- United States

- /

- Commercial Services

- /

- NYSE:NL

Undervalued Small Caps With Insider Action In March 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 4.1%, though it has risen by 6.6% over the past year, with earnings expected to grow by 14% annually in the coming years. In this context, identifying small-cap stocks that are perceived as undervalued and have recent insider activity can be an intriguing strategy for investors seeking opportunities amidst fluctuating market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Eagle Financial Services | 7.4x | 1.6x | 49.33% | ★★★★★☆ |

| Shore Bancshares | 10.1x | 2.3x | 10.75% | ★★★★★☆ |

| Arrow Financial | 14.6x | 3.2x | 41.73% | ★★★★☆☆ |

| Quanex Building Products | 75.4x | 0.6x | 45.89% | ★★★★☆☆ |

| S&T Bancorp | 10.9x | 3.7x | 41.97% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 13.95% | ★★★★☆☆ |

| German American Bancorp | 16.9x | 5.6x | 49.92% | ★★★☆☆☆ |

| Columbus McKinnon | 53.5x | 0.5x | 43.90% | ★★★☆☆☆ |

| Union Bankshares | 14.7x | 2.7x | 33.79% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -172.27% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

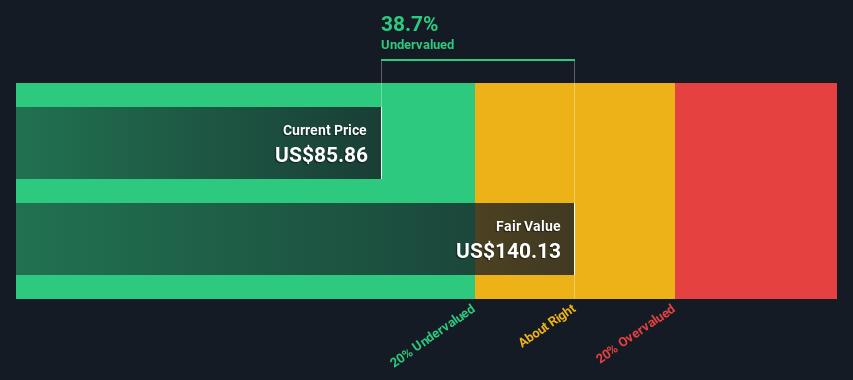

ICF International (NasdaqGS:ICFI)

Simply Wall St Value Rating: ★★★★★★

Overview: ICF International provides professional services to a broad array of clients, with a market capitalization of approximately $2.56 billion.

Operations: ICF International's revenue primarily stems from professional services, with the latest figures showing a total of $2.02 billion. The company's cost of goods sold (COGS) amounts to $1.28 billion, resulting in a gross profit of $737.77 million and a gross profit margin of 36.53%. Operating expenses stand at $568.35 million, while net income is reported at $110.17 million, reflecting a net income margin of 5.45%.

PE: 14.6x

ICF International, a small company in the U.S., is making strategic moves to enhance its position. Recently, they secured contracts worth over US$210 million with European and UK governments, boosting their global presence. Insider confidence is evident as the company repurchased 136,321 shares for US$18.18 million between October and December 2024. Despite high debt levels from external borrowing, ICF's diverse portfolio spans energy to digital transformation. New board member Caroline Angoorly brings expertise that may drive future growth in sustainable infrastructure projects.

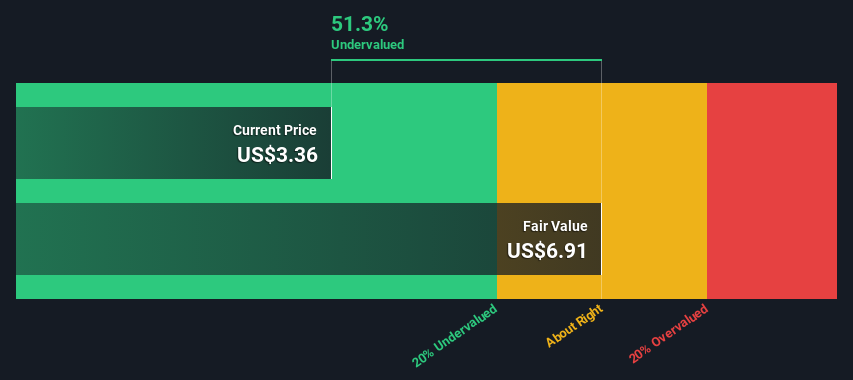

Vasta Platform (NasdaqGS:VSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vasta Platform is an education company in Brazil that provides educational and digital solutions to private schools, with a market cap of approximately $0.27 billion.

Operations: Vasta Platform's revenue model is primarily driven by its gross profit, which has shown fluctuations with a notable increase to R$1.02 billion in the latest period. The company's cost structure includes significant operating expenses, particularly in general and administrative costs and sales and marketing expenses. Over time, the gross profit margin has varied, recently recorded at 60.97%. Despite consistent negative net income margins over several periods, there was a positive shift to 29.06% in the most recent data point provided.

PE: 3.4x

Vasta Platform, a smaller company in its sector, recently reported a significant turnaround with net income reaching BRL 486.49 million for the year ending December 2024, compared to a net loss previously. Insiders have shown confidence by purchasing shares over the past few months. While revenue is expected to grow annually by 9.47%, earnings are forecasted to decline significantly over the next three years due to reliance on external borrowing for funding.

- Click here to discover the nuances of Vasta Platform with our detailed analytical valuation report.

Gain insights into Vasta Platform's past trends and performance with our Past report.

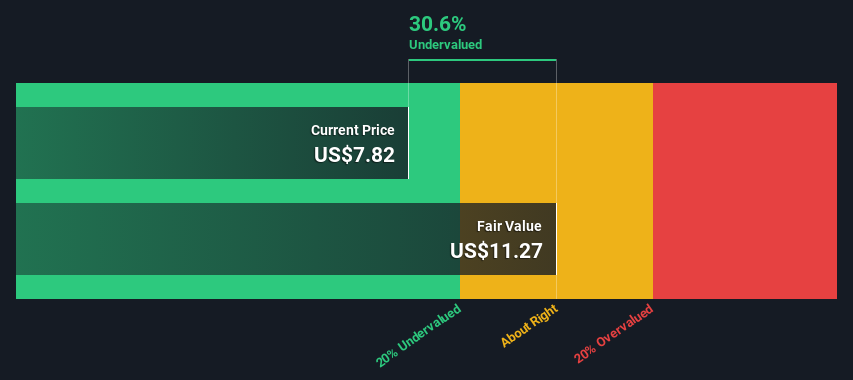

NL Industries (NYSE:NL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NL Industries is primarily engaged in the manufacture and sale of component products, with a market capitalization of approximately $0.43 billion.

Operations: The company generates revenue primarily from its component products segment, with recent quarterly revenues reaching approximately $145.90 million. The cost of goods sold (COGS) fluctuates, impacting the gross profit margin, which has varied between 28.34% and 39.77% over recent periods. Operating expenses are a significant part of costs, with general and administrative expenses being a major contributor within this category.

PE: 5.4x

NL Industries, a small cap company, has shown significant financial improvement with net income reaching US$67.23 million for 2024, reversing from a net loss the previous year. Insider confidence is evident as they increased their shareholdings over recent months. Despite legal settlements requiring US$56.1 million in payments, NL expects to recognize US$31.4 million in aggregate income from related environmental accrual releases and funds received from other companies involved in the settlement.

- Get an in-depth perspective on NL Industries' performance by reading our valuation report here.

Assess NL Industries' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Investigate our full lineup of 69 Undervalued US Small Caps With Insider Buying right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NL Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NL

NL Industries

Through its subsidiaries, operates in the component products industry in Europe, North America, the Asia Pacific, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives