- United States

- /

- Hospitality

- /

- NasdaqCM:LIND

3 Top Undervalued Small Caps With Insider Buying In Various Regions

Reviewed by Simply Wall St

As the U.S. stock market navigates a complex landscape of earnings reports and tariff developments, small-cap stocks within the S&P 600 have become a focal point for investors seeking opportunities amid broader economic uncertainties. With insider buying often seen as a positive indicator of confidence in a company's prospects, identifying undervalued small caps can be particularly appealing in today's market environment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 9.4x | 2.8x | 34.88% | ★★★★★☆ |

| Southside Bancshares | 10.0x | 3.4x | 40.50% | ★★★★★☆ |

| First United | 8.8x | 2.6x | 49.57% | ★★★★★☆ |

| S&T Bancorp | 10.6x | 3.6x | 41.97% | ★★★★☆☆ |

| Gentherm | 32.3x | 0.7x | 28.06% | ★★★★☆☆ |

| FirstSun Capital Bancorp | 10.9x | 2.6x | 47.70% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 22.21% | ★★★★☆☆ |

| Lindblad Expeditions Holdings | NA | 1.0x | 15.97% | ★★★★☆☆ |

| Farmland Partners | 7.1x | 8.6x | -43.54% | ★★★☆☆☆ |

| Auburn National Bancorporation | 14.1x | 3.0x | 19.94% | ★★☆☆☆☆ |

Let's review some notable picks from our screened stocks.

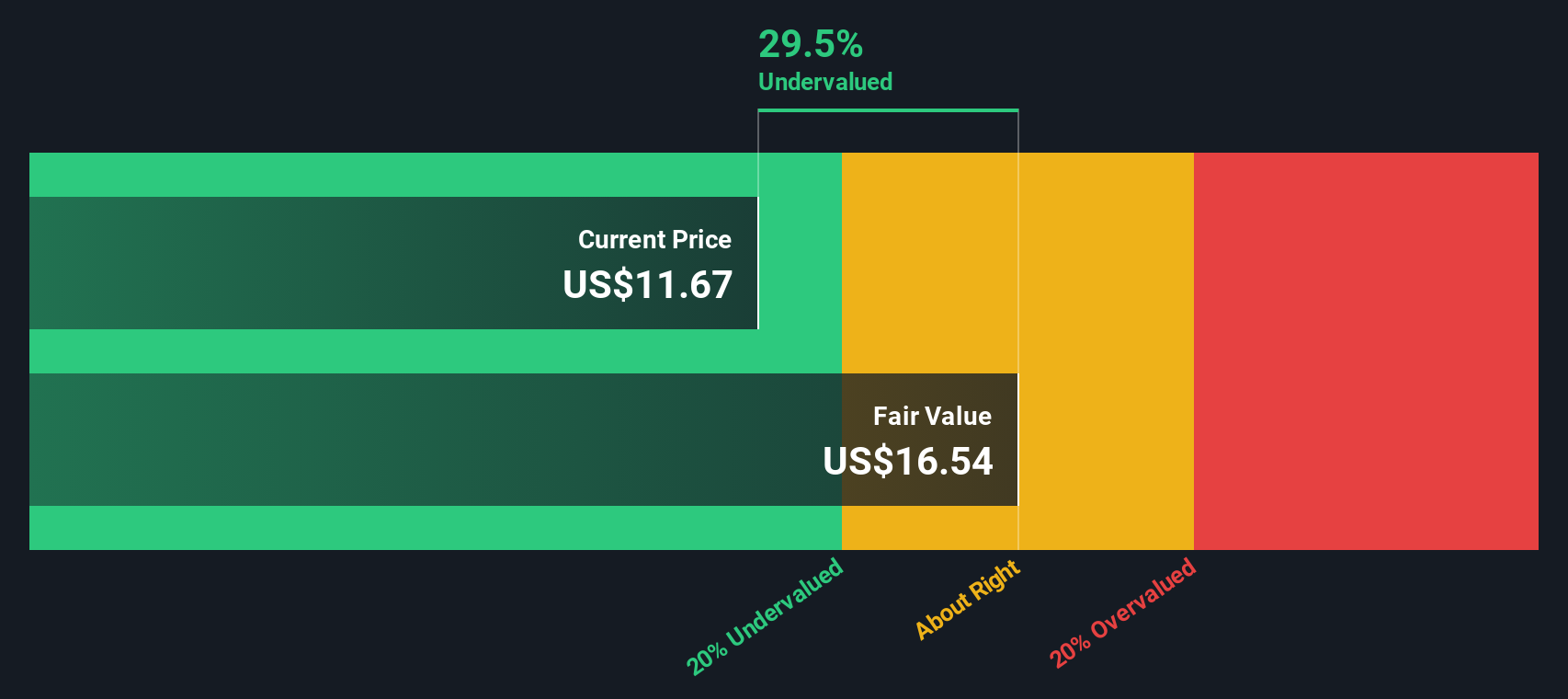

Lindblad Expeditions Holdings (LIND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lindblad Expeditions Holdings operates as a travel and expedition company, offering ship-based voyages and land experiences, with a market cap of approximately $0.54 billion.

Operations: Lindblad Expeditions Holdings generates revenue primarily from its Lindblad and Land Experiences segments, with recent revenues of $702.28 million. The company has experienced fluctuations in its gross profit margin, which reached 48.67% as of June 2025. Operating expenses are significant, with general and administrative costs being a notable component at $140.75 million during the same period.

PE: -48.7x

Lindblad Expeditions Holdings, a small company in the U.S., recently reported a net loss of US$8.52 million for Q2 2025, an improvement from last year's US$24.67 million loss. Sales rose to US$167.95 million from US$136.5 million, reflecting potential growth despite being dropped from multiple Russell indices in June 2025. The company's earnings are forecast to grow significantly at 113% annually, though they rely solely on external borrowing for funding—a higher risk factor to consider moving forward.

- Unlock comprehensive insights into our analysis of Lindblad Expeditions Holdings stock in this valuation report.

Understand Lindblad Expeditions Holdings' track record by examining our Past report.

Orthofix Medical (OFIX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Orthofix Medical is a company specializing in providing medical devices and solutions for spine and orthopedic markets, with a market cap of approximately $0.37 billion.

Operations: Orthofix Medical generates revenue primarily from its Global Spine and Global Orthopedics segments, with the former contributing significantly more. The company's cost structure includes notable expenses in Sales & Marketing and R&D. Over recent periods, the gross profit margin has fluctuated around 68.67% to 78.18%.

PE: -4.0x

Orthofix Medical, a company in the healthcare sector, has recently seen insider confidence with Massimo Calafiore purchasing 10,000 shares valued at US$125,400. Despite being unprofitable and not expected to achieve profitability in the next three years due to reliance on external borrowing for funding, Orthofix reported improved financials for Q2 2025. Sales rose to US$203 million from US$199 million year-over-year while net losses narrowed significantly. The launch of TrueLok Elevate targets a sizable market opportunity addressing diabetic-related amputations.

- Take a closer look at Orthofix Medical's potential here in our valuation report.

Gain insights into Orthofix Medical's past trends and performance with our Past report.

Vitesse Energy (VTS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vitesse Energy focuses on the acquisition, development, and production of oil and natural gas assets with a market capitalization of approximately $0.56 billion.

Operations: Vitesse Energy's primary revenue stream comes from the acquisition, development, and production of oil and natural gas assets, generating $239.90 million in revenue as of the latest period. The company experienced fluctuations in its gross profit margin, reaching a high of 87.92% and a low of 47.65% over the observed periods. Operating expenses include significant depreciation and amortization costs, with recent figures around $112.59 million impacting overall profitability.

PE: 25.5x

Vitesse Energy, navigating the energy sector as a smaller player, has shown promising financial performance recently. For Q2 2025, revenue jumped to US$81.76 million from US$66.6 million last year, with net income soaring to US$24.66 million from US$10.93 million. This growth is underpinned by increased production volumes and insider confidence reflected in stock purchases earlier this year. Despite higher risk funding sources and past shareholder dilution, its potential for continued production growth remains noteworthy with projected daily output of 15,000-17,000 Boe for 2025.

Key Takeaways

- Click here to access our complete index of 83 Undervalued US Small Caps With Insider Buying.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LIND

Lindblad Expeditions Holdings

Provides marine expedition adventures and travel experience worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion