- United States

- /

- Hospitality

- /

- NYSE:CAVA

The Bull Case For CAVA Group (CAVA) Could Change Following Miami Entry and New Menu Launch – Learn Why

Reviewed by Sasha Jovanovic

- CAVA Group opened its first Miami restaurant in Brickell, offering Mediterranean-inspired fast-casual dining and launching a new menu item, Cinnamon Sugar Pita Chips, while continuing community-focused initiatives like its Community Day to address food insecurity.

- This expansion into Miami highlights CAVA’s nationwide growth ambitions as it rapidly increases its store footprint, targeting at least 1,000 locations by 2032.

- We'll explore how CAVA's Miami entry and focus on community impact could influence the company's investment narrative and growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CAVA Group Investment Narrative Recap

To own CAVA Group stock, one needs confidence in the company’s ability to execute its fast-paced nationwide expansion and maintain relevance as a Mediterranean-focused brand. The recent Miami opening underscores CAVA’s unit growth strategy, but the news itself does not significantly affect the key short-term catalyst, new restaurant performance, or the biggest current risk of overexpansion leading to saturated markets and higher operating complexity.

Among CAVA’s latest announcements, the expanded loyalty program stands out as particularly relevant. While menu updates and new locations like Miami seek to drive guest visits, an upgraded rewards initiative directly supports customer retention, which is critical for sustaining sales momentum as more stores open and competition intensifies. In contrast, investors should still pay close attention to potential challenges if growth outpaces demand...

Read the full narrative on CAVA Group (it's free!)

CAVA Group's outlook anticipates $1.9 billion in revenue and $126.2 million in earnings by 2028. This projection is based on a 20.4% annual revenue growth rate but implies a decrease in earnings of $14.5 million from the current $140.7 million.

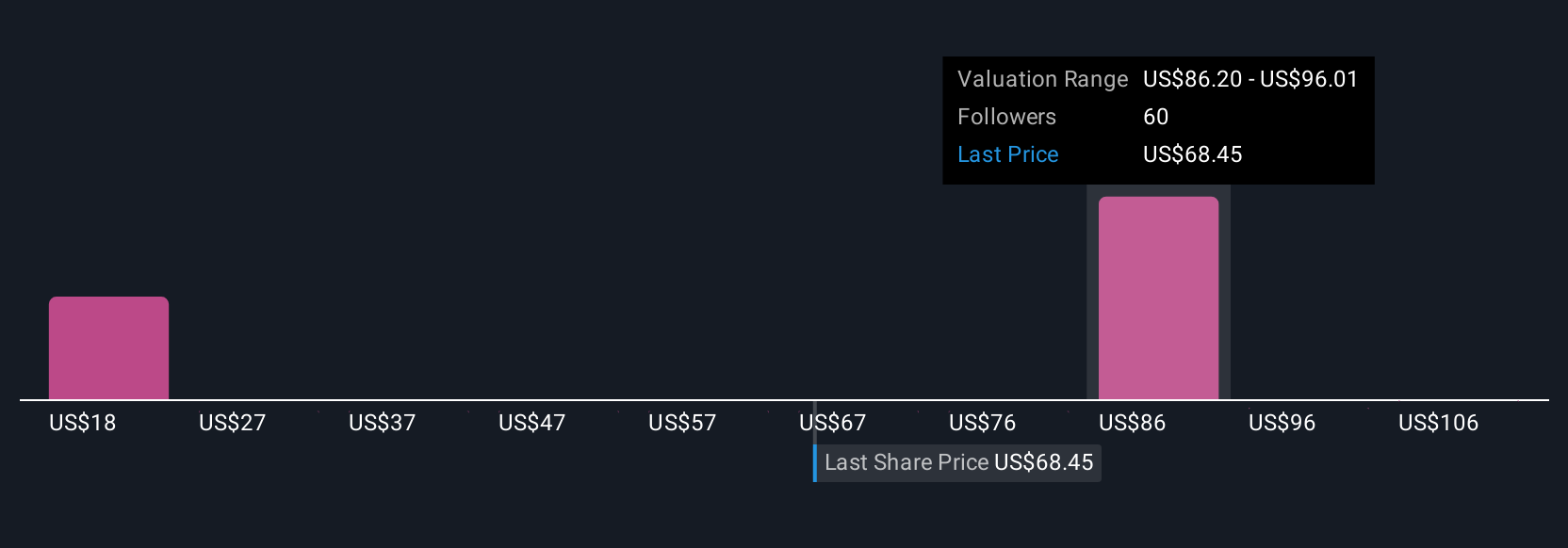

Uncover how CAVA Group's forecasts yield a $90.73 fair value, a 46% upside to its current price.

Exploring Other Perspectives

With 13 different fair value estimates from the Simply Wall St Community ranging between US$24 and US$118.75, market opinions on CAVA’s future run the gamut. Against this backdrop, aggressive expansion remains a double-edged sword you should evaluate when considering what could influence long-term performance.

Explore 13 other fair value estimates on CAVA Group - why the stock might be worth less than half the current price!

Build Your Own CAVA Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CAVA Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CAVA Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CAVA Group's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAVA

CAVA Group

Owns and operates a chain of restaurants under the CAVA brand in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives