- United States

- /

- Semiconductors

- /

- NYSE:DQ

US Growth Companies With High Insider Ownership For December 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance with the Dow Jones Industrial Average on a five-session winning streak, investors are closely watching for signs of sustained growth amid fluctuating indices. In such an environment, companies with high insider ownership can be particularly appealing as they often signal confidence from those who know the business best, potentially aligning management's interests with shareholders and offering resilience in uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 34.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Ultralife (NasdaqGM:ULBI) | 36% | 43.8% |

Underneath we present a selection of stocks filtered out by our screen.

Duolingo (NasdaqGS:DUOL)

Simply Wall St Growth Rating: ★★★★★★

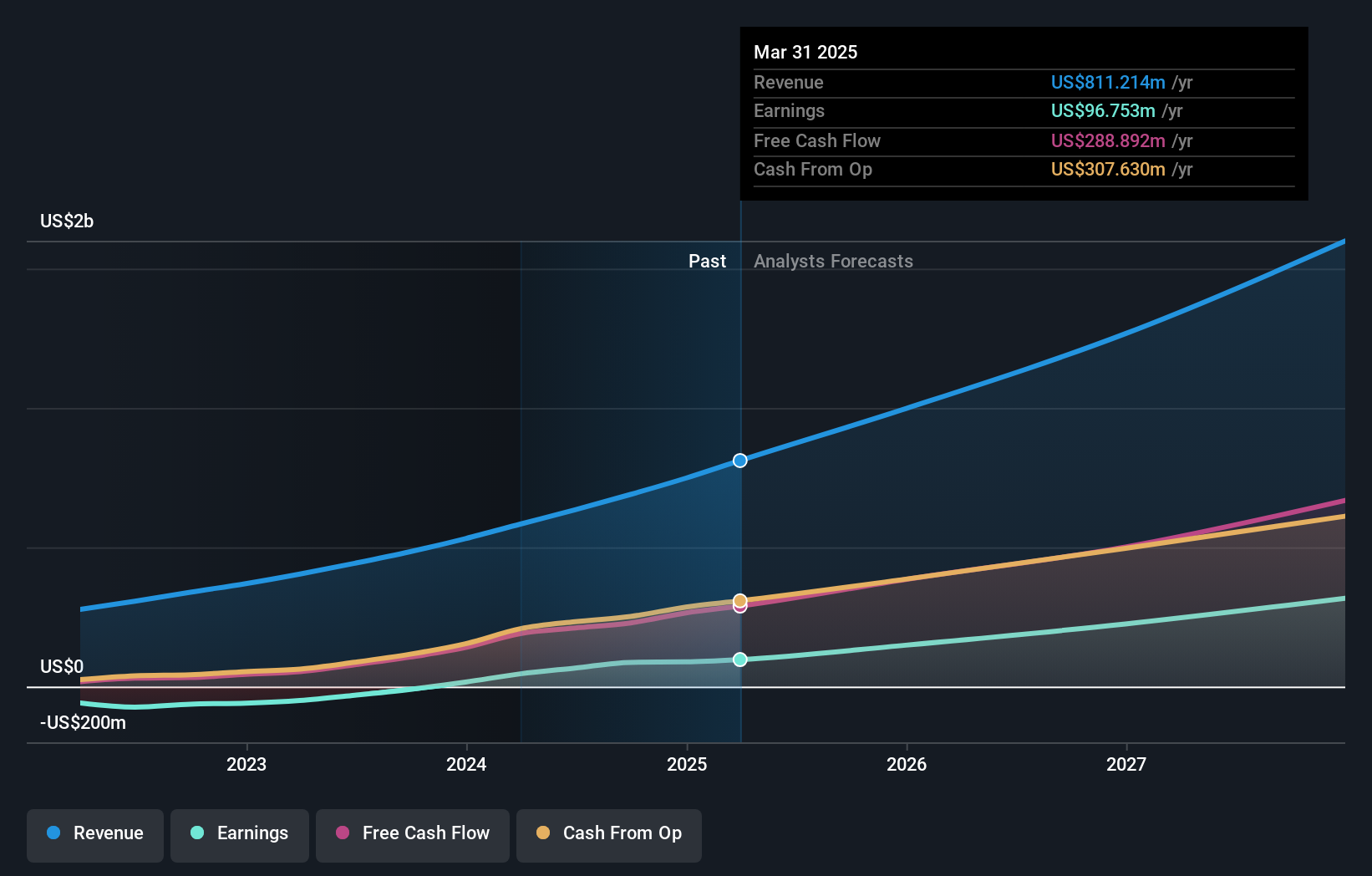

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of approximately $14.97 billion.

Operations: The company generates revenue of $689.46 million from its educational software segment.

Insider Ownership: 14.6%

Earnings Growth Forecast: 34.7% p.a.

Duolingo demonstrates strong growth potential, with revenue projected to increase by 20.9% annually, outpacing the US market's average. Despite recent insider selling, the company has become profitable this year and forecasts significant earnings growth of 34.71% per year over the next three years. Recent strategic moves include appointing Bonnie Ross to its board and collaborating with WEBTOON on a new webcomic series, enhancing its brand presence and engagement opportunities.

- Click here and access our complete growth analysis report to understand the dynamics of Duolingo.

- In light of our recent valuation report, it seems possible that Duolingo is trading beyond its estimated value.

Li Auto (NasdaqGS:LI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Li Auto Inc. operates in the energy vehicle market in the People's Republic of China and has a market cap of approximately $24.38 billion.

Operations: The company generates its revenue primarily from the auto manufacturing segment, which amounted to CN¥141.92 billion.

Insider Ownership: 30.4%

Earnings Growth Forecast: 25% p.a.

Li Auto shows promising growth prospects, with revenue expected to increase by 19.7% annually, surpassing the US market average. Despite a forecasted low return on equity in three years, its earnings are anticipated to grow significantly at 25% per year. Recent delivery results reflect robust performance, with substantial year-over-year increases in vehicle deliveries. The company trades below its estimated fair value and has made strategic board changes that could enhance governance oversight.

- Click to explore a detailed breakdown of our findings in Li Auto's earnings growth report.

- Our expertly prepared valuation report Li Auto implies its share price may be lower than expected.

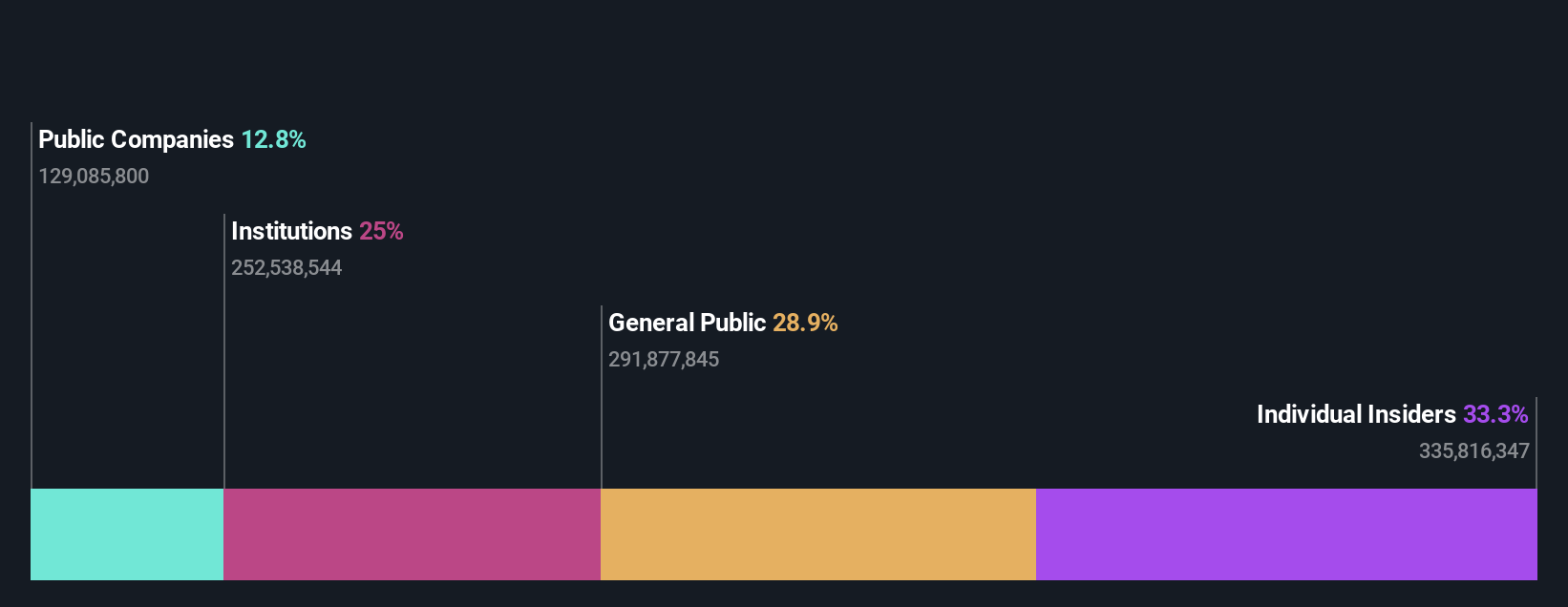

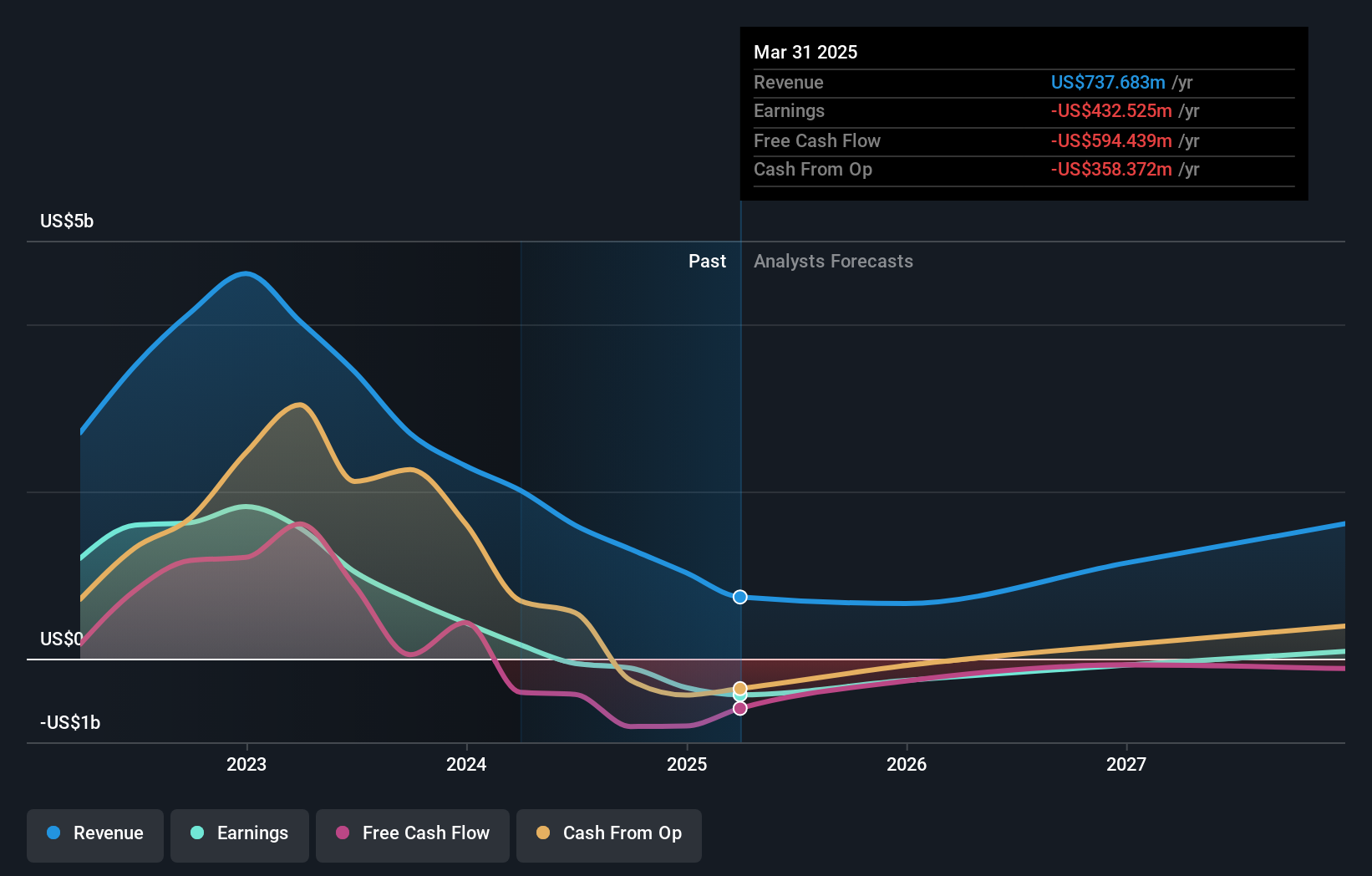

Daqo New Energy (NYSE:DQ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Daqo New Energy Corp. manufactures and sells polysilicon to photovoltaic product manufacturers in China, with a market cap of approximately $1.27 billion.

Operations: The company generates revenue of $1.31 billion from its polysilicon segment, catering to photovoltaic product manufacturers in China.

Insider Ownership: 22.2%

Earnings Growth Forecast: 82.6% p.a.

Daqo New Energy is poised for strong growth, with revenue expected to increase by 24% annually, outpacing the US market. Despite recent financial challenges, including a significant net loss in Q3 2024 and high share price volatility, the company is forecasted to become profitable within three years. Trading at a favorable valuation relative to peers, Daqo has also seen strategic leadership changes which may influence future governance and operational direction.

- Dive into the specifics of Daqo New Energy here with our thorough growth forecast report.

- Our valuation report unveils the possibility Daqo New Energy's shares may be trading at a discount.

Key Takeaways

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 196 more companies for you to explore.Click here to unveil our expertly curated list of 199 Fast Growing US Companies With High Insider Ownership.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DQ

Daqo New Energy

Manufactures and sells polysilicon to photovoltaic product manufacturers in the People’s Republic of China.

Flawless balance sheet with high growth potential.