- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

US Stocks Estimated To Be Trading Below Intrinsic Value In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, the U.S. stock market presents a mixed picture with the Dow Jones Industrial Average marking its fifth consecutive session of gains, while the S&P 500 and Nasdaq Composite have recently experienced minor setbacks. In this environment of fluctuating indices and shifting investor sentiment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for discerning investors seeking to capitalize on undervaluation in a complex market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.28 | $53.16 | 48.7% |

| Oddity Tech (NasdaqGM:ODD) | $43.48 | $84.40 | 48.5% |

| First National (NasdaqCM:FXNC) | $24.05 | $46.63 | 48.4% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | $34.58 | $68.97 | 49.9% |

| Western Alliance Bancorporation (NYSE:WAL) | $84.66 | $165.14 | 48.7% |

| HealthEquity (NasdaqGS:HQY) | $97.41 | $189.22 | 48.5% |

| Progress Software (NasdaqGS:PRGS) | $66.395 | $129.48 | 48.7% |

| Freshpet (NasdaqGM:FRPT) | $146.06 | $283.12 | 48.4% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.20 | $29.97 | 49.3% |

| Paycor HCM (NasdaqGS:PYCR) | $19.33 | $38.52 | 49.8% |

Here's a peek at a few of the choices from the screener.

DoorDash (NasdaqGS:DASH)

Overview: DoorDash, Inc. operates a commerce platform that links merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of approximately $71.37 billion.

Operations: The company generates revenue primarily through its Internet Information Providers segment, which amounts to $10.15 billion.

Estimated Discount To Fair Value: 30.6%

DoorDash is trading at US$170.57, significantly below its estimated fair value of US$245.62, suggesting it may be undervalued based on discounted cash flow analysis. Recent strategic partnerships, such as with Shipium and Walmart Canada, enhance its service offerings and market reach. Despite past shareholder dilution and insider selling concerns, DoorDash's revenue is forecast to grow faster than the US market average, with profitability expected within three years and a high future return on equity forecasted at 24.2%.

- The analysis detailed in our DoorDash growth report hints at robust future financial performance.

- Take a closer look at DoorDash's balance sheet health here in our report.

Dynatrace (NYSE:DT)

Overview: Dynatrace, Inc. offers a security platform for multicloud environments across various global regions and has a market cap of approximately $16.44 billion.

Operations: The company generates revenue of $1.56 billion from its Internet Software & Services segment.

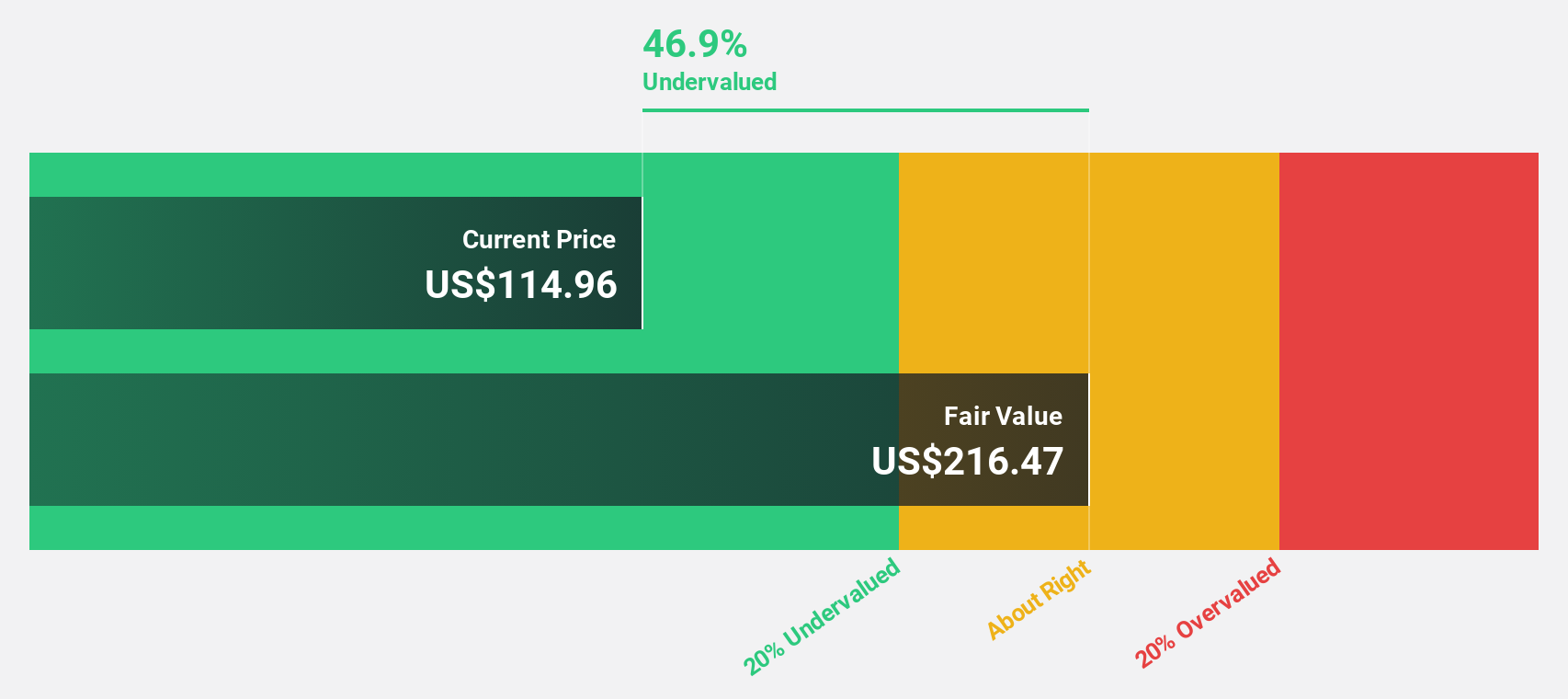

Estimated Discount To Fair Value: 33.4%

Dynatrace is trading at US$55.10, substantially below its estimated fair value of US$82.77, highlighting potential undervaluation based on discounted cash flow analysis. The company reported strong revenue growth, reaching US$418.13 million in the latest quarter, with earnings per share increasing to US$0.15 from US$0.12 year-over-year. Despite forecasts of slower revenue growth compared to some peers, Dynatrace's earnings are expected to grow significantly faster than the broader U.S. market average over the next few years.

- Our earnings growth report unveils the potential for significant increases in Dynatrace's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Dynatrace.

SharkNinja (NYSE:SN)

Overview: SharkNinja, Inc. is a product design and technology company that offers a range of consumer solutions globally, with a market cap of approximately $13.73 billion.

Operations: The company generates revenue primarily from its Appliance & Tool segment, which amounts to approximately $5.12 billion.

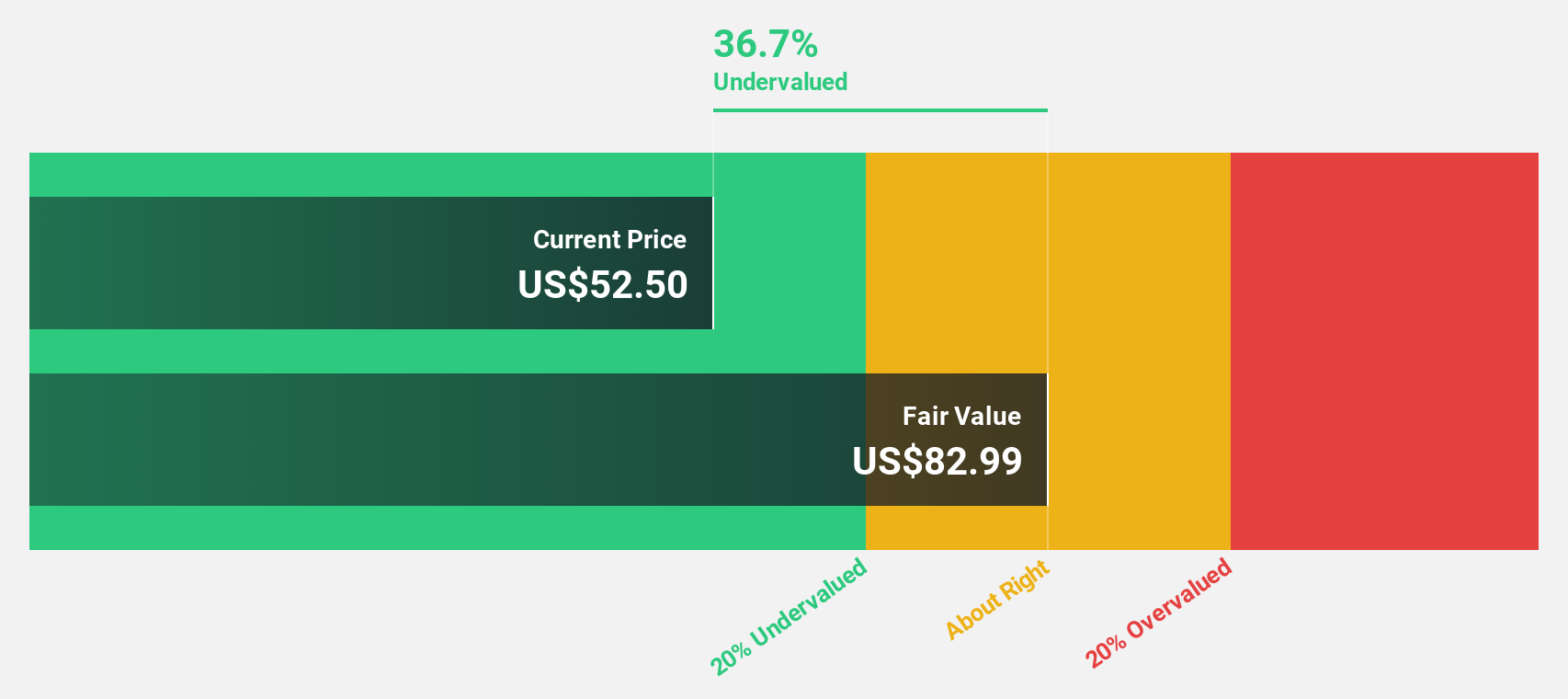

Estimated Discount To Fair Value: 37.3%

SharkNinja is trading at US$98.54, significantly below its estimated fair value of US$157.23, suggesting undervaluation based on discounted cash flow analysis. The company reported robust earnings growth, with third-quarter net income soaring to US$132.33 million from US$18.72 million year-over-year and raised its annual sales guidance by 25% to 26%. Despite debt concerns, SharkNinja's earnings are forecasted to grow considerably faster than the U.S. market average over the next few years.

- Our expertly prepared growth report on SharkNinja implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on SharkNinja's balance sheet by reading our health report here.

Taking Advantage

- Click here to access our complete index of 179 Undervalued US Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives