- United States

- /

- Hospitality

- /

- NYSE:CMG

Chipotle (CMG): Taking Stock of Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Chipotle Mexican Grill (CMG) has been on investors’ radars as its stock performance continues to shift. Over the past month, the company’s shares have gained nearly 9%, despite showing a different pattern over the past three months.

See our latest analysis for Chipotle Mexican Grill.

Taking a step back, Chipotle’s 1-month share price return of nearly 9% stands out amid a year marked by more cautious sentiment. While there’s been short-term momentum in the last week and month, the 1-year total shareholder return is still negative, reflecting some lingering concerns in the broader market even as the longer-term three-year and five-year total shareholder returns remain positive. Momentum is tentatively building again, hinting that investors may be warming back up to the stock’s growth story.

If you’re in the mood to branch out, now is a great time to discover fast growing stocks with high insider ownership.

With investor optimism returning and shares rebounding from recent lows, the next question is whether Chipotle is trading at a bargain today or if the company’s future growth is already reflected in the current share price.

Most Popular Narrative: 26% Undervalued

Chipotle’s current share price remains well below the consensus narrative’s fair value estimate, suggesting the market may be overlooking its future growth story. This gap between price and projected value raises compelling questions about what’s driving the optimism behind these numbers.

Chipotle is expanding its international presence with plans to open restaurants in Mexico by 2026 and exploring further expansion in Latin America and Europe. This international expansion is expected to drive future revenue growth.

Curious what’s powering such a bullish outlook? The secret mix isn’t just about more burrito bowls overseas. There is a hard-to-ignore financial leap forecasted, built on ambitious earnings and margin upgrades. Want to see exactly which future milestones justify this leap in valuation? The details may surprise you.

Result: Fair Value of $56.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as softer consumer spending and new tariffs on ingredients or packaging could put pressure on Chipotle’s growth outlook and profit margins.

Find out about the key risks to this Chipotle Mexican Grill narrative.

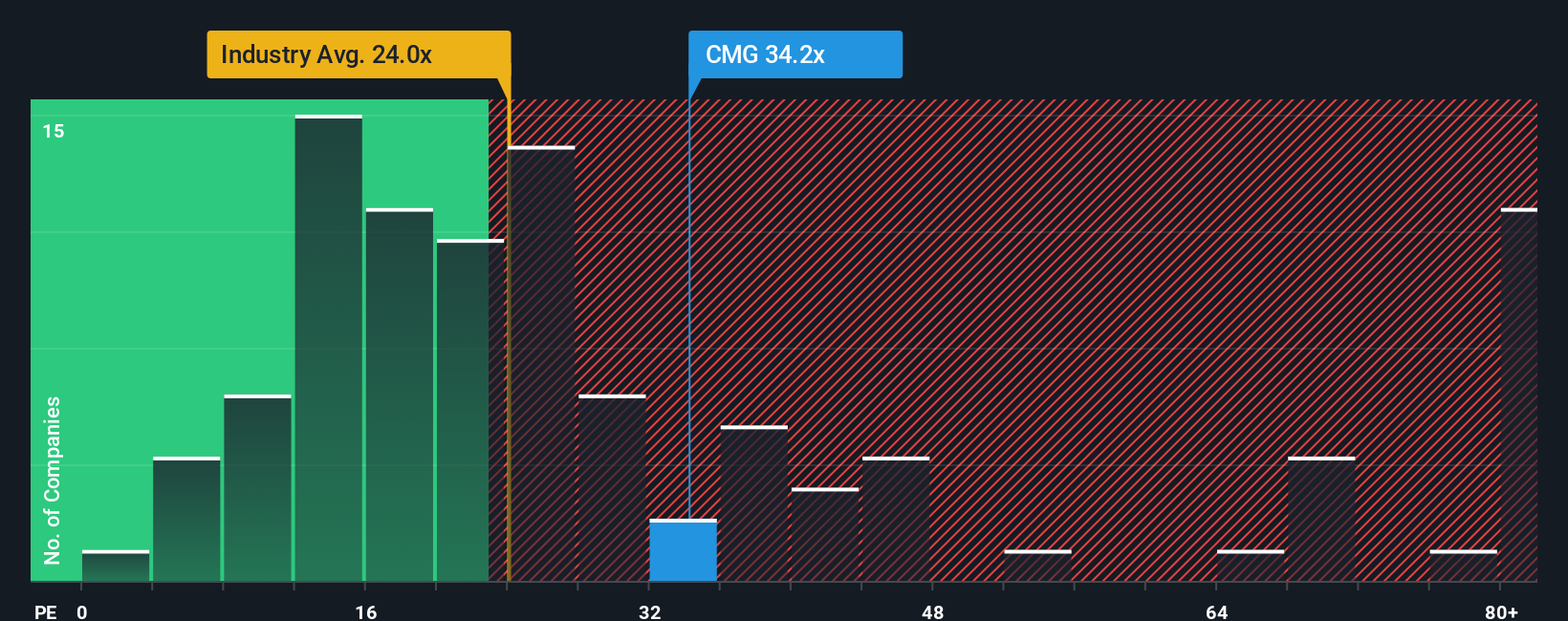

Another View: Looking Through the Lens of Price-to-Earnings

While fair value estimates remain bullish, Chipotle’s price-to-earnings ratio tells a more cautious story. At 36.6x, it sits well above both the US hospitality industry average of 23.4x and the peer average of 27.2x. It also exceeds the fair ratio of 29.8x. This suggests investors are paying a premium for Chipotle compared to its competitors, raising questions about how much upside is really left, or whether expectations are set too high. Which measure best signals Chipotle’s actual value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chipotle Mexican Grill Narrative

If you want to put the numbers to the test or see the story in a new light, you can build your own perspective in just a few clicks, and Do it your way.

A great starting point for your Chipotle Mexican Grill research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make smarter moves and keep your portfolio ahead of the curve by targeting stocks the market hasn’t fully appreciated yet. Don’t wait until the window closes on these opportunities.

- Tap into long-term wealth by securing steady payouts. See which companies stand out with these 18 dividend stocks with yields > 3% for serious income potential.

- Ride the artificial intelligence wave at the ground floor by selecting these 25 AI penny stocks pushing boundaries in machine learning breakthroughs and next-level innovation.

- Shield yourself from overpriced stocks by focusing on genuine value. Find your next pick among these 878 undervalued stocks based on cash flows responding to solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives