- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

US Stocks Trading At Estimated Discounts In January 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance amid fluctuating economic indicators and interest rate concerns, investors are closely watching for opportunities in undervalued stocks. In this environment, identifying stocks trading at estimated discounts can be crucial, as these may offer potential value despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.16 | $53.39 | 49.1% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $31.31 | $61.51 | 49.1% |

| Afya (NasdaqGS:AFYA) | $15.08 | $29.71 | 49.2% |

| Ally Financial (NYSE:ALLY) | $35.61 | $69.79 | 49% |

| Constellium (NYSE:CSTM) | $10.77 | $21.02 | 48.8% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $39.04 | $75.26 | 48.1% |

| Bilibili (NasdaqGS:BILI) | $16.78 | $32.73 | 48.7% |

| Vasta Platform (NasdaqGS:VSTA) | $2.30 | $4.41 | 47.8% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.78 | $30.71 | 48.6% |

| Coeur Mining (NYSE:CDE) | $6.44 | $12.66 | 49.1% |

We're going to check out a few of the best picks from our screener tool.

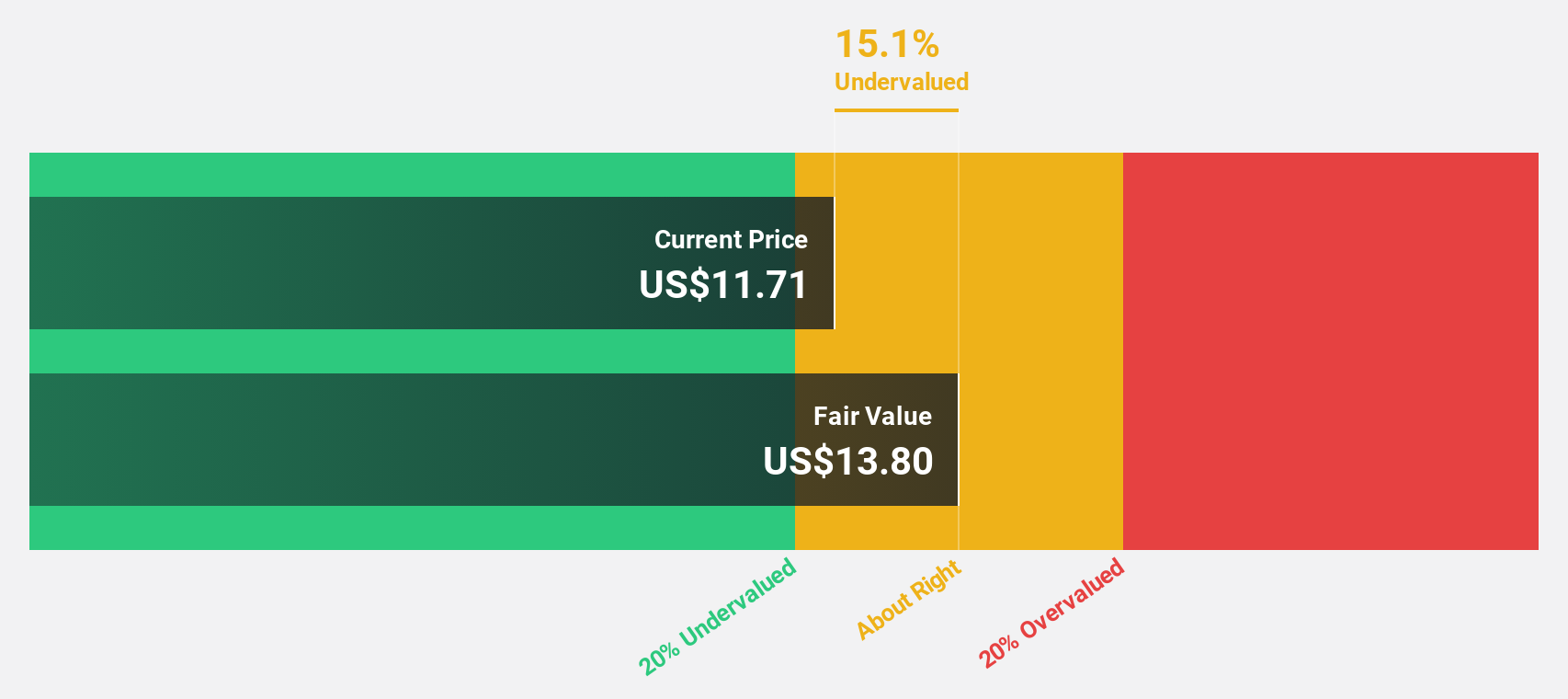

Sportradar Group (NasdaqGS:SRAD)

Overview: Sportradar Group AG, along with its subsidiaries, offers sports data services for the sports betting and media industries across various regions including the United Kingdom, the United States, Malta, Switzerland, and internationally, with a market cap of approximately $5.53 billion.

Operations: Sportradar Group AG generates revenue through its sports data services, catering to the sports betting and media sectors across multiple regions including the UK, US, Malta, Switzerland, and globally.

Estimated Discount To Fair Value: 11.8%

Sportradar Group is trading at US$18.56, below its estimated fair value of US$21.04, suggesting it may be undervalued based on cash flows. The company recently reported a significant increase in net income and raised its earnings guidance for 2024, expecting revenue to reach at least €1.09 billion. While revenue growth is forecasted to be moderate, earnings are expected to grow significantly over the next three years, supported by strategic M&A opportunities and innovative product offerings with the NBA.

- Upon reviewing our latest growth report, Sportradar Group's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Sportradar Group with our detailed financial health report.

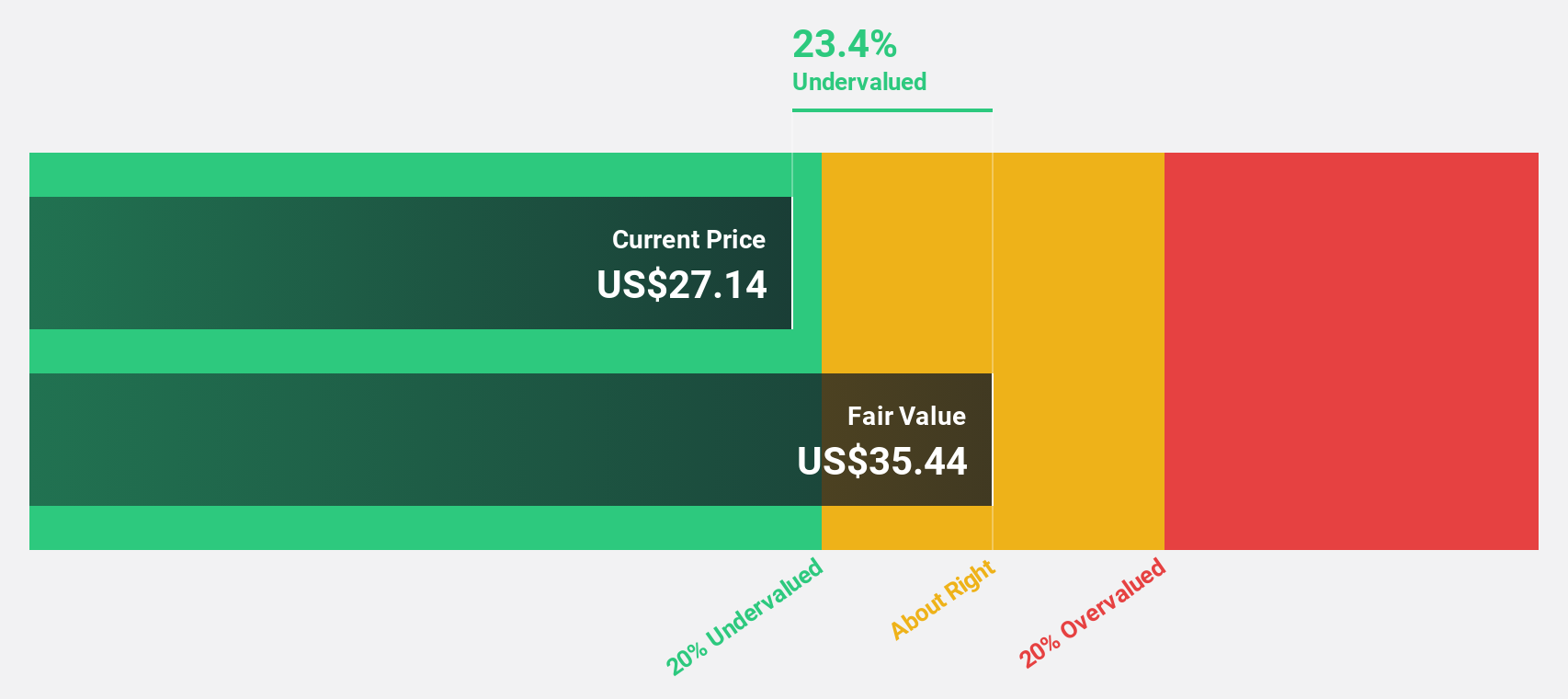

Cadence Bank (NYSE:CADE)

Overview: Cadence Bank offers commercial banking and financial services with a market cap of $6.42 billion.

Operations: The company's revenue segments include Mortgage at $98.11 million, Banking Services at $145.35 million, Community Banking at $1.27 billion, and Corporate Banking at $427.93 million.

Estimated Discount To Fair Value: 46.3%

Cadence Bank, trading at US$35.10, is significantly undervalued with a fair value estimate of US$65.35 based on discounted cash flow analysis. Recent earnings show strong growth in net income to US$136.44 million for Q3 2024 from the previous year’s US$92.58 million, alongside a substantial increase in net interest income. However, profit margins have decreased to 9.3% from 22.9%, and dividend sustainability remains questionable despite consistent payouts.

- Our comprehensive growth report raises the possibility that Cadence Bank is poised for substantial financial growth.

- Get an in-depth perspective on Cadence Bank's balance sheet by reading our health report here.

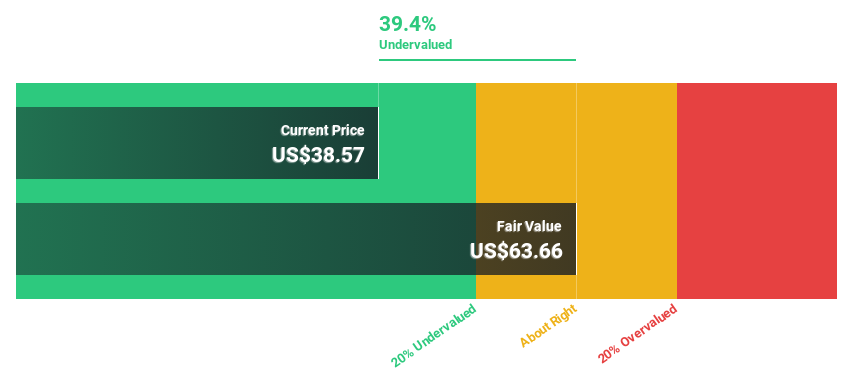

V.F (NYSE:VFC)

Overview: V.F. Corporation, along with its subsidiaries, operates in the design, procurement, marketing, and distribution of branded lifestyle apparel, footwear, and accessories for men, women, and children across the Americas, Europe, and the Asia-Pacific regions with a market cap of $8.39 billion.

Operations: The company's revenue segments include Work at $857.11 million, Active at $3.83 billion, and Outdoor at $5.41 billion.

Estimated Discount To Fair Value: 22.6%

V.F. Corporation, priced at US$21.54, is undervalued with a fair value estimate of US$27.82 based on discounted cash flow analysis. Despite slower revenue growth forecasts of 1.5% annually compared to the market's 9%, earnings are expected to grow significantly at 59.77% per year, becoming profitable within three years. Recent results show improved net income of US$52.18 million for Q2 2024 from a loss last year, yet dividend coverage remains weak and interest payments are not well covered by earnings.

- According our earnings growth report, there's an indication that V.F might be ready to expand.

- Dive into the specifics of V.F here with our thorough financial health report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 170 Undervalued US Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Provides sports data services for the sports betting and media industries in the United Kingdom, the United States, Malta, Switzerland, and internationally.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives