- United States

- /

- Medical Equipment

- /

- NasdaqCM:SMLR

Top Undervalued Small Caps With Insider Buying In US For November 2024

Reviewed by Simply Wall St

The United States market has experienced a flat week but has shown impressive growth of 31% over the past year, with earnings anticipated to increase by 15% annually in the coming years. In this context, identifying small-cap stocks with insider buying can be an intriguing opportunity for investors seeking potential value plays amid these dynamic market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| ProPetro Holding | NA | 0.6x | 41.67% | ★★★★★☆ |

| Capital Bancorp | 14.6x | 3.0x | 46.53% | ★★★★☆☆ |

| Franklin Financial Services | 10.5x | 2.1x | 35.17% | ★★★★☆☆ |

| HighPeak Energy | 11.5x | 1.7x | 32.77% | ★★★★☆☆ |

| German American Bancorp | 16.3x | 5.4x | 43.25% | ★★★☆☆☆ |

| USCB Financial Holdings | 19.7x | 5.6x | 46.81% | ★★★☆☆☆ |

| First United | 14.3x | 3.2x | 44.49% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -81.23% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -83.91% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

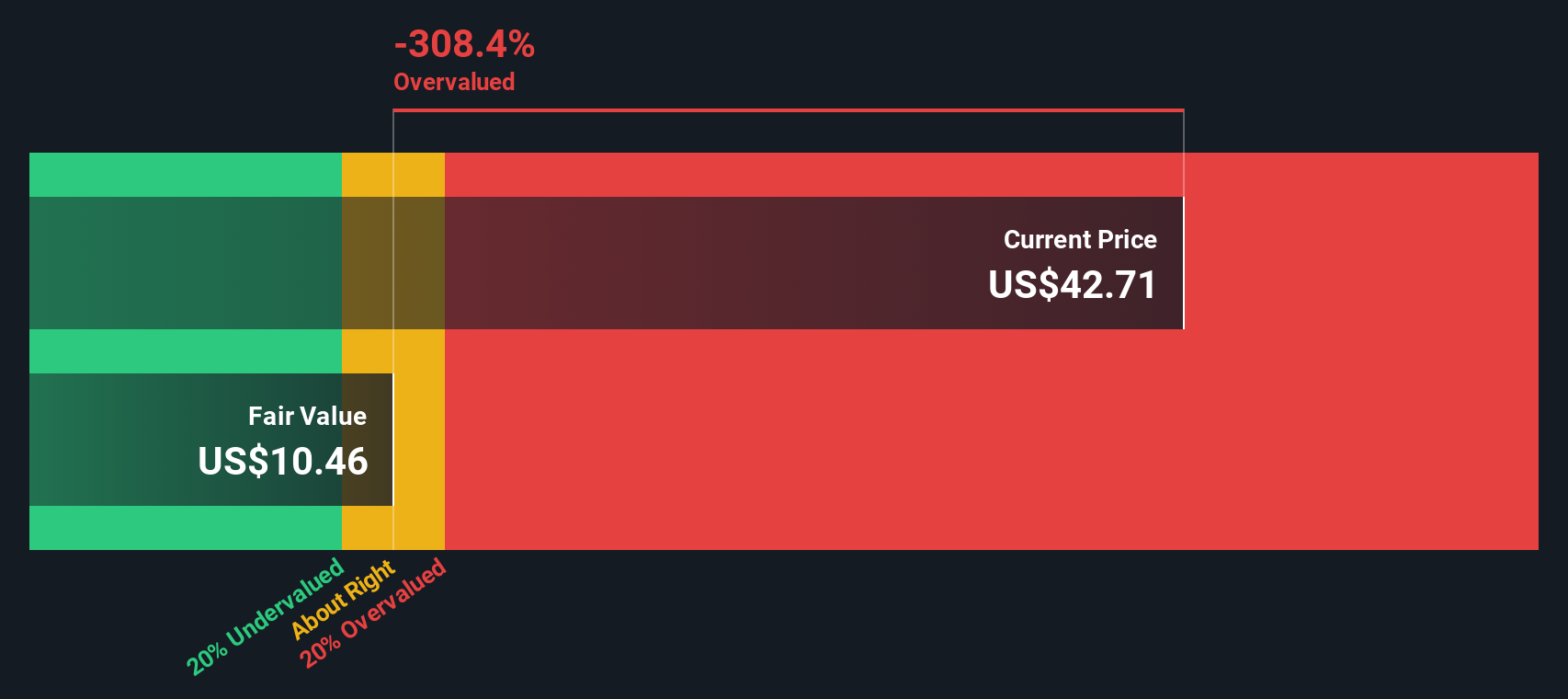

Semler Scientific (NasdaqCM:SMLR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Semler Scientific specializes in developing and selling diagnostic kits and equipment, with a market cap of approximately $0.23 billion.

Operations: The company's revenue is primarily derived from diagnostic kits and equipment, with a significant gross profit margin trend peaking at 92.86% in September 2023 before declining to 88.05% by September 2024. Operating expenses, including sales and marketing, R&D, and general & administrative costs, are substantial components of the cost structure. Net income margins have shown improvement over time, reaching up to 32.92% in March 2024 before a slight reduction to around 27% by September of the same year.

PE: 31.8x

Semler Scientific, a smaller company in the U.S., recently caught attention due to insider confidence, with Eric Semler purchasing 50,000 shares for US$1.90 million. Despite a drop in third-quarter sales to US$13.51 million from US$16.32 million last year, net income slightly increased to US$5.61 million. The firm filed for a shelf registration of approximately US$95 million and faces high volatility and riskier funding sources but maintains stable earnings quality despite these challenges.

- Click here to discover the nuances of Semler Scientific with our detailed analytical valuation report.

Evaluate Semler Scientific's historical performance by accessing our past performance report.

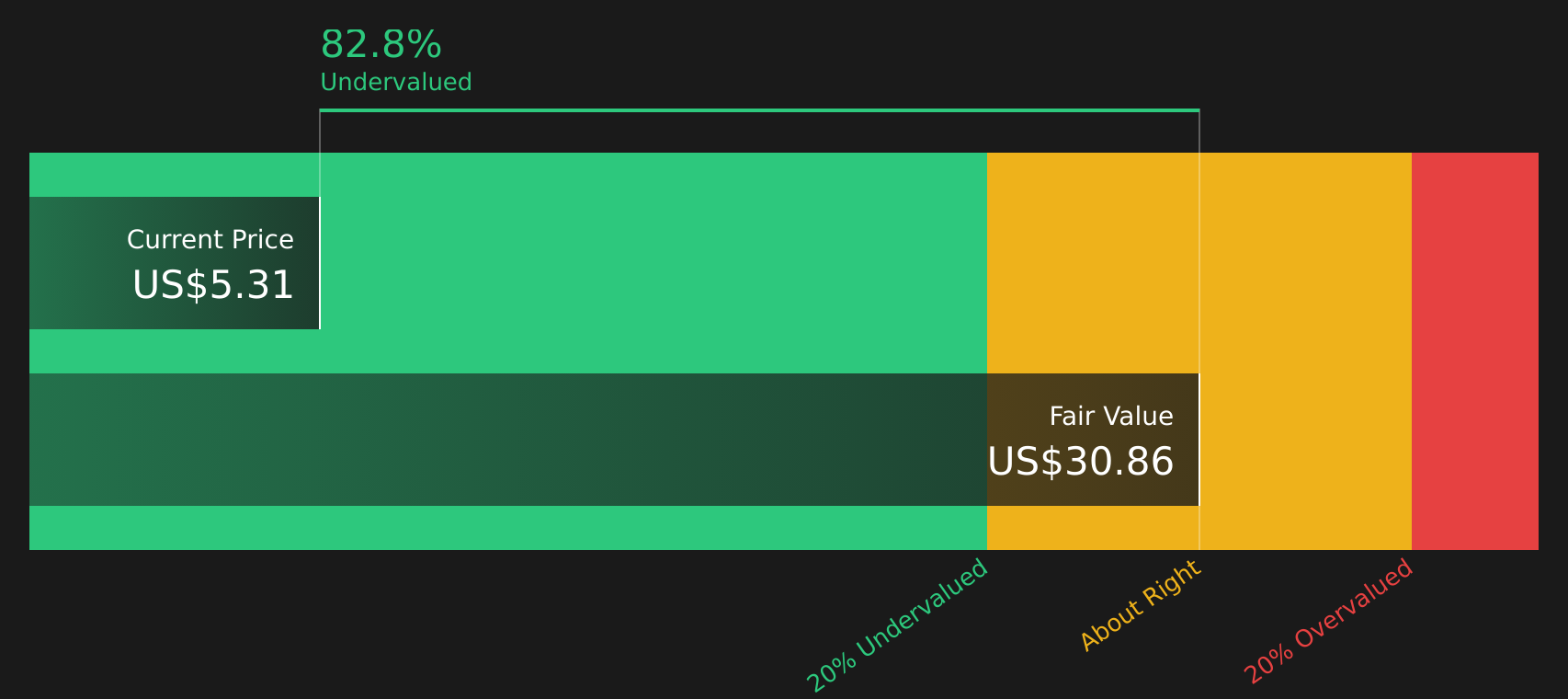

ProFrac Holding (NasdaqGS:ACDC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ProFrac Holding is a company engaged in providing hydraulic fracturing services and manufacturing, with operations including proppant production and stimulation services, and has a market capitalization of approximately $2.06 billion.

Operations: ProFrac Holding's primary revenue stream is from Stimulation Services, contributing significantly to its total revenue. The company has experienced fluctuations in its gross profit margin, reaching a high of 40.69% and later decreasing to 34.51%. Operating expenses remain substantial, with notable allocations towards general and administrative expenses.

PE: -6.9x

ProFrac Holding, a company in the energy sector, is currently experiencing significant insider confidence with recent share purchases indicating potential value recognition. Despite reporting a net loss of US$45.2 million for Q3 2024, ProFrac's strategic partnership with Prairie Operating Co. to deploy an electric frac fleet marks a forward-thinking shift towards sustainable operations. Sales remained steady at US$575 million for the quarter compared to last year, reflecting resilience amidst industry challenges and positioning ProFrac as an intriguing prospect within its category.

- Navigate through the intricacies of ProFrac Holding with our comprehensive valuation report here.

Understand ProFrac Holding's track record by examining our Past report.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre operates as a technology solutions provider for the global travel and tourism industry, with a focus on its Travel Solutions and Hospitality Solutions segments, and has a market cap of $2.89 billion.

Operations: The company's revenue primarily comes from Travel Solutions, contributing $2.72 billion, and Hospitality Solutions at $321.16 million. Over the years, the gross profit margin has shown fluctuations, reaching a high of 81.41% in mid-2020 before stabilizing around 59% to 60% in recent periods.

PE: -4.8x

Sabre, a tech company in the travel industry, is gaining traction by integrating New Distribution Capability (NDC) content with airlines like EVA Air and Air India, enhancing travel agency offerings. Recent product launches like Sabre Red Launchpad streamline booking processes for agents. Despite a net loss of US$62.82 million in Q3 2024, improved from last year, insider confidence shown through recent share purchases hints at potential growth prospects as revenue forecasts suggest an 87% annual increase.

- Dive into the specifics of Sabre here with our thorough valuation report.

Gain insights into Sabre's past trends and performance with our Past report.

Where To Now?

- Get an in-depth perspective on all 47 Undervalued US Small Caps With Insider Buying by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Semler Scientific, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMLR

Semler Scientific

Provides technology solutions to enhance the clinical effectiveness and efficiency of healthcare providers in the United States.

Slight with worrying balance sheet.

Market Insights

Community Narratives