- United States

- /

- Hospitality

- /

- NYSE:BYD

Assessing Boyd Gaming After a 6.7% Drop Despite Expansion and Digital Growth Plans

Reviewed by Bailey Pemberton

Thinking about what to do with Boyd Gaming stock right now? You are not alone. Any time a stock takes a turn down, seasoned investors like us start wondering if it might be the perfect moment to buy more, or if there is something bigger at work. This year, Boyd Gaming started off strong, climbing nearly 10% year-to-date. Add to that an impressive 14.6% gain over the past 12 months and a huge 158.3% rise in the last five years, and you can see why long-term holders have plenty to smile about.

That said, it has not all been a straight line up. Over the past month, shares have slid 6.7%, including a 4.4% dip just this past week. The pressure seems to have kicked in as broader market jitters and cautiousness around consumer spending have filtered down to gaming stocks. Still, recent expansion announcements in new regional markets and steady progress on digital betting initiatives have kept Boyd in the conversation as a growth story, even when sentiment swings short-term.

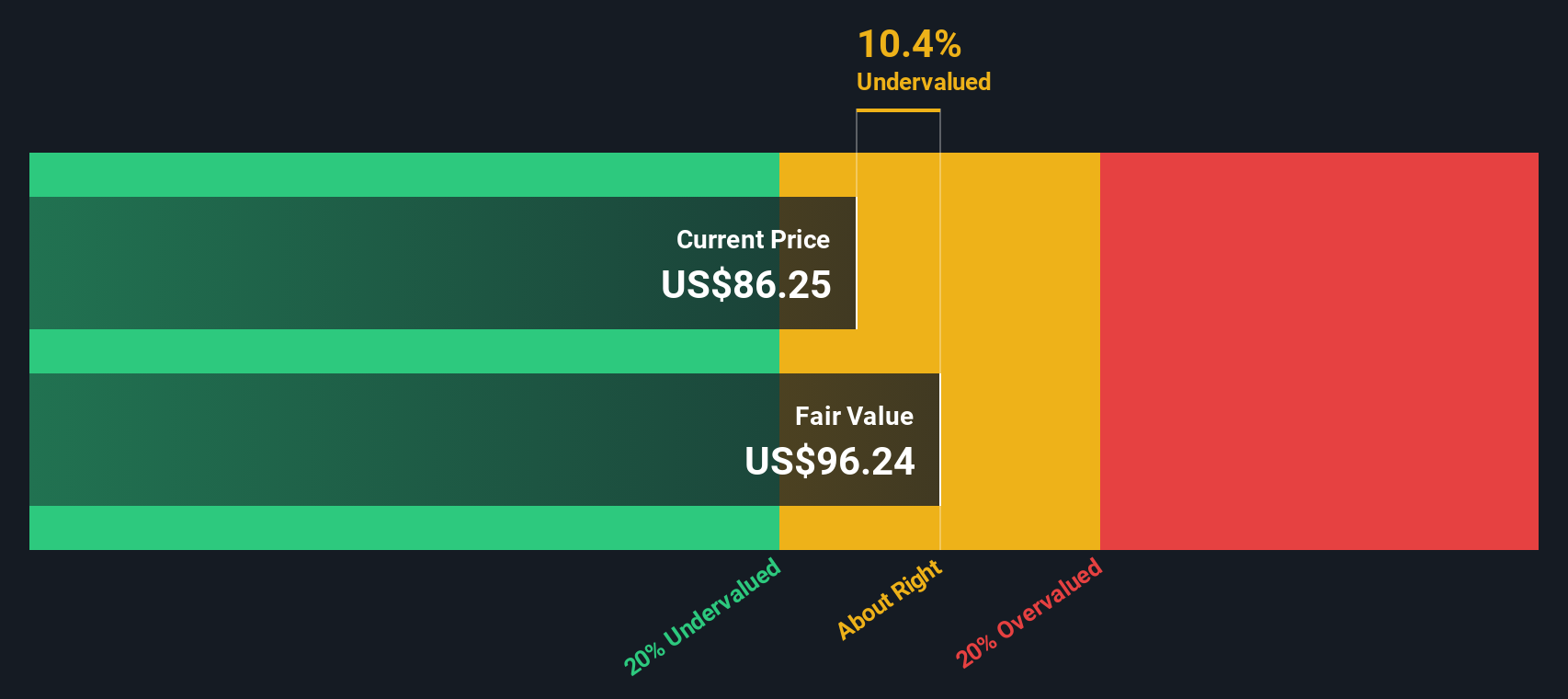

As with any stock, price moves only tell part of the story. To really make an informed call, you need to decide whether Boyd Gaming’s current share price represents fair value or opportunity. According to a basic valuation screening, the company is scoring a 4 out of 6, suggesting it is undervalued on most, but not all, measures. So how do various valuation approaches stack up? Let’s break those down next, and stay tuned for a hands-on strategy to understand valuation even better.

Approach 1: Boyd Gaming Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method that projects a company's future cash flows and then discounts them back to today, aiming to estimate a more objective intrinsic value for the business. For Boyd Gaming, analysts and modelers look at the money the company produces after expenses, called Free Cash Flow (FCF), and factor in both near-term analyst estimates and longer-term extrapolations.

Currently, Boyd Gaming’s FCF stands at $525 million. Analyst projections extend in detail for the next few years, with FCF expected to reach about $571 million by 2027. Beyond the analyst horizon, further cash flow increases are extrapolated, reaching roughly $636 million by 2035. All projections are reflected in millions and denominated in USD.

When all these estimated cash flows are added up and discounted back to the present, the DCF model arrives at an intrinsic value of $88.25 per share. Given Boyd Gaming’s current share price, this translates to an implied discount of 10.7%, suggesting the stock is currently undervalued according to this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boyd Gaming is undervalued by 10.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Boyd Gaming Price vs Earnings

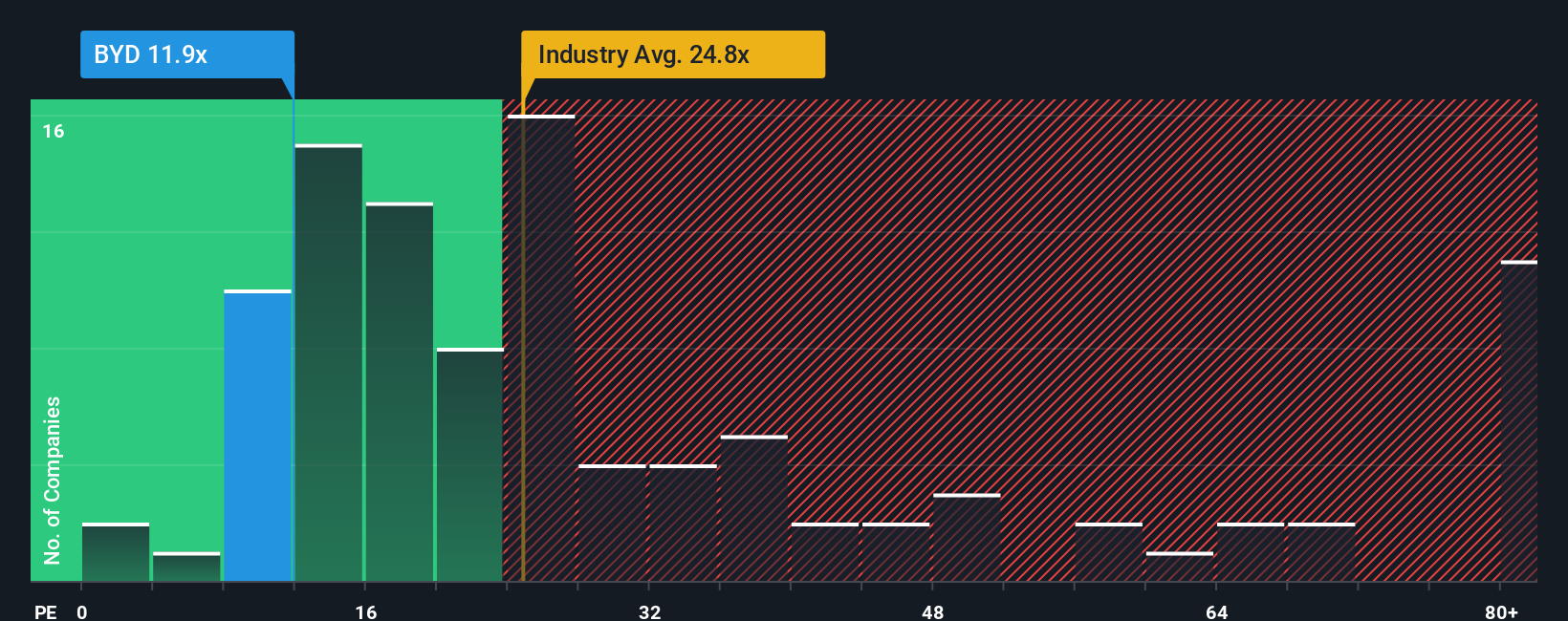

The Price-to-Earnings (PE) ratio is widely considered the gold standard for valuing profitable companies like Boyd Gaming because it directly relates a company's share price to its actual earnings. This metric gives investors a quick way to judge how much they are paying for each dollar of profit. However, what counts as a "fair" PE ratio can vary. Companies with faster expected growth, lower risk, or larger scale typically command higher PE ratios, while those with more uncertainty or weaker growth may trade at lower multiples.

Boyd Gaming’s current PE ratio is 3.4x, which is strikingly lower than both the industry average of 23.9x for Hospitality and the peer average of 24.2x. On the surface, this may suggest the stock is significantly undervalued compared to competitors and the broader sector.

To get a more nuanced view, Simply Wall St calculates a “Fair Ratio” in this case, 5.4x which takes into account specific factors like Boyd’s earnings growth outlook, profit margins, the overall Hospitality industry, company size, and its risk profile. Unlike a simple industry or peer comparison, the Fair Ratio is tailored to reflect Boyd’s individual characteristics, providing a more relevant benchmark for fair value.

Comparing the current PE of 3.4x to the Fair Ratio of 5.4x indicates that Boyd Gaming is still trading below where it should be, even after adjusting for company-specific growth and risk considerations. That points to an undervalued stock by this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Boyd Gaming Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, the unique perspective and expectations you bring when deciding what it's worth.

With Narratives, investing becomes more than just numbers. You connect Boyd Gaming’s business story, such as expansion projects or digital growth plans, to your own forecasts for revenue, earnings, and margins. In this way, you arrive at a personal fair value estimate. This means your investment decisions are rooted in a view that makes sense for you, not just a formula.

Narratives are accessible and easy to use on Simply Wall St’s Community page, where millions of investors create and share their own scenarios for companies like Boyd Gaming. Narratives empower you to compare your fair value estimate to the current share price and decide if now is the right time to buy or sell, based on your outlook rather than just consensus.

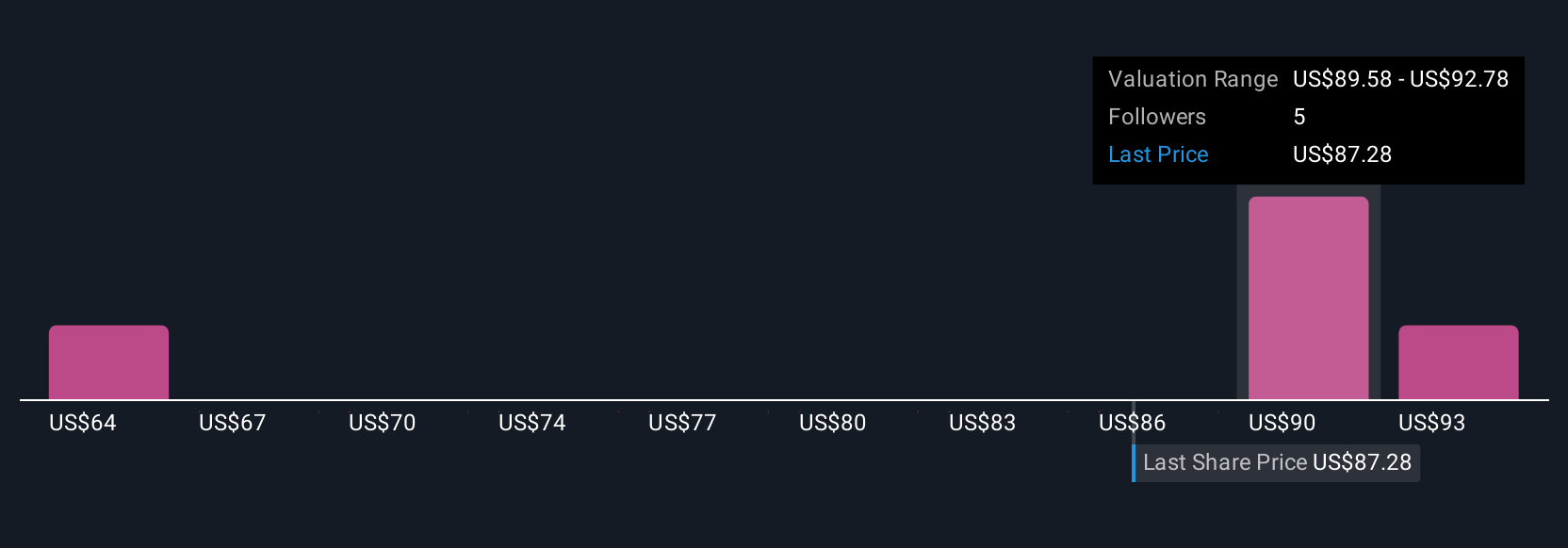

Best of all, Narratives update automatically whenever new information or financial results are released, keeping your investment thesis relevant. For example, some investors currently estimate Boyd Gaming’s fair value as high as $101.00 per share, leaning into ambitious growth from new projects. Others take a more cautious view with a fair value as low as $80.00, reflecting concerns about revenue declines and rising risks.

No matter where you land, Narratives give you a practical, up-to-date framework for making smarter and more confident decisions.

Do you think there's more to the story for Boyd Gaming? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Boyd Gaming might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BYD

Boyd Gaming

Operates as a multi-jurisdictional gaming company in the United States and Canada.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)