- United States

- /

- Hospitality

- /

- NYSE:CMG

Does Chipotle’s Recent 33% Drop Signal Opportunity After New Drive Thru Strategy in 2025?

Reviewed by Bailey Pemberton

Trying to decide whether to buy, hold, or sell Chipotle Mexican Grill stock? You are not alone. Investors have been keeping a close eye on the company as the stock's performance has shifted gears more than once in the past year. Despite some headwinds, there is plenty to unpack, especially when it comes to valuation.

Chipotle closed at 39.82 recently. The short-term moves have been bumpy, with a -4.6% return over the last week but a decent recovery over the past month at 2.9%. Longer-term, though, the rollercoaster is obvious: the stock is down a significant -33.5% so far this year and is trailing with a -32.1% return over the last twelve months. Yet, zooming out to three or five years tells a different story, with solid gains of 32.0% and 48.6% respectively. Clearly, market sentiment and risk perception toward Chipotle have changed dramatically, and broader sector pressures might be partly to blame.

But is this recent price weakness a buying opportunity or a warning signal? When we turn to fundamental valuation checks, Chipotle scores a 2 out of 6, meaning it appears undervalued in just 2 key categories. Of course, not every valuation method tells the whole story. Let us look at the major approaches for valuing stocks, and stick around to the end for a potentially better way of understanding what Chipotle's real value might be.

Chipotle Mexican Grill scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Chipotle Mexican Grill Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and then discounting them back to today's dollars. This approach aims to capture the true value of a business based on how much cash it is likely to generate in the years ahead.

For Chipotle Mexican Grill, the latest reported Free Cash Flow stands at $1.45 Billion. Analysts forecast growth, with Free Cash Flow expected to reach $2.63 Billion by 2029. While precise estimates are available for just the next five years, longer-term projections (out to 2035) are extrapolated to provide a broader picture of the company's earning power over the next decade.

According to the 2 Stage Free Cash Flow to Equity model, the DCF places Chipotle's intrinsic value at $35.22 per share. With the current share price at $39.82, this suggests the stock is estimated to be 13.1% overvalued based on anticipated cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Chipotle Mexican Grill may be overvalued by 13.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Chipotle Mexican Grill Price vs Earnings

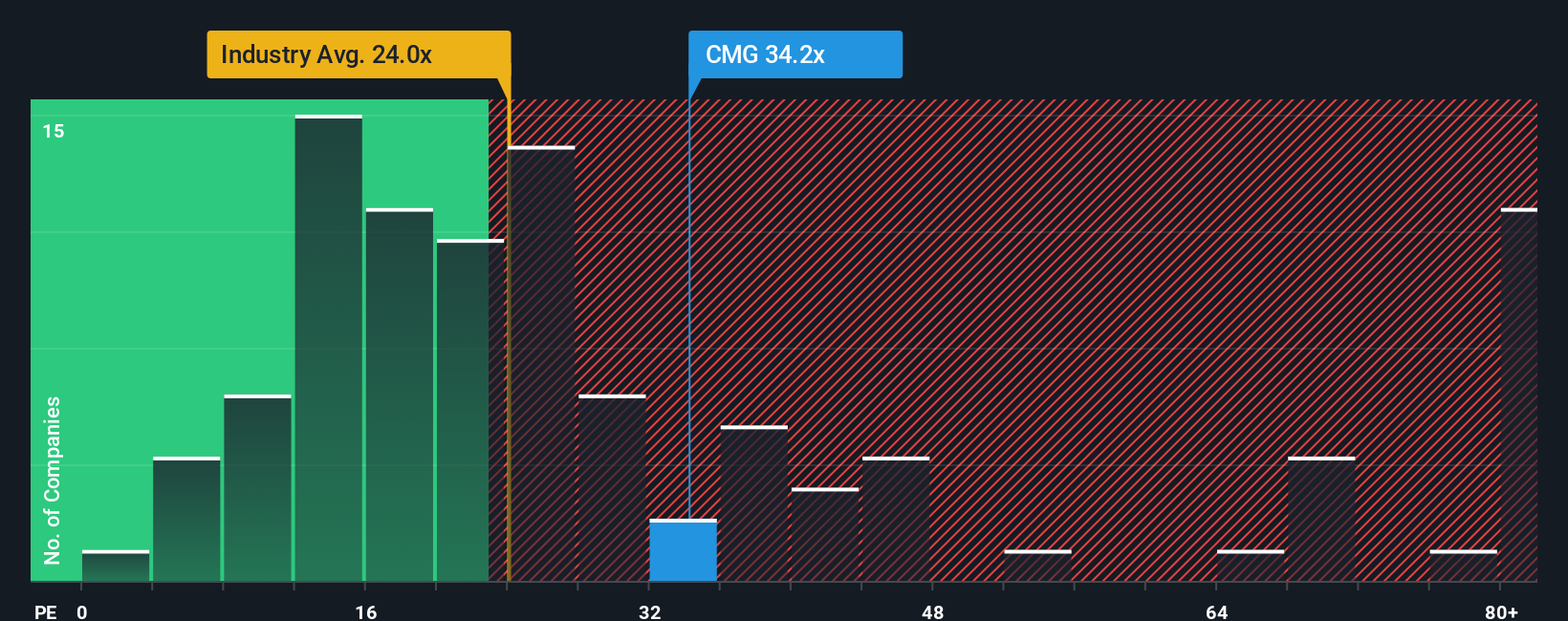

The Price-to-Earnings (PE) ratio is a widely used measure for valuing profitable companies, as it compares a company’s current share price to its earnings per share. For established businesses like Chipotle, PE is especially relevant because it reflects how much investors are willing to pay today for a dollar of the company’s future earnings.

Typically, higher growth prospects or lower perceived risks justify a higher PE ratio, while slower growth or more business uncertainty often lead to a lower “normal” or “fair” PE. For Chipotle, the current PE stands at 34.6x, which is significantly above both the Hospitality industry average of 23.1x and the average for Chipotle’s public peers at 58.1x.

However, comparing simply to industry or peer averages misses the full picture. That is where the Simply Wall St “Fair Ratio” comes in, set at 29.8x for Chipotle. This proprietary metric is calculated using tailored factors such as the company’s expected earnings growth, historical profit margins, sector trends, risk profile, and market capitalization. As a result, it provides a more nuanced benchmark suited to Chipotle’s own characteristics, rather than generic sector figures.

With Chipotle’s actual PE of 34.6x sitting somewhat above the “Fair Ratio” of 29.8x, the shares might be a bit expensive based on its earnings outlook and fundamentals. That said, the gap is not extreme, but does suggest a slight overvaluation on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chipotle Mexican Grill Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple story that explains your view on a company, linking together your outlook for future revenue, earnings, and profit margins into a forward-looking fair value estimate. Think of it as the “why” behind the numbers, connecting your personal perspective or an analyst’s thesis directly to assumptions about growth, risks, and market potential.

On Simply Wall St’s Community page, millions of investors create and share Narratives, each summarizing how they see Chipotle’s future and what they believe the stock is actually worth. This flexible tool allows you to easily compare your calculated Fair Value with today’s market price. This can make your buy or sell decisions more grounded in real analysis, not just gut feeling or headlines. Narratives also update automatically when new earnings, news, or company events happen, so your view always reflects the latest information.

For instance, some see Chipotle achieving aggressive price targets, such as $65.00, which may be driven by international expansion and tech innovation. Others are more cautious, pointing to industry risks and setting much lower targets, such as $46.00. Narratives let you capture these different perspectives in one place so you can make smarter decisions faster, based on the story you believe in and the data behind it.

Do you think there's more to the story for Chipotle Mexican Grill? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives