- United States

- /

- Hospitality

- /

- NYSE:LTH

Life Time (LTH) Expands Work Lounge Offerings: Exploring the Stock's Valuation After New Growth Initiative

Reviewed by Simply Wall St

Most Popular Narrative: 25.9% Undervalued

According to the most widely referenced narrative, Life Time Group Holdings appears significantly undervalued compared to its estimated fair value, based on future growth and margin projections. Analysts see strong multi-year potential driving this estimate.

The expanding pipeline of new and larger club openings in affluent and high-density markets positions Life Time for sustained membership and top-line revenue growth. This expansion benefits from the growing consumer demand for premium health, wellness, and lifestyle experiences. Accelerating growth in ancillary, higher-margin services, including personal training, Life Time Digital offerings, nutritional supplements, and health and wellness programs, supports increased average revenue per member and improved net margins as consumer expectations shift toward holistic wellness.

Curious about what powers this bullish outlook? One key forecast in this narrative includes bold targets for revenue and profit margins far above past averages, but the most surprising details are still under wraps. Want to know which single growth lever could be a game changer, and just how high analysts expect those earnings to climb? Keep reading to unlock the projections and pressure points behind this potential valuation surge.

Result: Fair Value of $39.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected shifts in real estate markets or a downturn in luxury demand could quickly challenge the bullish outlook for Life Time’s expansion.

Find out about the key risks to this Life Time Group Holdings narrative.Another View: A Market Multiple Perspective

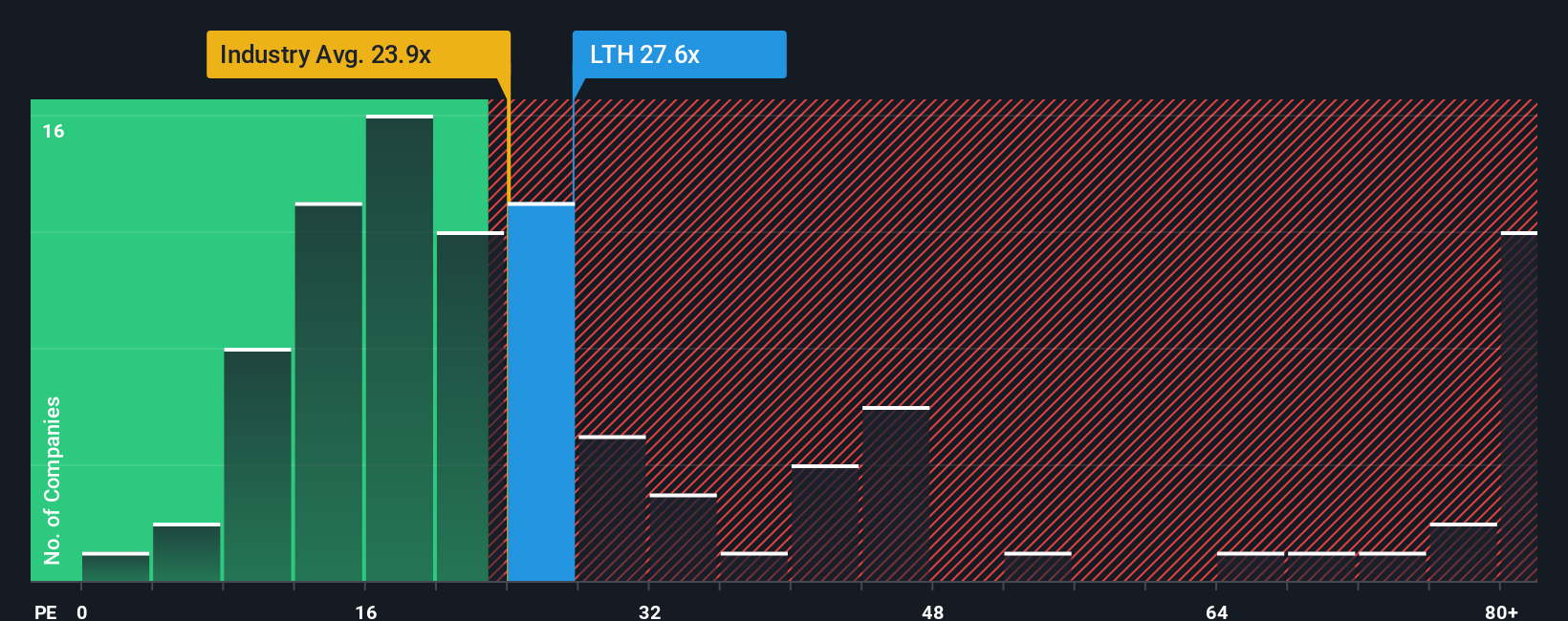

While our initial outlook suggested that Life Time Group Holdings is undervalued versus its fair value, a look through a different lens tells a more cautious story. Compared to the industry, the stock is trading at a premium, raising the question: has the market already rewarded recent successes?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Life Time Group Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Life Time Group Holdings Narrative

If you want to take a closer look, challenge the conclusions, or simply investigate the numbers for yourself, it is easy to piece together your own perspective in just a few minutes. Do it your way.

A great starting point for your Life Time Group Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Your next big win could be just a few clicks away. Don’t let great stocks get away. Check out these handpicked ideas and capture tomorrow’s standouts today:

- Spot companies trading far below their true value and get ahead of the crowd by using our undervalued stocks based on cash flows tool.

- Tap into the booming world of next-generation healthcare with stocks powered by artificial intelligence, thanks to our healthcare AI stocks resource.

- Unlock new ways to earn steady income with market leaders offering strong yields via our dividend stocks with yields > 3% list.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:LTH

Life Time Group Holdings

Provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives