Last Update 15 Dec 25

Fair value Increased 0.25%SRAD: Share Buybacks And Core Media Strength Will Drive Returns Ahead

Analysts have modestly reduced their average price target on Sportradar Group, trimming fair value expectations by less than $1 to reflect slightly higher discount rates and a marginally lower long term profit margin outlook, while remaining encouraged by solid core momentum, improving media traction, and longer term upside from prediction markets.

Analyst Commentary

Recent Street commentary reflects a generally constructive stance on Sportradar's long term growth profile, even as near term expectations are calibrated lower. Analysts are fine tuning models following the latest quarterly update, leading to modest price target reductions without a shift in overall positive ratings.

Bullish Takeaways

- Bullish analysts continue to recommend the shares, arguing that the recent pullback has overreacted to a muted growth outlook and now offers an attractive entry point relative to long term earnings power.

- Updates to models incorporate better visibility into 2025 guidance, with particular confidence in the durability of the core data and integrity business, which is seen as a key driver of margin expansion over time.

- The strengthening media segment, including improved traction with rights holders and distribution partners, is viewed as a structural growth engine that can support sustained double digit revenue growth.

- Optionality from prediction markets and the integration of acquired assets is seen as underappreciated in current valuation multiples, providing upside if execution remains disciplined.

Bearish Takeaways

- Bearish analysts are concerned that the near term growth outlook appears subdued relative to prior expectations, warranting higher discount rates and slightly lower long term margin assumptions in valuation models.

- There is caution that integration and scaling of new assets, including recent acquisitions, could pressure execution and delay the realization of anticipated synergies.

- Some investors worry that competitive intensity in sports data and media could limit pricing power, constraining upside to revenue per client and delaying operating leverage.

- The modest, but broad based trimming of price targets underscores a view that Sportradar must demonstrate more consistent quarterly delivery before the market is willing to re rate the stock toward prior valuation highs.

What's in the News

- The Bear Cave published a cautious report arguing investors may overestimate Sportradar's moat and business quality while underestimating growing competition, prediction market headwinds, and reputational risk related to alleged facilitation of crooked gambling (periodical).

- Cboe Global announced plans to launch federally regulated prediction markets that will initially exclude sports products. This highlights rising competition and regulatory focus in adjacent markets relevant to Sportradar's long term opportunity set (periodical).

- Sportradar raised its fiscal 2025 guidance and now expects revenue of at least €1,290 million, implying year on year growth of at least 17%. This reinforces management's stated confidence in the growth outlook despite heightened scrutiny (key development).

- The company increased its equity buyback authorization by $100 million to a total of $300 million, indicating continued capital return and signaling that management views the shares as undervalued (key development).

- Underdog became the first U.S. operator to adopt Sportradar's Bettor Sense AI powered responsible gaming solution, expanding the firm's footprint in player protection technology and supporting its integrity focused brand positioning (key development).

Valuation Changes

- Fair Value has risen slightly, moving from €32.92 to approximately €33.00 per share. This reflects a modest uplift in long term valuation assumptions.

- The Discount Rate has increased slightly from about 7.79 percent to 7.86 percent, indicating a marginally higher required return applied to future cash flows.

- Revenue Growth remains essentially unchanged, ticking up fractionally from 17.71 percent to 17.71 percent and signaling stable top line expectations.

- The Net Profit Margin has edged down slightly from roughly 15.81 percent to 15.79 percent, implying a modestly more conservative long term profitability outlook.

- The Future P/E has declined slightly from 34.0x to about 33.8x, suggesting a small compression in the multiple investors are expected to pay for forward earnings.

Key Takeaways

- Expanding global sports betting markets and rising demand for advanced data solutions are driving recurring revenue growth and margin expansion.

- Deeper client integration, premium product adoption, and strategic sports rights deals increase retention, pricing power, and earnings quality.

- Intensifying competition, regulatory risks, and rising costs threaten Sportradar's revenue stability, profitability, and negotiating strength as sports data becomes increasingly commoditized.

Catalysts

About Sportradar Group- Provides sports data services for the sports betting and media industries in Switzerland, the United States, North America, Africa, the Asia Pacific, the Middle East, Europe, Latin America, and the Caribbean.

- Continued global legalization and expansion of sports betting, particularly ongoing rapid growth in the U.S., Brazil, and emerging APAC markets, are expanding Sportradar's total addressable market and underpinning robust, recurring revenue growth.

- Increasing demand for advanced, real-time sports data, in-play betting, and micro markets is driving greater adoption of premium, higher-margin products like MTS and 4Sight, supporting both revenue acceleration and EBITDA margin expansion.

- Deepening integration with clients and cross-selling/upselling a broader suite of products-evidenced by 40% of clients now using four or more Sportradar products-boosts take rates, retention and generates high-quality, recurring revenue, positively impacting earnings growth.

- Investment in AI-driven analytics, automated content generation, and operational efficiencies is increasing developer productivity, accelerating product time-to-market, and lowering costs, which should further support sustained margin expansion and cash flow generation.

- Acquisition of IMG's sports rights and ongoing long-term data rights partnerships secure multi-year revenue visibility and premium pricing power, enhancing top-line growth and earnings quality.

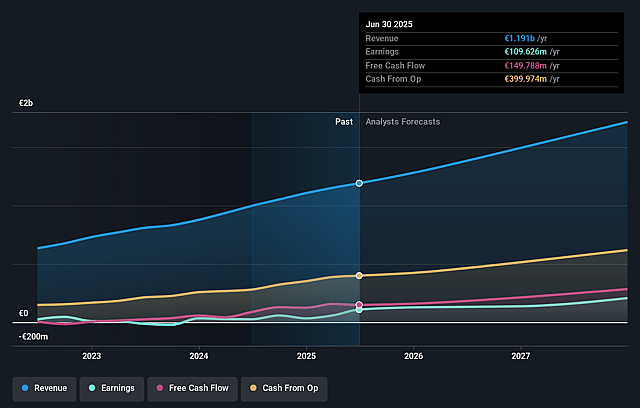

Sportradar Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sportradar Group's revenue will grow by 15.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.2% today to 14.3% in 3 years time.

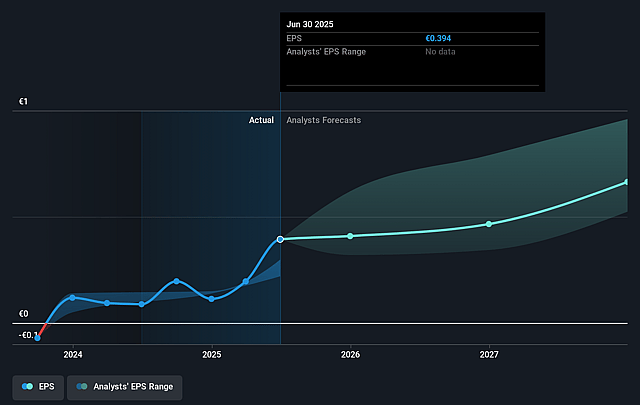

- Analysts expect earnings to reach €262.9 million (and earnings per share of €0.82) by about September 2028, up from €109.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €303.7 million in earnings, and the most bearish expecting €168.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 49.5x on those 2028 earnings, down from 71.4x today. This future PE is greater than the current PE for the US Hospitality industry at 24.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.91%, as per the Simply Wall St company report.

Sportradar Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing competition from both established players and sports leagues directly entering the data distribution market (e.g., European league data rights previously held by IMG lost due to unprofitable deals) may pressure Sportradar's pricing power and reduce onboarding fee opportunities, negatively impacting future revenue and net margins.

- Ongoing margin compression risk exists as Sportradar continues to invest heavily in technology, AI, and acquisitions (e.g., pending IMG Arena acquisition), which could increase R&D and personnel costs faster than revenue growth if market expansion slows, potentially eroding net margins and earnings.

- Overdependence on long-term contracts and content rights for key sports (e.g., ATP, MLB, Bundesliga) creates vulnerability should these leagues renegotiate, reprice, or internalize their data distribution, which could lead to revenue instability or declines if exclusivity is lost.

- Regulatory uncertainties and potential changes-such as evolving tax treatment, data privacy laws, or restrictions on betting advertising and operations-especially in emerging markets like Brazil, Thailand, or the U.S., may increase compliance costs and limit the addressable market, putting downward pressure on both revenue growth and net margins.

- The growing commoditization of sports data and potential for technological disintermediation (e.g., rapid advancement in AI-driven direct-to-consumer betting tools or sports analysis) might diminish Sportradar's value proposition to operators and media firms, threatening medium-to-long-term take rates, revenue, and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $32.974 for Sportradar Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $38.85, and the most bearish reporting a price target of just $26.18.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.8 billion, earnings will come to €262.9 million, and it would be trading on a PE ratio of 49.5x, assuming you use a discount rate of 7.9%.

- Given the current share price of $30.52, the analyst price target of $32.97 is 7.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Sportradar Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.