- United States

- /

- Hospitality

- /

- NYSE:CCL

Is Carnival (CCL) Using Destination Expansion To Quietly Redefine Its Long-Term Profit Engine?

Reviewed by Sasha Jovanovic

- Carnival Corporation, ITM Group and Hutchison Ports ECV have unveiled plans for Ensenada Bay Village at the Ensenada Cruise Terminal in Baja California, Mexico, a shoreside destination designed to host up to 9,000 visitors daily and support local tourism and jobs once construction is completed in roughly 24 months.

- Alongside continued investment in upgraded private destinations and recognition of its Global Chief Information Security Officer with a CISOs Connect Trailblazer Award, Carnival is signaling an emphasis on both guest experience and cybersecurity leadership as it refines its long-term growth profile.

- We’ll now examine how the Ensenada Bay Village development could influence Carnival’s investment narrative around destination expansion and guest economics.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Carnival Corporation & Investment Narrative Recap

To own Carnival today, you need to believe its destination focused expansion, disciplined capacity management and debt reduction can translate recent earnings momentum into durable free cash flow, despite elevated leverage and geopolitical risks. The Ensenada Bay Village plan fits the push toward curated, higher margin experiences, but its financial impact is not the key near term catalyst compared with upcoming guidance and progress on refinancing and deleveraging, nor does it materially change the central risk around Carnival’s sizable debt load.

The Ensenada Bay Village announcement aligns with Carnival’s broader build out of private and semi private destinations like Celebration Key, which are intended to support higher guest spend and better economics per passenger. For investors watching catalysts, this cluster of destination projects sits alongside the new multi currency revolver and recent note refinancings as part of the same story about improving financial flexibility while investing in experiences that can support pricing and onboard revenue.

However, beneath the appeal of new destinations, investors should be aware of Carnival’s still heavy debt burden and the refinancing obligations that...

Read the full narrative on Carnival Corporation & (it's free!)

Carnival Corporation &'s narrative projects $29.0 billion revenue and $3.7 billion earnings by 2028. This requires 3.8% yearly revenue growth and about a $1.2 billion earnings increase from $2.5 billion today.

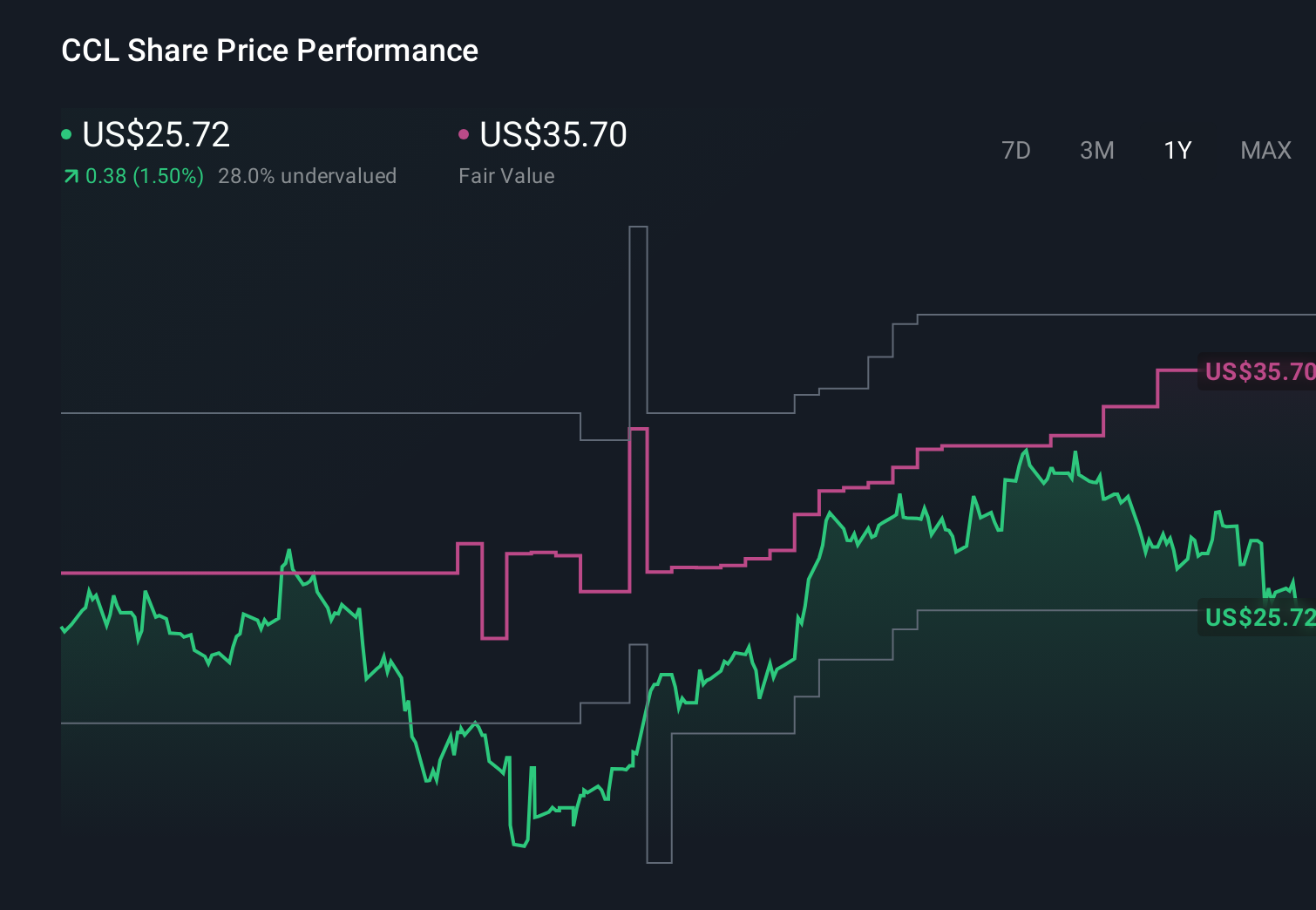

Uncover how Carnival Corporation &'s forecasts yield a $35.76 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Eleven members of the Simply Wall St Community currently value Carnival between US$24.61 and US$42.50, reflecting a wide span of expectations. Against that backdrop, the company’s ongoing need for substantial fleet and destination capital spending highlights why views on its future cash generation and balance sheet strength can differ so sharply, and why it can be useful to compare several independent opinions before forming your own.

Explore 11 other fair value estimates on Carnival Corporation & - why the stock might be worth as much as 49% more than the current price!

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)