- United States

- /

- Hospitality

- /

- NasdaqGS:WING

A Look at Wingstop’s Valuation as It Expands to Calgary and Broadens Global Growth Strategy

Reviewed by Kshitija Bhandaru

Wingstop (WING) is set to open its first Calgary location in 2026, moving beyond Ontario as part of a larger expansion plan with JPK Capital. This step reflects the chain’s ongoing push for global brand recognition.

See our latest analysis for Wingstop.

Wingstop’s news-making expansion into Calgary follows steady execution on international growth, just as investor attention turns to its upcoming November earnings report. While the one-year total shareholder return is flat at -0.38%, long-term holders have enjoyed a robust 88% three-year total shareholder return. This suggests momentum is steadier for patient investors even as the stock’s valuation remains well above the sector average.

If restaurant expansion stories like this inspire you, now’s your chance to explore opportunities with fast growing stocks with high insider ownership.

With shares coming off a subdued year and the stock trading at a premium to the sector, the big question now is whether Wingstop offers genuine value for new investors or if the market has already factored in its next stage of growth.

Most Popular Narrative: 36.1% Undervalued

Wingstop’s most widely followed valuation narrative sets its fair value at $381.83, well above the recent close of $244.02. This sizable gap stands out and fuels debate around the stock’s true upside and the assumptions powering such a bullish target.

The rapid roll-out and full system implementation of the Wingstop Smart Kitchen platform is significantly improving operational efficiency, order throughput, guest satisfaction, speed of service, and consistency. This is expected to drive higher same-store sales, increased delivery frequency, and better net margins as restaurants ramp to the new model.

Want to know what’s driving this big projected jump? The valuation leans on aggressive growth in customer numbers, streamlined technology rollouts, and powerful financial upgrades. Wondering how digital upgrades and global momentum combine to justify that premium forecast? Dig into the narrative for the exact financial playbook.

Result: Fair Value of $381.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness among value-focused consumers and mounting expansion risks could challenge the upbeat outlook that analysts have set for Wingstop’s next chapter.

Find out about the key risks to this Wingstop narrative.

Another View: What the Ratios Say

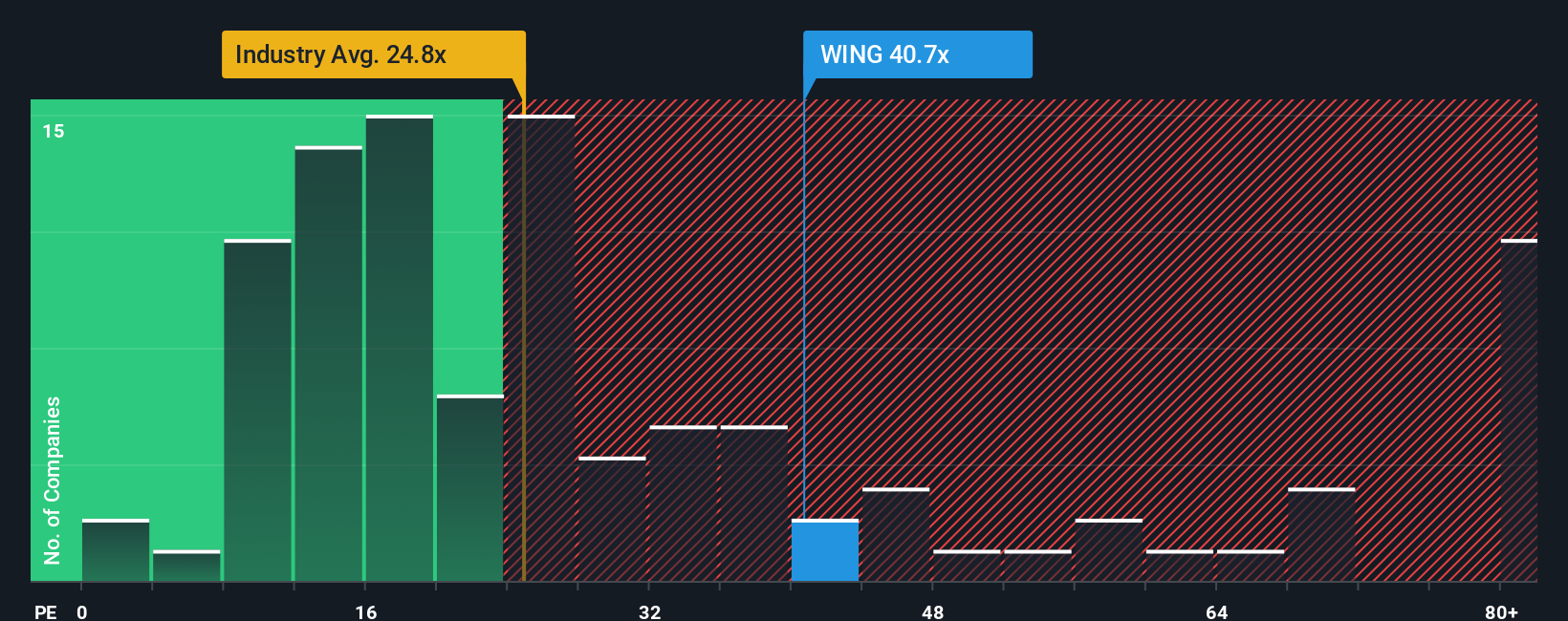

Looking at Wingstop through a different lens, the price-to-earnings ratio is 39.7x, which is significantly higher than the US Hospitality industry average of 24.4x and well above the fair ratio of 20.2x that the market could eventually move toward. This big premium suggests investors are betting on strong future performance, but it also means there is little margin for error if growth stalls. Is the optimism fully earned, or could expectations be set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wingstop Narrative

If you see things differently or want to dig into the data on your own terms, it’s easy to craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Wingstop research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities don't wait. If you want your next move to matter, check out these handpicked ways to target growth, value, and tomorrow’s transformative trends right now.

- Kickstart your search for value by checking out these 894 undervalued stocks based on cash flows that balance strong fundamentals and untapped price potential.

- Strengthen your portfolio with income by scanning these 19 dividend stocks with yields > 3% boasting yields above 3% and consistent payout histories.

- Ride the AI revolution and seize tech’s edge by reviewing these 25 AI penny stocks reshaping industries with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wingstop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WING

Wingstop

Wingstop Inc., together with its subsidiaries, franchises and operates restaurants under the Wingstop brand.

Proven track record with slight risk.

Market Insights

Community Narratives