- United States

- /

- Hospitality

- /

- NYSE:CMG

Chipotle Mexican Grill (CMG): Assessing Valuation After Red Chimichurri Launch Sparks Fresh Growth Optimism

Reviewed by Kshitija Bhandaru

Chipotle Mexican Grill (CMG) shares are back in the spotlight after the company rolled out its Red Chimichurri sauce across North America. This menu update arrives as investors weigh sales headwinds and cost pressures.

See our latest analysis for Chipotle Mexican Grill.

The launch of Red Chimichurri comes during a busy period for Chipotle, with new menu items, fresh promotions, and an ongoing restaurant expansion plan helping to stir renewed optimism. After some volatility and sharp guidance cuts earlier in the year, momentum has started to steady. The 1-year total shareholder return sits just below flat, reflecting a market that is watching closely for sustained progress and improved value signals.

If Chipotle's turnaround efforts have piqued your interest, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With Chipotle shares staging a muted recovery and analysts divided on growth drivers versus economic risks, the key question is whether recent improvements signal a genuine buying opportunity or if the market has already accounted for a rebound in the price.

Most Popular Narrative: 26.9% Undervalued

With the widely followed narrative estimating fair value at $56.94, Chipotle's last close of $41.63 suggests considerable potential upside. The debate now pivots to expansion bets and how much of that optimism is truly priced in.

Chipotle is expanding its international presence with plans to open restaurants in Mexico by 2026 and exploring further expansion in Latin America and Europe. This international expansion is expected to drive future revenue growth. The company is investing in technological innovations such as produce slicers and a new equipment package to improve operational efficiency and consistency, which can positively impact net margins by reducing labor costs and enhancing throughput.

Want to see what’s behind this ambitious valuation? The narrative hinges on big expansion, bolder tech investments, and dramatic margin gains. Analysts are projecting moves that could change Chipotle’s future growth curve. Are their expectations too bullish or not wild enough? See the full rationale and the financial leap of faith it’s built on by reading deeper into the narrative.

Result: Fair Value of $56.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in consumer spending and rising costs from tariff pressures could quickly challenge the positive outlook analysts have made for Chipotle's future.

Find out about the key risks to this Chipotle Mexican Grill narrative.

Another View: Looking at the Numbers Differently

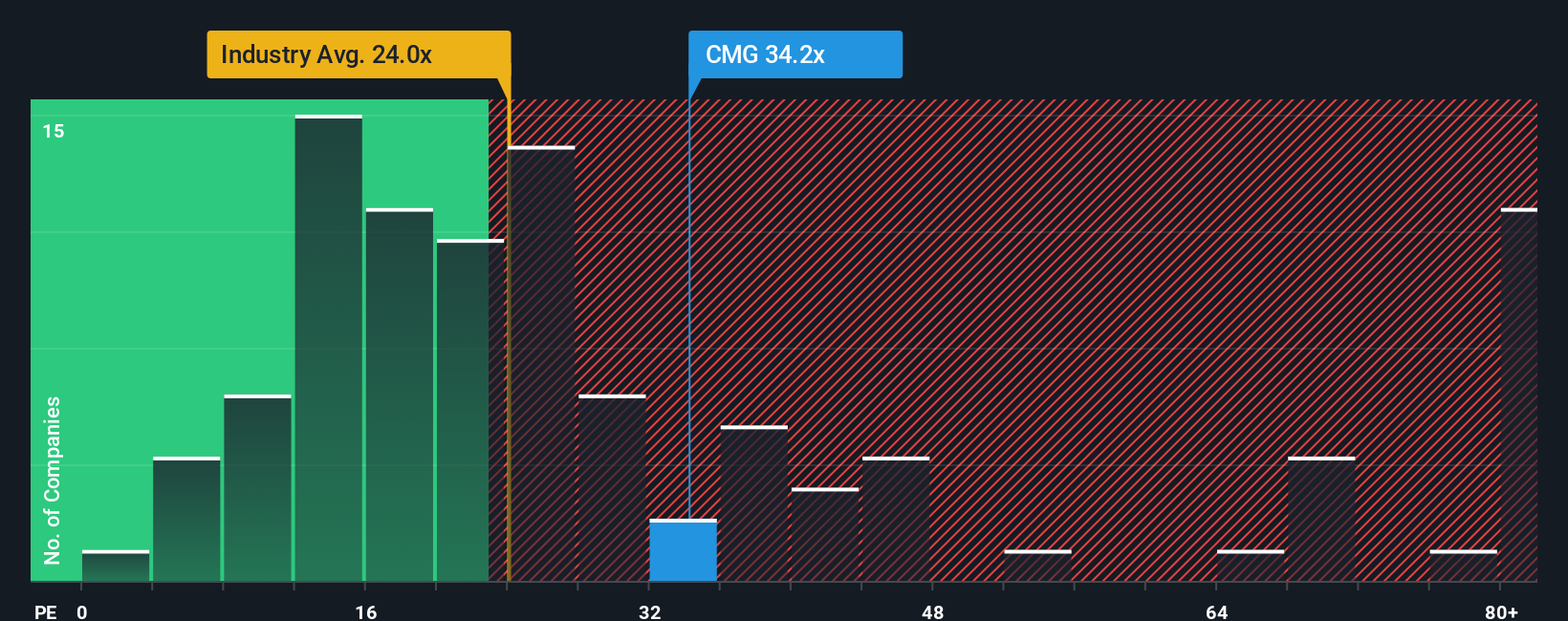

While many analysts point to upside using growth projections, our market-based valuation takes a closer look at Chipotle's price-to-earnings ratio. Currently, shares trade at 36.2 times earnings, which is above the fair ratio of 29.9 and the industry average of 24.9. This premium signals investors are paying up for future expectations; however, how long will the market support this gap if performance slips?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chipotle Mexican Grill Narrative

If you have a different perspective or want to dig into the numbers yourself, it's quick and easy to craft your own story in just a few minutes, so why not Do it your way

A great starting point for your Chipotle Mexican Grill research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to one company. Smart investors check proven opportunities. Seize the chance to use Simply Wall Street’s advanced tools and uncover hidden winners shaping tomorrow’s market.

- Tap into the next digital wave and spot market game-changers with these 25 AI penny stocks that are pioneering real-world applications of artificial intelligence.

- Unlock stable returns and strengthen your portfolio by selecting from these 19 dividend stocks with yields > 3% offering consistent yields above 3% and robust fundamentals.

- Be early to groundbreaking technology trends. Propel your watchlist forward with these 26 quantum computing stocks leading innovation in the quantum computing space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives