- United States

- /

- Hospitality

- /

- NasdaqGS:CHUY

Should You Take Comfort From Insider Transactions At Chuy's Holdings, Inc. (NASDAQ:CHUY)?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So before you buy or sell Chuy's Holdings, Inc. (NASDAQ:CHUY), you may well want to know whether insiders have been buying or selling.

What Is Insider Buying?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

Check out our latest analysis for Chuy's Holdings

Chuy's Holdings Insider Transactions Over The Last Year

The insider, Michael Hatcher, made the biggest insider sale in the last 12 months. That single transaction was for US$114k worth of shares at a price of US$23.03 each. So it's clear an insider wanted to take some cash off the table, even below the current price of US$40.54. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 20% of Michael Hatcher's stake. Michael Hatcher was the only individual insider to sell shares in the last twelve months.

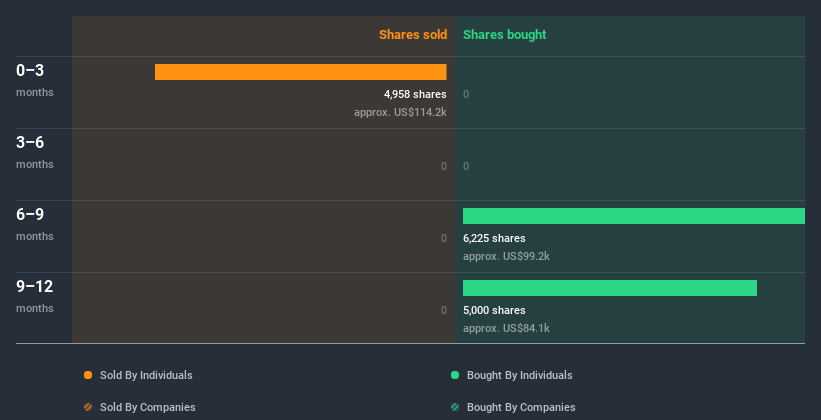

Happily, we note that in the last year insiders paid US$184k for 11.23k shares. On the other hand they divested 4.96k shares, for US$114k. In total, Chuy's Holdings insiders bought more than they sold over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Chuy's Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Chuy's Holdings Insiders Are Selling The Stock

Over the last three months, we've seen significant insider selling at Chuy's Holdings. In total, insider Michael Hatcher sold US$114k worth of shares in that time, and we didn't record any purchases whatsoever. Overall this makes us a bit cautious, but it's not the be all and end all.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. Our data indicates that Chuy's Holdings insiders own about US$9.0m worth of shares (which is 1.1% of the company). Whilst better than nothing, we're not overly impressed by these holdings.

So What Do The Chuy's Holdings Insider Transactions Indicate?

An insider sold Chuy's Holdings shares recently, but they didn't buy any. On the other hand, the insider transactions over the last year are encouraging. But insiders own relatively little of the company, from what we can see. So we can't be sure that insiders are optimistic. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Chuy's Holdings. Every company has risks, and we've spotted 3 warning signs for Chuy's Holdings you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Chuy's Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CHUY

Chuy's Holdings

Through its subsidiaries, owns and operates full-service restaurants under the Chuy’s name in the United States.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)