- United States

- /

- Hospitality

- /

- NYSE:PRKS

What United Parks & Resorts (PRKS)'s Alleged Hidden Fees Lawsuit Means for Shareholders

Reviewed by Sasha Jovanovic

- Earlier this week, United Parks & Resorts, the parent company of SeaWorld and Busch Gardens, was sued in Virginia for allegedly using deceptive fee practices and violating consumer protection laws by hiding mandatory charges until late in the ticket purchase process.

- This legal action highlights growing scrutiny of pricing transparency across the theme park industry and raises questions about how such practices might affect customer trust and regulatory compliance for operators.

- We'll explore how ongoing concerns around pricing transparency and regulatory risk could reshape elements of United Parks & Resorts’ investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

United Parks & Resorts Investment Narrative Recap

To be optimistic about United Parks & Resorts as a shareholder, you need to believe that strong demand for themed entertainment, new attractions, and consumer interest in experiences will outweigh regulatory and reputational risks. The recent Virginia lawsuit focused on alleged deceptive fee practices draws attention to transparency concerns, but it does not appear to materially impact the main short-term catalysts: resilient bookings and new ride launches; however, it does reinforce customer trust as a key business risk.

Among recent announcements, the launch of SeaWorld Orlando’s Expedition Odyssey experience stands out for its alignment with the company’s catalyst: leveraging fresh attractions to boost attendance and guest spending. While this supports near-term growth, ongoing regulatory concerns add a layer of unpredictability to how effectively new offerings translate into long-term financial gains.

By contrast, investors should be aware that regulatory compliance is under sharper scrutiny and continued attention to...

Read the full narrative on United Parks & Resorts (it's free!)

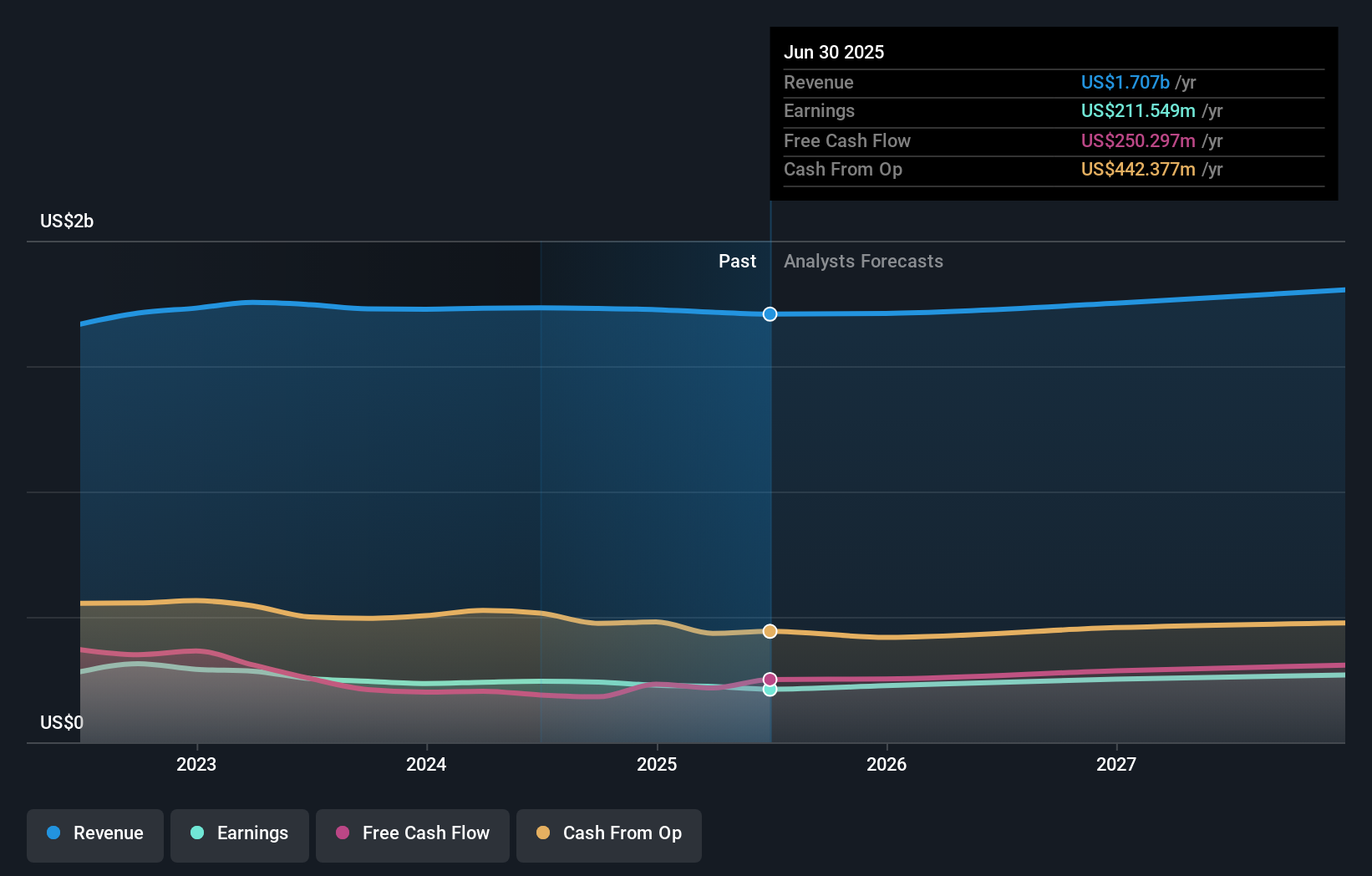

United Parks & Resorts is forecast to reach $1.8 billion in revenue and $284.5 million in earnings by 2028. This projection assumes a 2.1% annual revenue growth rate and an earnings increase of $73 million from the current $211.5 million.

Uncover how United Parks & Resorts' forecasts yield a $57.45 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community supplied one fair value estimate for United Parks & Resorts at US$57.45. As regulatory focus on pricing practices rises, it is important to consider how greater uncertainty could affect future performance, see what other community members think about possible outcomes.

Explore another fair value estimate on United Parks & Resorts - why the stock might be worth just $57.45!

Build Your Own United Parks & Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parks & Resorts research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Parks & Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parks & Resorts' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRKS

United Parks & Resorts

Operates as a theme park and entertainment company in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives