- United States

- /

- Hospitality

- /

- NYSE:HLT

Is Hilton Still Attractive After a 161.1% Five Year Surge?

Reviewed by Bailey Pemberton

- Wondering if Hilton Worldwide Holdings is still a smart buy after such a strong multi year run, or if the easy money has already been made? This breakdown will help you decide whether the current price still makes sense.

- Despite a slight pullback of about 1.2% over the last week, Hilton is up roughly 9.4% over the past month, 14.7% year to date, and 106.2% over three years and 161.1% over five years. This naturally raises questions about how much upside is left from here.

- Those gains have come as Hilton has leaned into asset light growth, expanded its global pipeline, and continued to push its loyalty ecosystem. The market tends to reward these features with richer multiples when demand looks resilient. At the same time, ongoing expansion in higher margin segments and steady development signings have reinforced the narrative that Hilton is positioned as one of the stronger brands in global travel, even as investors keep one eye on macro risks.

- Yet, on our numbers Hilton currently scores just 0/6 on our valuation checks, suggesting it does not screen as undervalued on any of the standard metrics we use. Next we will unpack what different valuation approaches say about that price tag, and then circle back at the end to a more nuanced way of thinking about what Hilton might really be worth.

Hilton Worldwide Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hilton Worldwide Holdings Discounted Cash Flow (DCF) Analysis

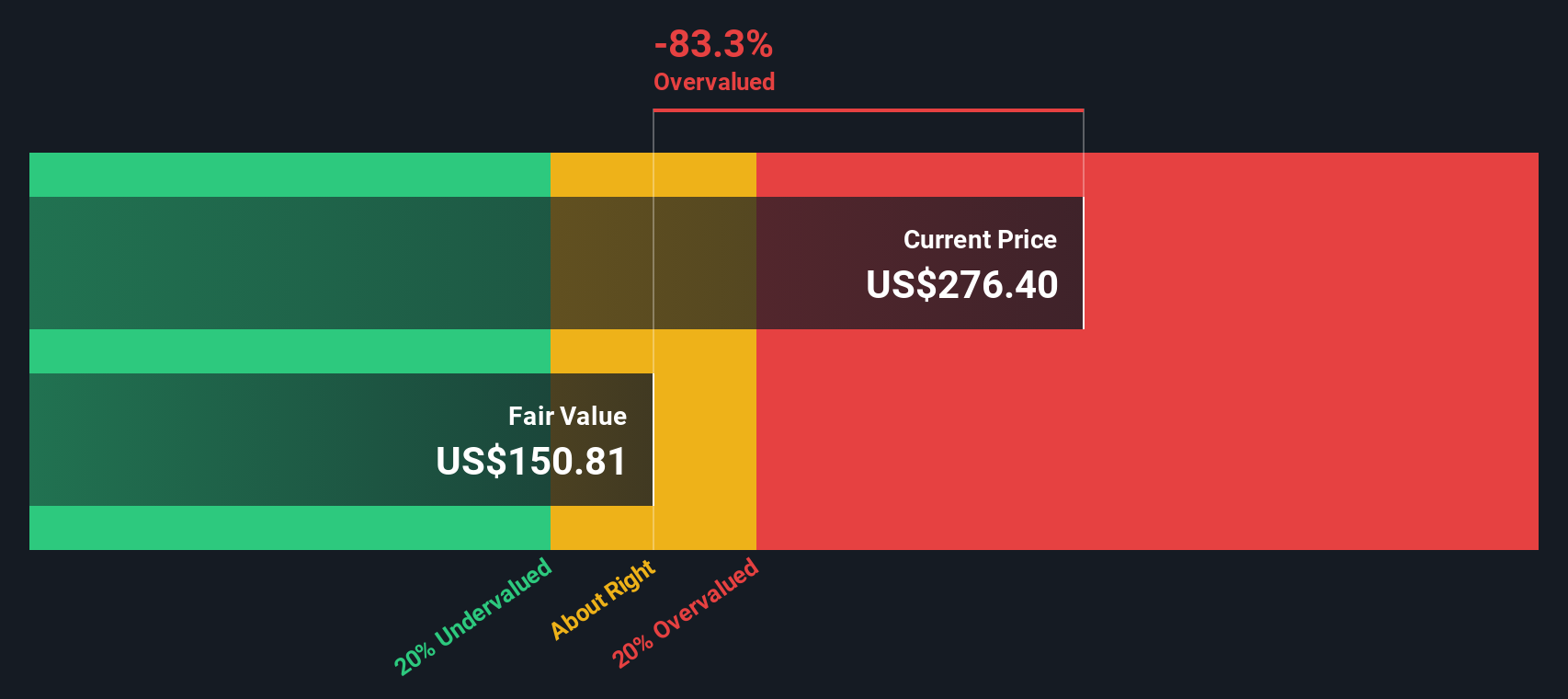

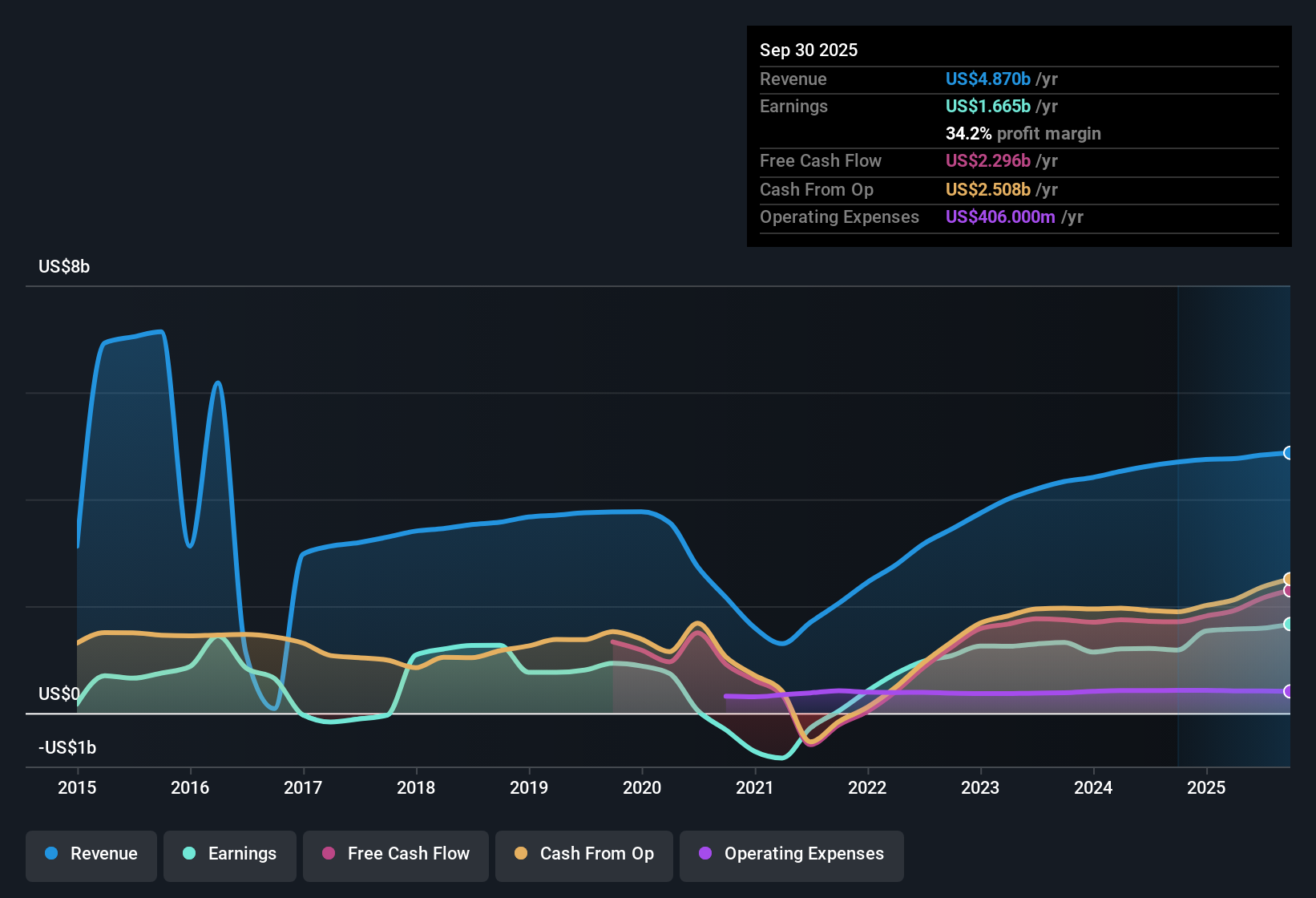

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in $ terms. For Hilton Worldwide Holdings, the 2 Stage Free Cash Flow to Equity model starts with last twelve month free cash flow of about $2.29 billion, then applies analyst forecasts for the next few years and extrapolates out to 2035.

On Simply Wall St projections, free cash flow is expected to rise to roughly $2.83 billion by 2035, with growth gradually slowing over time as the business matures. All of these future $ cash flows are discounted back to today, which yields an estimated intrinsic value of about $168 per share.

Compared with the current share price, this implies the stock is around 67.4% overvalued on a DCF basis. This suggests the market is already pricing in very optimistic long term expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hilton Worldwide Holdings may be overvalued by 67.4%. Discover 933 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hilton Worldwide Holdings Price vs Earnings

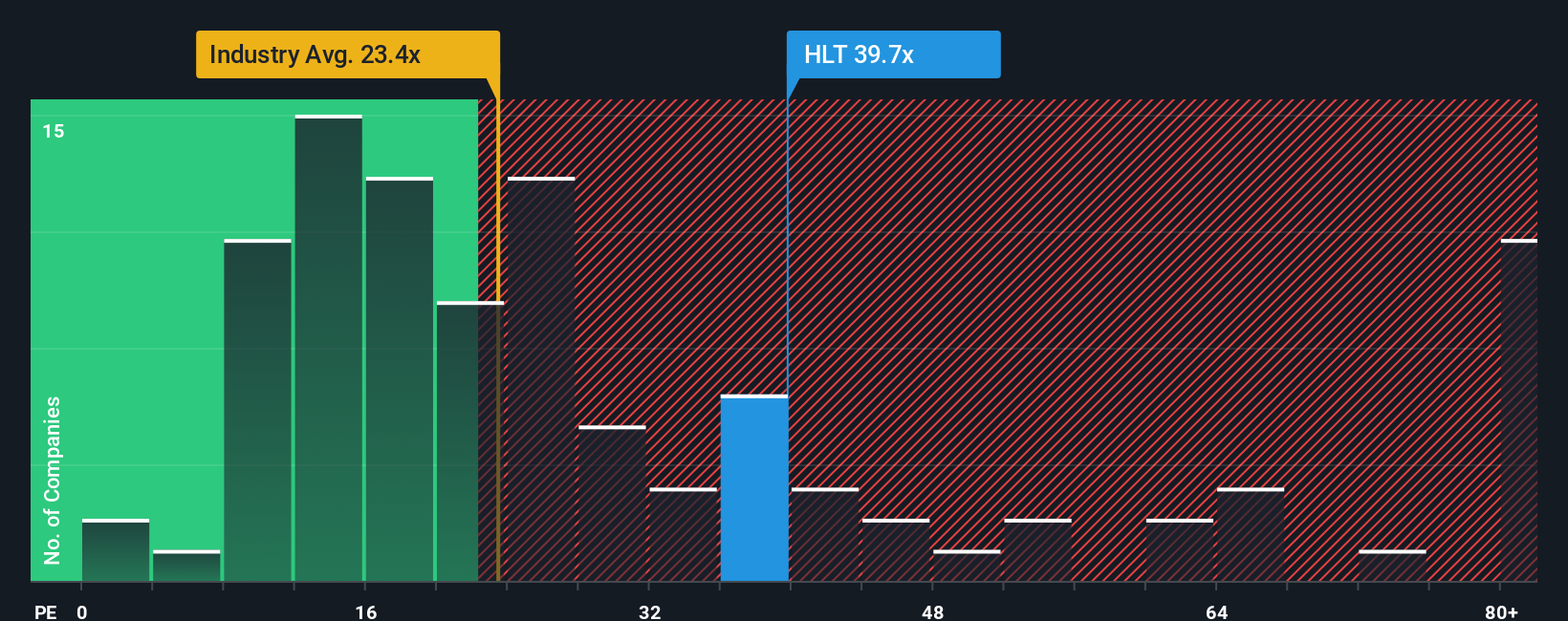

For a profitable, mature business like Hilton, the price to earnings ratio is a useful yardstick because it links what investors are paying directly to the company’s current earnings power. In general, companies with faster, more reliable growth and lower perceived risk can justify higher PE ratios, while slower growth or higher uncertainty usually calls for a discount multiple.

Hilton currently trades on about 39.25x earnings, well above both the Hospitality industry average of roughly 21.25x and the peer group average of about 24.92x. At first glance, that premium suggests the market is baking in stronger growth and resilience than for typical hotel peers.

Simply Wall St’s Fair Ratio framework refines this comparison by asking what PE multiple would be appropriate after explicitly accounting for Hilton’s earnings growth outlook, profitability, industry dynamics, size, and risk profile. On this basis, Hilton’s Fair Ratio is estimated at around 29.78x, which is lower than the current 39.25x. That gap implies investors are paying more than what the fundamentals justify, even after allowing for Hilton’s strengths and growth prospects.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hilton Worldwide Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you connect your view of Hilton’s story to a specific forecast and Fair Value. You can then compare that to today’s price to decide whether to buy or sell, with the numbers and valuation automatically updating as new news and earnings arrive. One investor might build a bullish Hilton Narrative around rapid Asia Pacific expansion, resilient margins and a Fair Value closer to the higher analyst target. Another could create a more cautious Narrative focused on softer RevPAR, macro risks and a Fair Value nearer the low end of analyst estimates. Both perspectives are captured as clear, living stories behind the numbers rather than a single static “right” answer.

Do you think there's more to the story for Hilton Worldwide Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026