, it is important to consider not just the headline numbers but also the growth expectations and risk profile. Typically, companies with strong earnings growth or lower perceived risk are awarded higher PE multiples, while those facing uncertainty or slower growth trade at lower multiples.

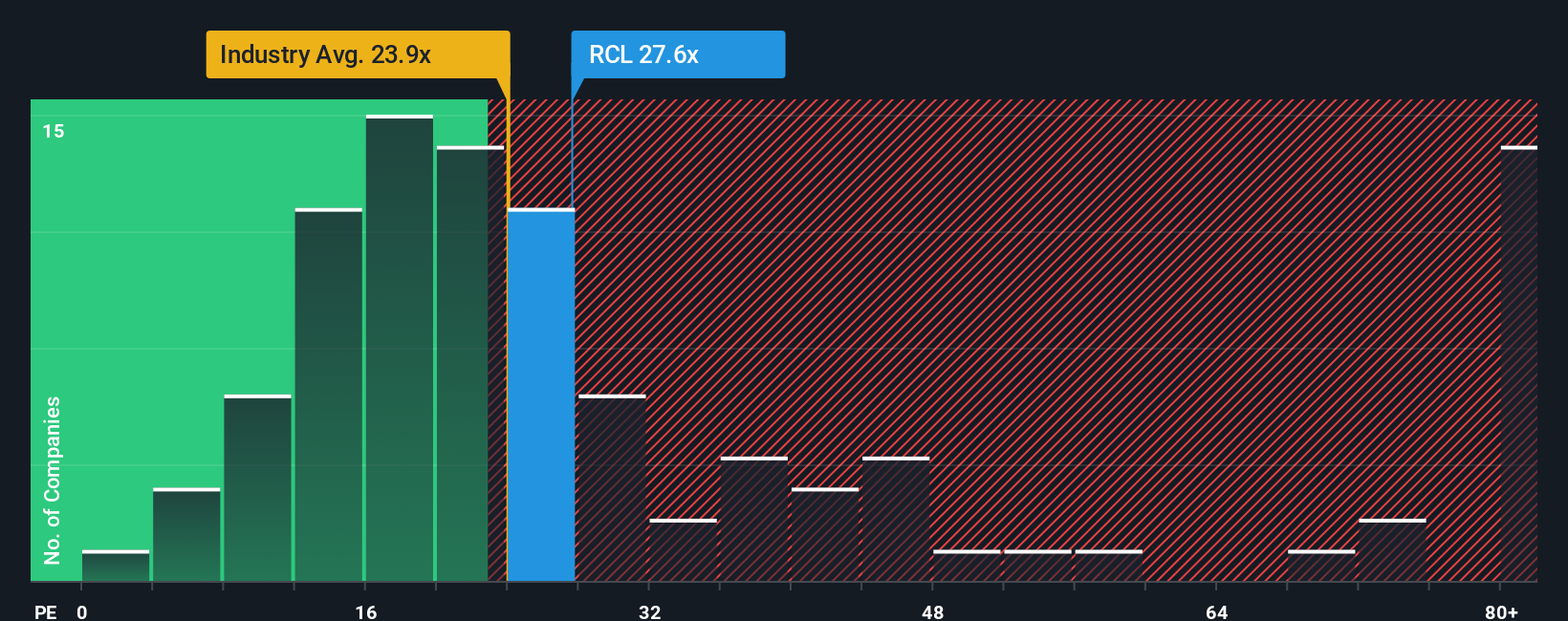

Royal Caribbean currently trades at a PE ratio of 26x. This is above the hospitality industry average of 24x and slightly below the peer group average of 29x. However, determining what constitutes a "fair" PE ratio involves more than these simple comparisons.

Simply Wall St’s proprietary Fair Ratio for Royal Caribbean is 32.8x. This metric calculates the appropriate PE multiple based on multiple factors, including the company’s earnings growth prospects, its industry, profit margin, market capitalization, and assessed risks. By factoring in these details, the Fair Ratio addresses the shortcomings of generic peer or industry comparisons and provides a much clearer view of the stock's value.

Comparing Royal Caribbean’s actual PE of 26x to its Fair Ratio of 32.8x suggests the stock is currently trading below where it could reasonably be valued, given its profile. This may indicate potential undervaluation relative to its fundamentals.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Royal Caribbean Cruises Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. In simple terms, a Narrative is your unique story or perspective about a company, weaving together your assumptions about its future revenue, earnings, and margins to estimate what you believe is a fair value. Instead of relying only on traditional metrics, Narratives connect the company's evolving business story with your financial forecasts, turning numbers into a more meaningful investment viewpoint.

Available to millions of investors in the Community section of Simply Wall St's platform, Narratives make it easy and accessible to clarify why you think the stock is worth what it is, and help you track your thinking over time. They let you compare your fair value to the current share price so you can confidently decide when it might be time to buy, hold, or sell. Plus, since Narratives automatically update as new information or earnings are released, your perspective can adapt just as quickly as the story changes.

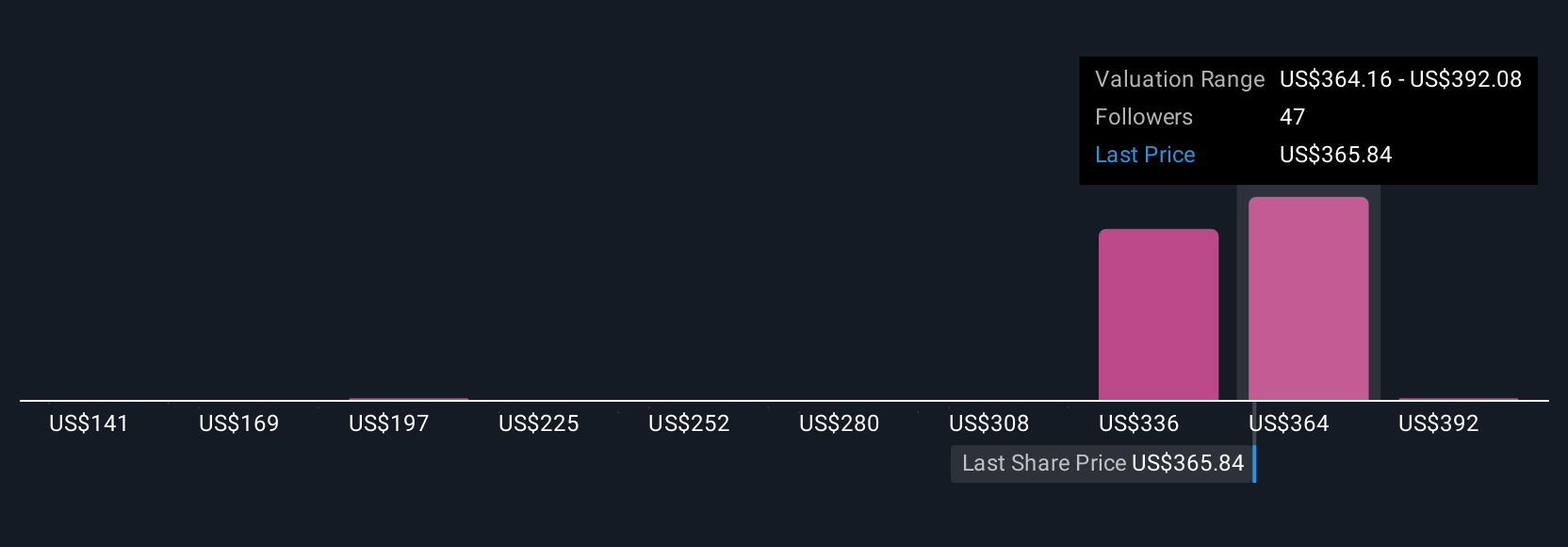

For Royal Caribbean Cruises, for example, the most optimistic Narrative values the company at $420 per share, while the most cautious perspective sees it at just $218. This highlights the diverse beliefs and forecasts that investors bring to the table.

Do you think there's more to the story for Royal Caribbean Cruises? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives