- United States

- /

- Hospitality

- /

- NasdaqGS:TCOM

Trip.com Group (NasdaqGS:TCOM) Sees Revenue Rise To ¥13,830 Million In Q1 2025

Reviewed by Simply Wall St

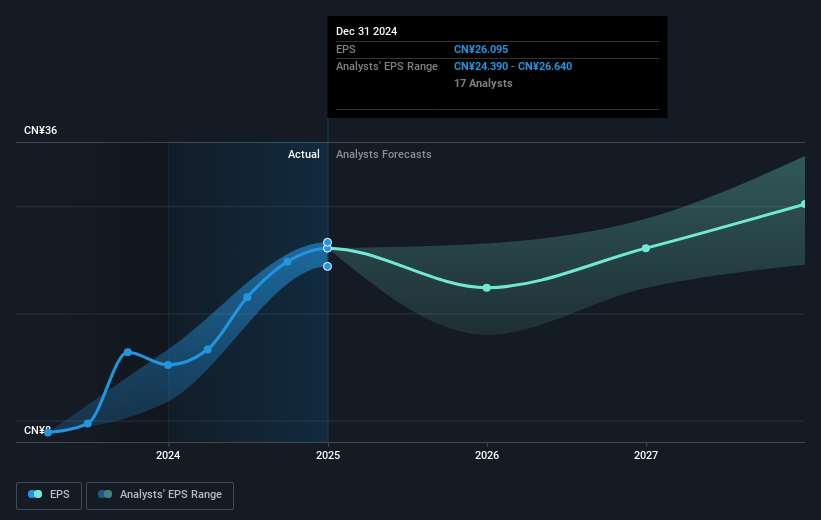

Trip.com Group (NasdaqGS:TCOM) reported its first quarter earnings, showcasing a revenue increase to CNY 13,830 million, despite a slight dip in net income and EPS compared to the previous year. This financial update arrives alongside a notable market trend, where major indices experienced slight downturns after steady gains. The company's stock price surged by 22% last month, an impressive figure, potentially buoyed by the broader positive market momentum seen in recent weeks. Trip.com's earnings release, combined with a recently robust market, may have amplified the positive sentiment around its shares during this period.

Buy, Hold or Sell Trip.com Group? View our complete analysis and fair value estimate and you decide.

The recent earnings report from Trip.com Group, showing a revenue increase to CN¥13.83 billion, amidst a decline in net income and EPS, can potentially influence investors' perceptions of the company's growth trajectory. The positive revenue numbers may bolster confidence in Trip.com's strategic initiatives, such as enhancing user engagement with AI-driven tools and expanding its market presence. However, concerns over declining net margins and increased operational costs amidst macroeconomic challenges might temper these sentiments.

Over the past three years, Trip.com's total shareholder return, including share price and dividends, was 231.55%. This significant long-term performance exceeds the US Market and US Hospitality industry returns over the past year, which were 11.9% and 13.3% respectively. The substantial long-term gains highlight the company's successful navigation of past challenges, contrasting with its more modest annual performance relative to the market and industry benchmarks.

The company's robust recent performance, with a 22% share price surge in the past month, is framed within its analyst consensus price target of US$74.49. With the current share price at US$61.22, there's a 17.8% potential upside based on these projections. The earnings forecast, assuming an annual revenue growth of 11.3%, alongside anticipated lower profit margins, remains critical as Trip.com seeks to align operational efficiencies with its growth strategies in the evolving market landscape. These forecasts might be affected by continued revenue increases and any further operational cost adjustments, spotlighting the importance of maintaining momentum in travel service offerings and market expansions.

Examine Trip.com Group's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trip.com Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCOM

Trip.com Group

Through its subsidiaries, operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours, in-destination, corporate travel management, and other travel-related services in China and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives