- United States

- /

- Hospitality

- /

- NYSE:CCL

Raised Earnings Guidance and Successful Bond Offering Could Be a Game Changer for Carnival (CCL)

Reviewed by Sasha Jovanovic

- Carnival Corporation & plc recently completed a US$1.25 billion fixed-income offering and reported third-quarter and nine-month earnings showing increases in revenue and net income compared to the previous year.

- The company also raised its full-year 2025 net income guidance, citing favorable third-quarter results, lower interest expenses in the fourth quarter, and improved fuel prices as contributing factors.

- Given the raised earnings guidance and strong operational performance, we'll explore how improved profitability prospects may influence Carnival's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Carnival Corporation & Investment Narrative Recap

To be a Carnival shareholder today, you need conviction in the global cruise recovery, resilience in consumer leisure demand, and the company’s ability to steadily manage its substantial debt. The recent US$1.25 billion debt refinancing and raised 2025 earnings guidance both support improved short-term profitability, but Carnival's high debt remains a material risk, as obligations will continue to limit flexibility and could be affected by future market conditions.

The most relevant recent announcement is Carnival’s upward revision of its full-year 2025 net income guidance. This higher forecast, attributed to strong operational results, lower interest expenses, and improved fuel prices, directly reinforces optimism about improved margins being a potential near-term catalyst for the share price. However, this positive momentum still sits alongside the looming pressures of Carnival’s sizeable debt load and capital needs.

By contrast, the ongoing need to refinance and service Carnival’s large debt burden is a critical factor that investors should keep in mind given...

Read the full narrative on Carnival Corporation & (it's free!)

Carnival Corporation &'s outlook anticipates $29.0 billion in revenue and $3.7 billion in earnings by 2028. This scenario assumes a 3.8% annual revenue growth rate and an increase in earnings of $1.2 billion from the current $2.5 billion.

Uncover how Carnival Corporation &'s forecasts yield a $35.75 fair value, a 29% upside to its current price.

Exploring Other Perspectives

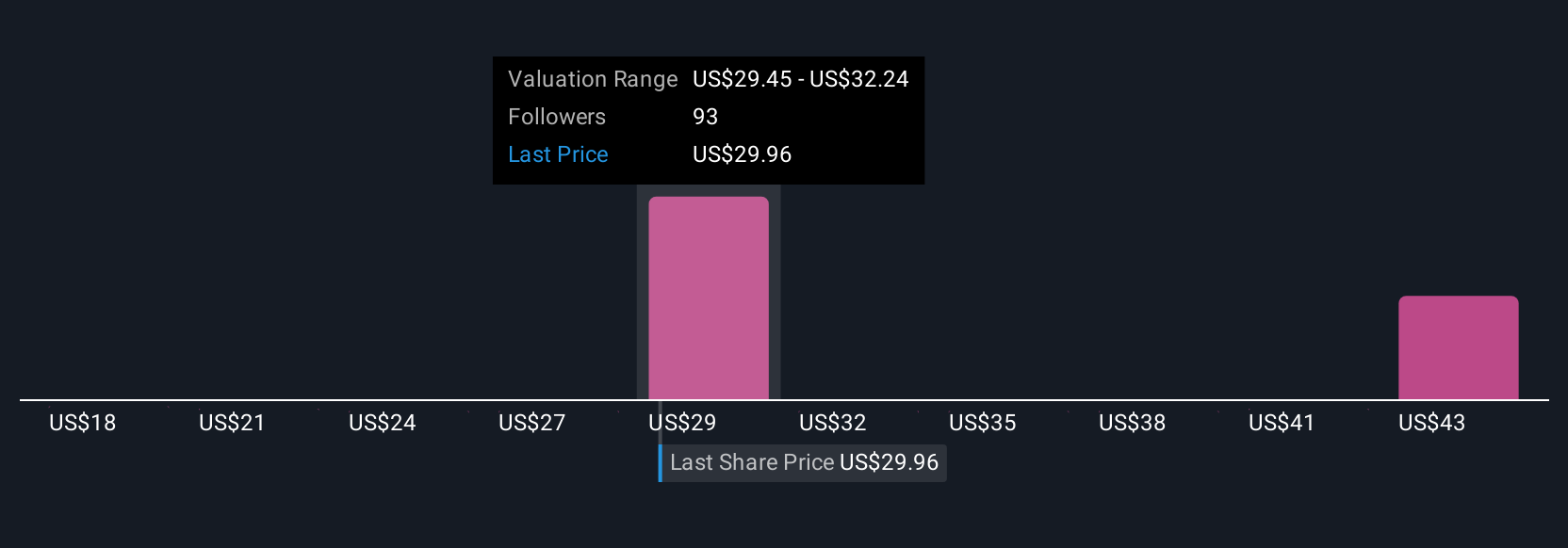

Ten private investors in the Simply Wall St Community estimate fair values for Carnival between US$21.99 and US$41.57 per share. While many see upside driven by earnings growth and margin expansion, opinions can diverge widely, especially with debt risk remaining a key issue impacting future performance.

Explore 10 other fair value estimates on Carnival Corporation & - why the stock might be worth 21% less than the current price!

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives