- United States

- /

- Hospitality

- /

- NYSE:LTH

Life Time (LTH): Exploring Valuation After Bold New Fitness Initiatives and Member Engagement Push

Reviewed by Kshitija Bhandaru

Life Time Group Holdings (NYSE:LTH) has been making some waves lately, announcing two high-energy initiatives that could reshape how members interact with its clubs and digital platform. The company revealed the upcoming launch of the LT Games, a hybrid-athlete competition designed to showcase both intensity and inclusivity across 17 distinct fitness challenges, along with major prize money for top finishers. Just days later, Life Time also brought back its 30 Strong Challenge, a month-long wellness program on its app that has attracted tens of thousands of members in past years and now comes with even more health-minded habits to build on its momentum.

These dual announcements are landing at a fascinating moment for the stock. Life Time’s shares have climbed 26% so far this year and are up 14% over the past year, suggesting growing optimism around its business model and new member-driven initiatives. While momentum looked shaky over the past month and quarter, the company’s track record for steady annual revenue and net income growth, as well as its push for bigger community events, hint at an evolving story beyond just gym memberships.

So, is the market undervaluing Life Time’s innovation pipeline, or is all the future growth already baked into the current share price?

Most Popular Narrative: 27.6% Undervalued

According to the most widely followed narrative, Life Time Group Holdings is currently viewed as significantly undervalued, trading well below its estimated fair value based on future earnings projections and profitability growth.

The expanding pipeline of new and larger club openings in affluent and high-density markets positions Life Time for sustained membership and top-line revenue growth. The company is benefiting from growing consumer demand for premium health, wellness, and lifestyle experiences. Accelerating growth in ancillary, higher-margin services, including personal training, Life Time Digital offerings, nutritional supplements, and health and wellness programs, supports increased average revenue per member and improved net margins as consumer expectations shift toward holistic wellness.

Curious about what propels this bullish outlook? The narrative hints at ambitious growth in membership, revenues, and profit margins, along with a future profit multiple that goes beyond the sector’s norm. Want to uncover the bold projections and the crucial financial leaps backing this valuation? Prepare to be surprised by the potential upside that analysts are betting on.

Result: Fair Value of $39.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising construction costs or an economic downturn impacting high-end memberships could quickly challenge this bullish outlook and change growth expectations.

Find out about the key risks to this Life Time Group Holdings narrative.Another View: A Model-Based Assessment

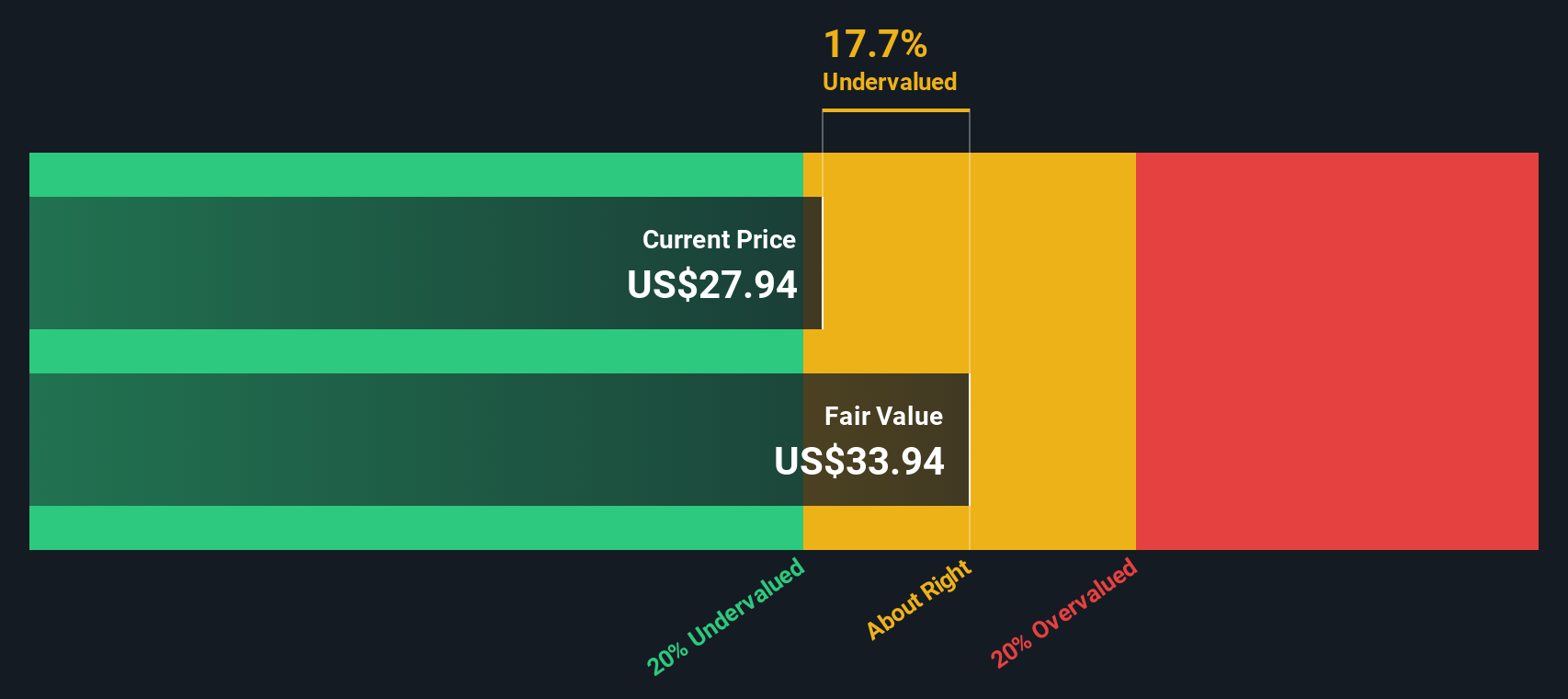

Switching gears, our DCF model also suggests Life Time is trading below its intrinsic value. This reinforces the earlier optimism. However, does this approach capture all the risk and growth factors, or is something missing?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Life Time Group Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Life Time Group Holdings Narrative

If you want to dive deeper, challenge these assumptions, or craft your own perspective, it only takes a few minutes to assemble your unique view. Do it your way.

A great starting point for your Life Time Group Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Confident investors know that new opportunities are everywhere, but only if you know where to look. Give yourself an edge and stay ahead of the pack by zeroing in on handpicked stocks built for the future. Don’t let your next winner pass you by.

- Uncover steady income plays by adding dividend stocks with yields > 3% to your watchlist for reliable yields and defensive growth potential.

- Get a jump on tech’s next chapter by searching AI penny stocks taking artificial intelligence innovation to the next level.

- Find companies flying under the radar with undervalued stocks based on cash flows primed for a turnaround based on strong fundamentals and discounted valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTH

Life Time Group Holdings

Provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives