- United States

- /

- Hospitality

- /

- NasdaqGS:DPZ

Is Domino's Still Attractive After Recent Tech Partnerships and Premium Valuation Signs?

Reviewed by Bailey Pemberton

- Wondering if Domino's Pizza is still a hot slice for your portfolio or if the best gains are already baked in? This breakdown will help you figure out what you are really paying for the stock today.

- Shares are up 3.6% over the last week and 6.9% over the past month, even though they are still slightly down at -0.7% year to date and -3.6% over the last year, which suggests sentiment is shifting after a softer stretch.

- Recently, investors have been reacting to Domino's ongoing push into tech driven delivery and ordering partnerships, including expanded third party delivery integration that aims to capture more digital demand. At the same time, franchise growth and store remodel initiatives have kept Domino's in the headlines as management focuses on efficiency and convenience.

- Despite that backdrop, Domino's currently scores just 0/6 on our valuation checks, which means it does not screen as undervalued on any of our standard tests. Next, we will unpack what different valuation approaches say about that price tag, and then finish with a more holistic way to think about value that goes beyond the usual models.

Domino's Pizza scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Domino's Pizza Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present. For Domino's Pizza, the model uses a 2 Stage Free Cash Flow to Equity approach based on cash flow projections.

Domino's last twelve months Free Cash Flow is about $622.3 Million, and analysts expect this to grow to around $787.4 Million by 2028. Beyond the explicit analyst window, Simply Wall St extrapolates further, with projected Free Cash Flow reaching roughly $926.8 Million by 2035. This reflects a steady, but moderating, growth trajectory as the business matures.

When all those future cash flows are discounted back to today, the DCF model arrives at an estimated intrinsic value of roughly $348.84 per share. Based on this framework, Domino's shares screen as about 23.8% above the DCF fair value, which implies the market is paying a premium relative to these cash flow assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Domino's Pizza may be overvalued by 23.8%. Discover 901 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Domino's Pizza Price vs Earnings

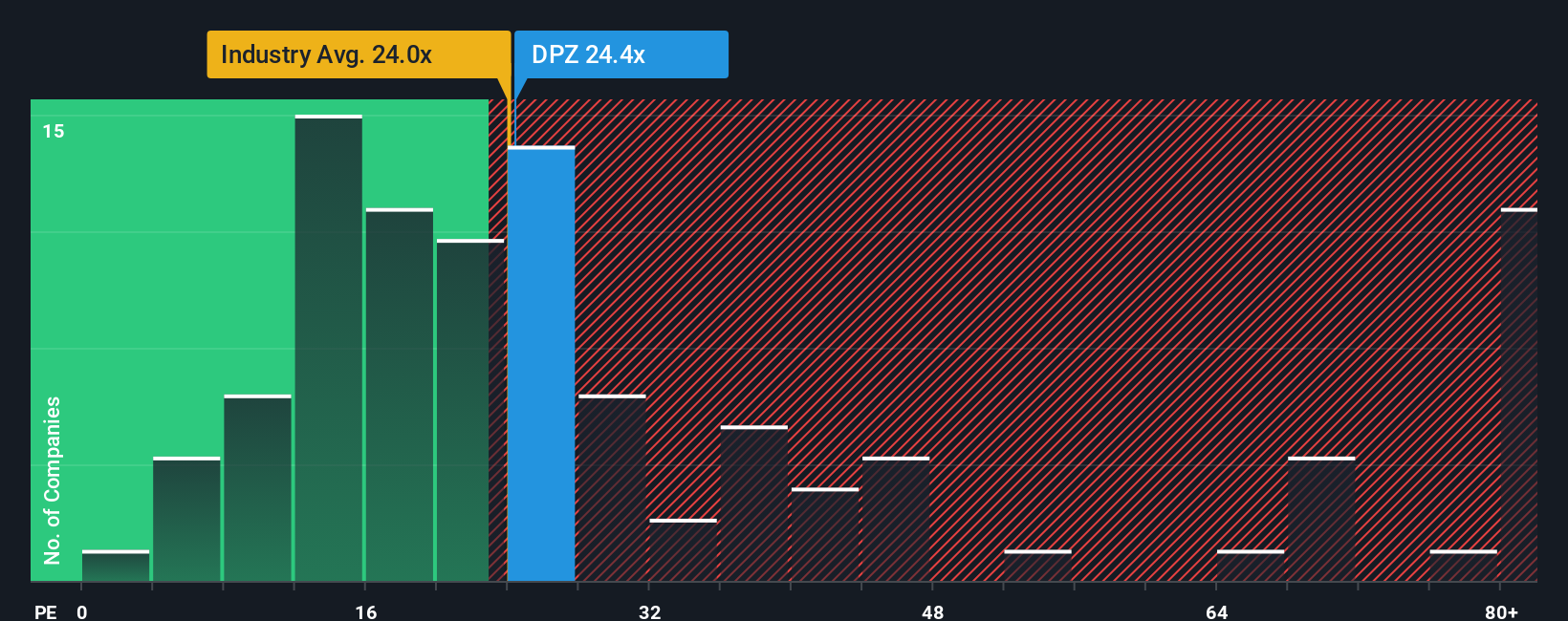

For a profitable, established brand like Domino's, the price to earnings (PE) ratio is a helpful way to gauge whether investors are paying a sensible price for each dollar of current profit. In general, faster growing and lower risk companies deserve higher PE multiples, while slower or riskier businesses should trade closer to, or below, the market and sector norms.

Domino's currently trades on about 24.7x earnings, which is slightly above both its Hospitality industry average of around 24.6x and its peer group average of roughly 23.5x. On the surface, that suggests the market is willing to pay a small premium for Domino's earnings stream.

Simply Wall St's Fair Ratio framework goes a step further by estimating what PE Domino's should trade on, after factoring in its earnings growth profile, margins, industry, market cap and specific risks. That Fair Ratio comes out at about 20.7x, meaning the shares are pricing in more optimism than this model would usually justify. Taken together, the current PE looks somewhat stretched relative to what Domino's fundamentals alone support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Domino's Pizza Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories you create about a company that link your view of its future revenue, earnings and margins to a financial forecast and, ultimately, to a fair value estimate you can compare with the current share price to decide whether to buy, hold or sell. On Simply Wall St, millions of investors build and explore these Narratives in the Community page, using an easy interface that lets them plug in assumptions and instantly see how their story translates into numbers. Because the platform ingests fresh data like news and earnings, each Narrative can be updated dynamically as the facts change, helping your investment thesis stay current rather than static. For Domino's Pizza, for example, one bullish Narrative might lean on digital partnerships, fortressing and menu innovation to justify a fair value near the higher analyst target of about $594. A more cautious Narrative could focus on flat pizza category growth and international challenges and land closer to the lower target near $340, showing how reasonable people can disagree but still stay grounded in disciplined forecasts.

Do you think there's more to the story for Domino's Pizza? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DPZ

Domino's Pizza

Operates as a pizza company in the United States and internationally.

Established dividend payer with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)