- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

The Bull Case For Sportradar Group (SRAD) Could Change Following Morgan Stanley’s Upgraded Outlook and Analyst Endorsements – Learn Why

Reviewed by Sasha Jovanovic

- In recent days, Morgan Stanley maintained its rating on Sportradar Group AG while raising its outlook, and Jim Cramer expressed confidence in the company's business fundamentals and industry leadership.

- Analyst and media endorsement have helped drive renewed attention to Sportradar’s role as a key technology provider supporting the growth of sports betting markets worldwide.

- We’ll examine how Morgan Stanley’s increased attention, especially their reassessment of Sportradar’s industry standing, could influence the investment narrative from here.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sportradar Group Investment Narrative Recap

To be a shareholder in Sportradar today, you need to believe in its ability to capitalize on the global expansion of sports betting, continued integration with major leagues, and a strong pipeline of advanced data products. The recent attention from Morgan Stanley and Jim Cramer aligns with this thesis and may boost short-term sentiment, but it does not materially alter the primary catalyst: ongoing adoption of premium data services or the key risk of intensifying competition and margin pressure from heavy investment in technology and acquisitions.

Among recent company developments, Sportradar’s expanded partnership with Bundesliga International stands out as particularly relevant, reinforcing the company’s efforts to deepen its integration with top-tier leagues, a direct factor supporting recurring revenue streams and future margin expansion. By delivering enhanced data offerings and betting experiences for the upcoming season, this announcement closely aligns with the demand catalyst highlighted by market watchers.

In contrast, investors should also remain keenly aware of the risks posed if sports leagues decide to internalize data distribution rights and what this might mean for Sportradar’s exclusivity...

Read the full narrative on Sportradar Group (it's free!)

Sportradar Group's narrative projects €1.8 billion revenue and €262.9 million earnings by 2028. This requires 15.5% yearly revenue growth and a €153.3 million increase in earnings from €109.6 million currently.

Uncover how Sportradar Group's forecasts yield a $33.74 fair value, a 28% upside to its current price.

Exploring Other Perspectives

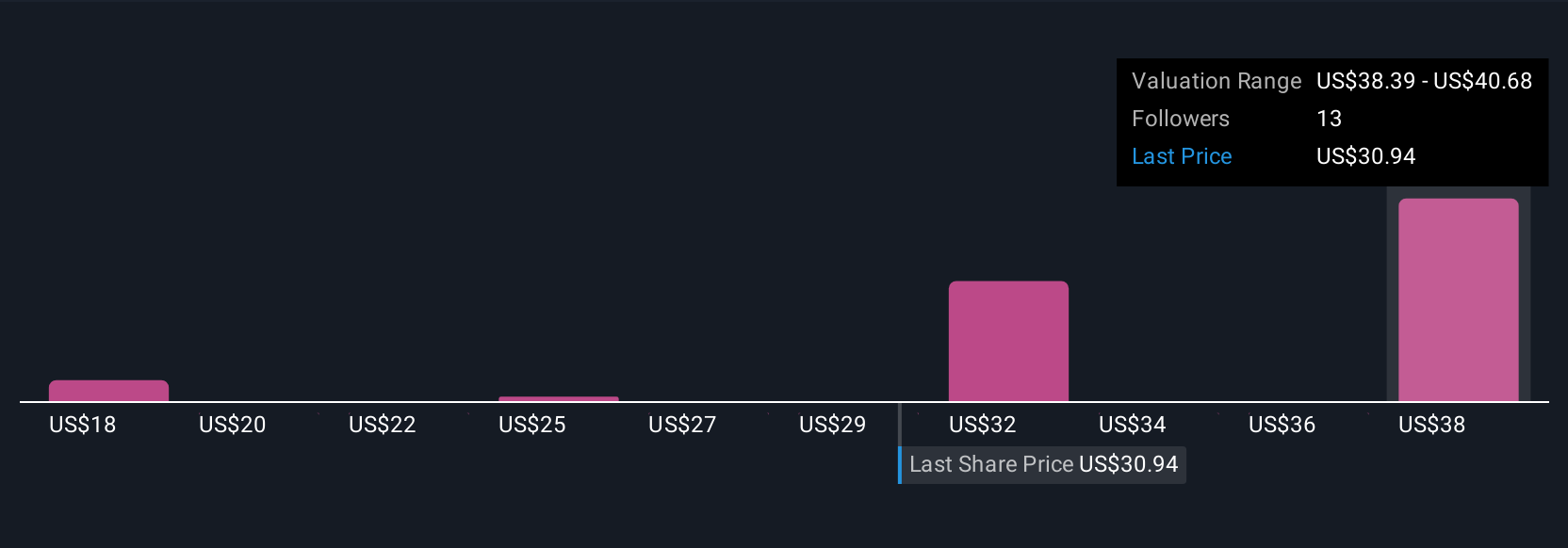

Four fair value estimates from the Simply Wall St Community range from US$17.81 up to US$41.10. Some see strong growth potential, but the risk of escalating technology costs and margin compression may weigh on future profitability. Explore the full spectrum of views and how your outlook compares.

Explore 4 other fair value estimates on Sportradar Group - why the stock might be worth as much as 55% more than the current price!

Build Your Own Sportradar Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sportradar Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Sportradar Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sportradar Group's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Provides sports data services for the sports betting and media industries in Switzerland, the United States, North America, Africa, the Asia Pacific, the Middle East, Europe, Latin America, and the Caribbean.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives