- United States

- /

- Hospitality

- /

- NYSE:CAVA

CAVA Group (CAVA): Exploring Valuation After Recent Slide and Analyst Optimism

Reviewed by Kshitija Bhandaru

See our latest analysis for CAVA Group.

After a rocky ride over the past several months, CAVA Group’s share price continues to lose ground. This reflects a fading momentum despite earlier growth headlines. With a 1-year total shareholder return of -53.5%, recent declines may signal increased uncertainty or a rethinking of growth prospects among investors.

If CAVA’s recent volatility has you rethinking your approach, now is an interesting moment to broaden your perspective and discover fast growing stocks with high insider ownership

With CAVA trading well below recent analyst price targets but still facing sluggish momentum, investors must ask whether the current valuation signals an attractive entry point or if the market is correctly accounting for growth risks ahead.

Most Popular Narrative: 31.5% Undervalued

With CAVA Group’s most widely followed narrative assigning a fair value of $90.73, the stock’s last close at $62.15 marks a meaningful gap. This valuation highlights what bulls see as long-term upside, but rests on several ambitious assumptions. Let's see what drives this outlook.

Rapid geographic expansion into new and underserved markets, supported by strong new unit performance and a robust target of at least 1,000 restaurants by 2032, is likely to accelerate systemwide sales and drive higher topline revenue growth.

Ever wonder what bold projections underpin this price gap? The narrative’s fair value is built on rapid restaurant rollouts and aggressive growth targets. Dig in to uncover the dramatic assumptions behind their valuation.

Result: Fair Value of $90.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, CAVA’s ambitious expansion could risk market saturation. In addition, reliance on Mediterranean offerings may invite brand fatigue and temper growth prospects.

Find out about the key risks to this CAVA Group narrative.

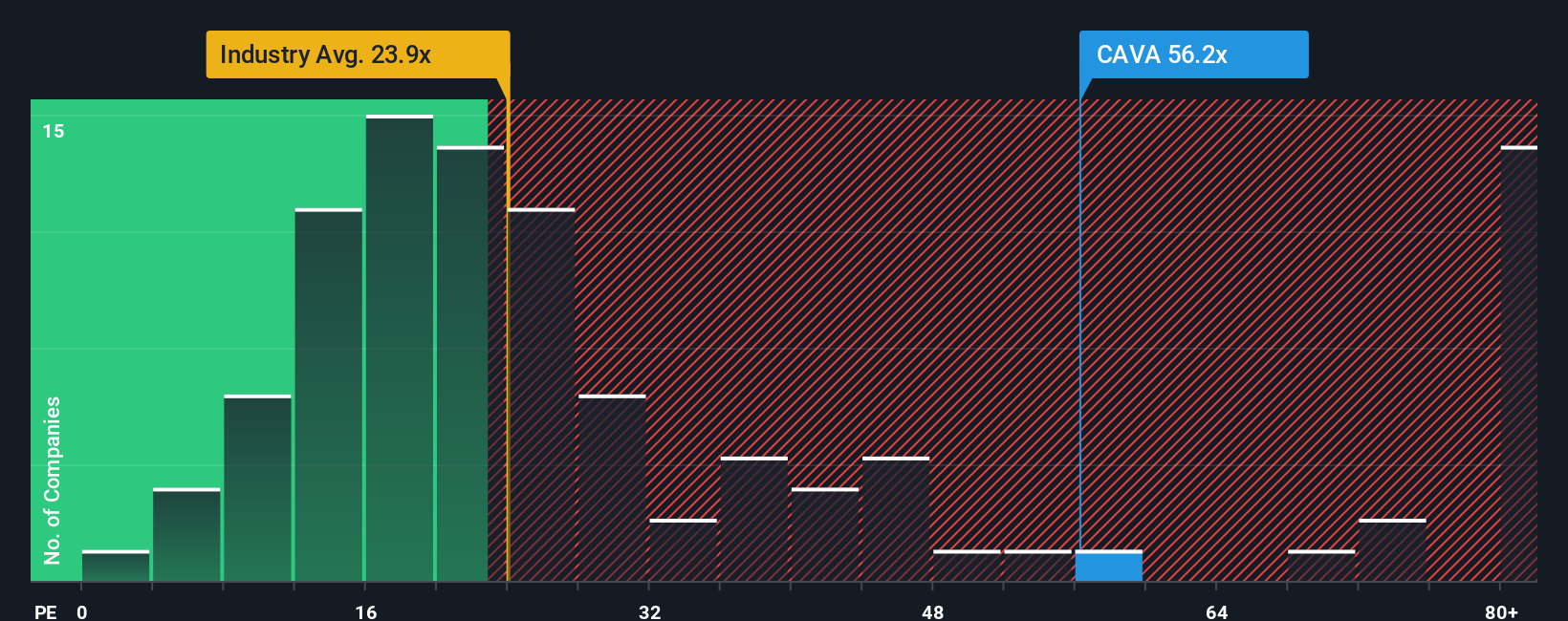

Another View: Price-to-Earnings Paints a Starker Picture

While analyst narratives assign CAVA Group a fair value well above its current share price, a look at the company's actual price-to-earnings ratio tells a different story. At 51.2x, CAVA is trading significantly higher than both the broader industry average of 23.1x and its peer group at 46.7x. Compared to the fair ratio of 22.2x, this premium could signal investors are pricing in a lot of future success, or overestimating it. Does this premium mean untapped potential, or extra valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CAVA Group Narrative

If you think differently or would rather interpret the numbers yourself, take a moment to shape your own story based on the latest data. You can create a fresh perspective in under three minutes. Do it your way

A great starting point for your CAVA Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your search to just one opportunity. Uncover smart alternatives in fast-moving markets using the powerful Simply Wall Street Screener. Your next big idea could be just a click away.

- Unlock potential with these 898 undervalued stocks based on cash flows and spot companies trading below their true worth based on future cash flows.

- Seize an edge in innovation by checking out these 24 AI penny stocks powering tomorrow’s breakthroughs in artificial intelligence.

- Tap into growth and steady income with these 19 dividend stocks with yields > 3% featuring strong yields above 3% and robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAVA

CAVA Group

Owns and operates a chain of restaurants under the CAVA brand in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives