- United States

- /

- Hospitality

- /

- NasdaqCM:CCHH

Undiscovered Gems in the US Market for December 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of heightened anticipation surrounding potential interest rate cuts by the Federal Reserve, major indices like the S&P 500 have experienced slight pullbacks after nearing record highs. In this environment, small-cap stocks often present unique opportunities due to their potential for growth and innovation, making them intriguing candidates for investors seeking undiscovered gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

CCH Holdings (CCHH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CCH Holdings Ltd is a company that operates a chicken and fish head hotpot restaurant chain in Malaysia, with a market capitalization of $280.09 million.

Operations: CCHH generates revenue primarily from its restaurant operations, totaling $8.92 million.

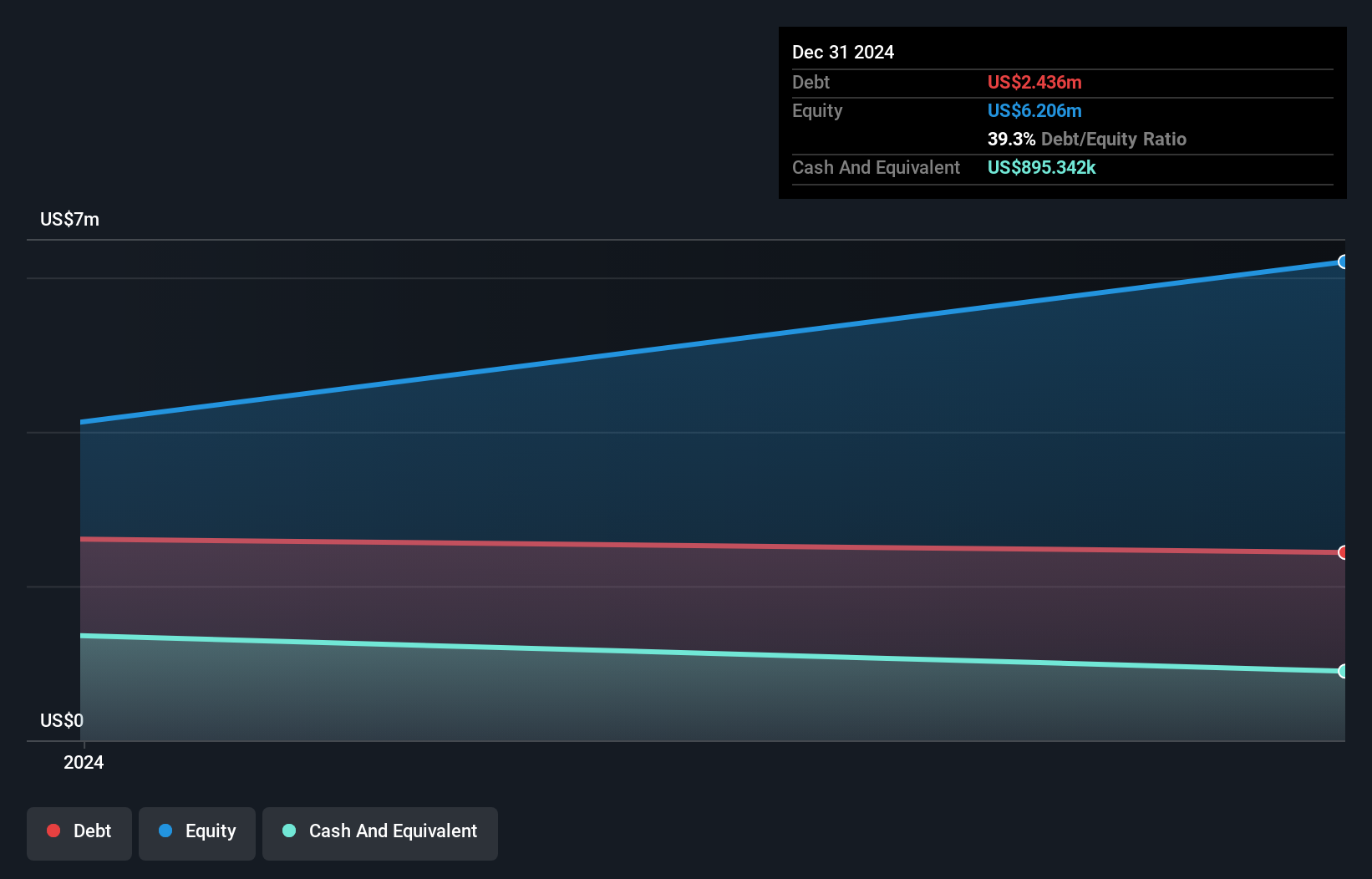

CCH Holdings, a relatively small player in the hospitality sector, has shown impressive earnings growth of 148% over the past year, outpacing the industry average of 17%. Despite this strong performance, revenue saw an 8.8% dip. The company's net debt to equity ratio stands at a satisfactory 24.8%, and its interest payments are well covered by EBIT at a multiple of 10.1x. Recent developments include its addition to the NASDAQ Composite Index and completion of an IPO raising US$5 million aimed at expanding its restaurant network and strategic investments.

- Get an in-depth perspective on CCH Holdings' performance by reading our health report here.

Assess CCH Holdings' past performance with our detailed historical performance reports.

Willdan Group (WLDN)

Simply Wall St Value Rating: ★★★★★★

Overview: Willdan Group, Inc. offers professional, technical, and consulting services mainly in the United States with a market capitalization of approximately $1.52 billion.

Operations: The company generates revenue primarily from its Energy segment, contributing $548.42 million, and its Engineering & Consulting segment, which adds $103.50 million.

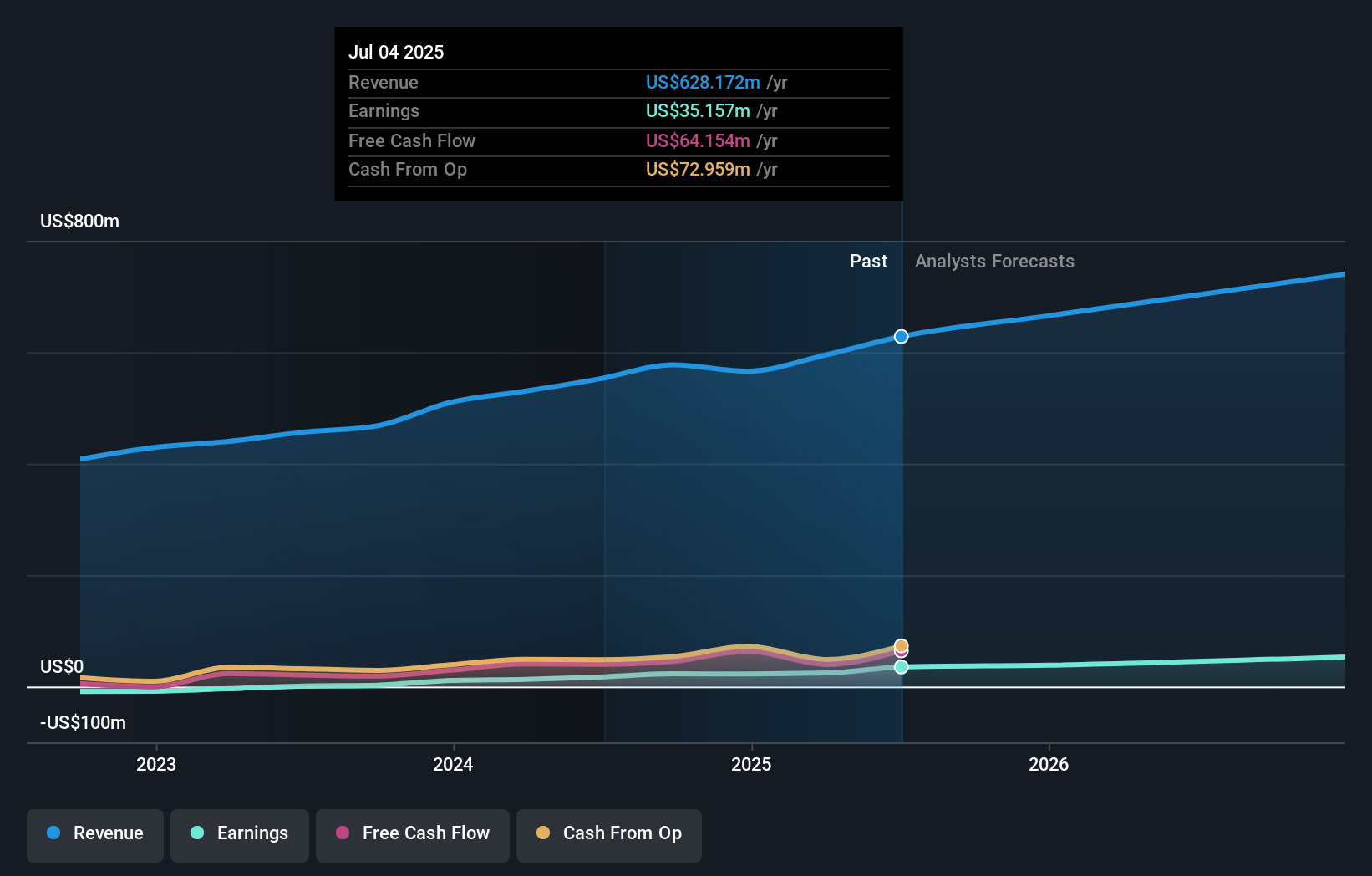

Willdan Group, a promising player in the infrastructure and electrification space, is making waves with strategic acquisitions and proprietary technology. The company recently secured a $97 million contract with Alameda County for energy upgrades, including solar PV generation and EV charging stations. In its latest earnings report, Willdan posted sales of US$182 million for Q3 2025, up from US$158 million the previous year, while net income rose to US$13.72 million from US$7.35 million. With an improved debt-to-equity ratio of 17% over five years and high-quality earnings growth outpacing industry averages by 81%, Willdan's financial health appears robust despite potential risks like policy reliance and rising costs.

Pathward Financial (CASH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association, offering a range of banking products and services in the United States with a market cap of approximately $1.63 billion.

Operations: Pathward Financial generates revenue primarily from its Consumer segment, contributing $498.67 million, and its Commercial segment, which adds $248.34 million. The Corporate Services segment accounts for an additional $36.10 million in revenue.

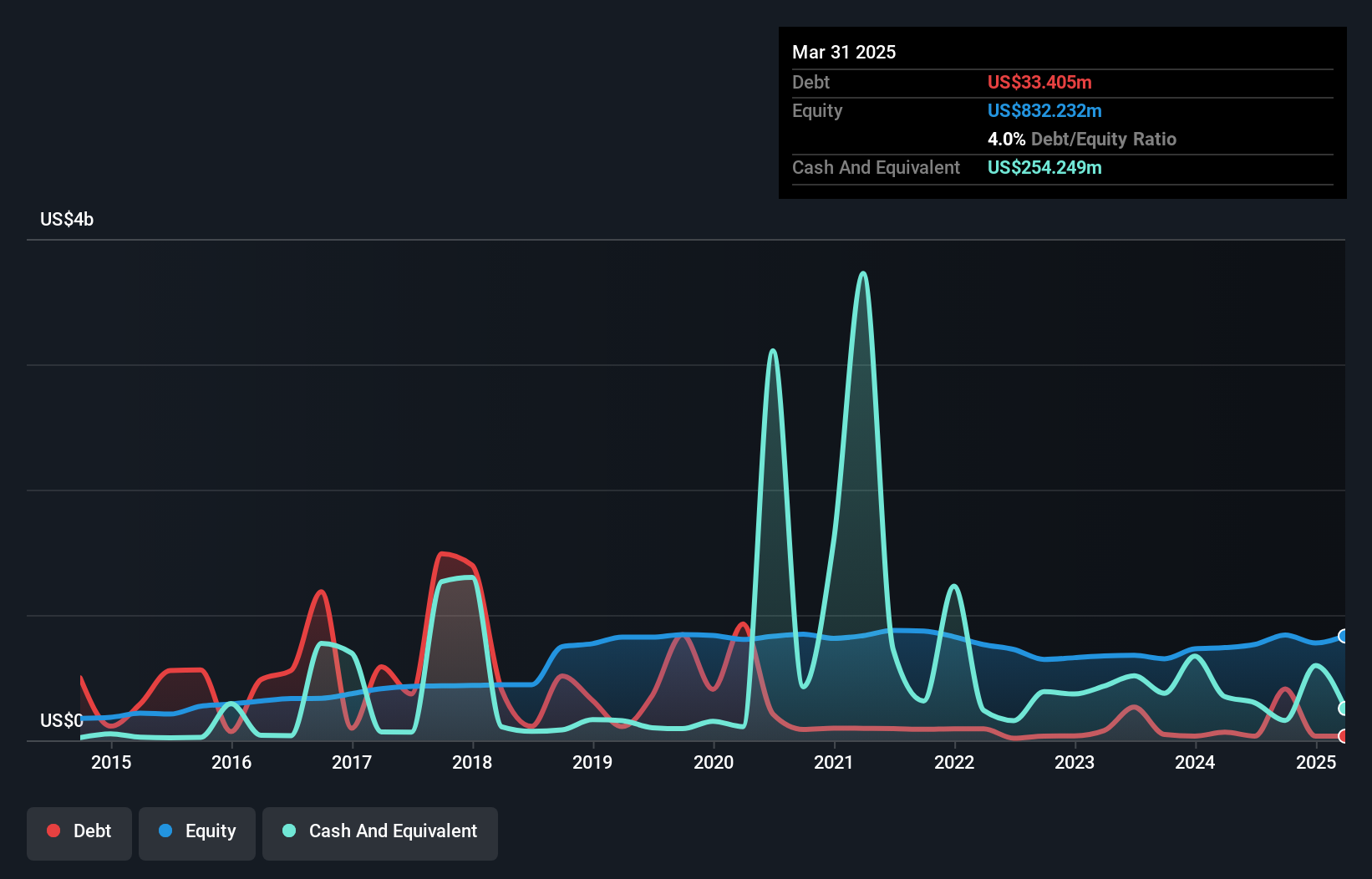

Pathward Financial, with total assets of US$7.2 billion and equity of US$857.5 million, is navigating the financial landscape by leveraging digital banking partnerships to boost transaction revenue. The company has a net interest margin of 7.4% and holds deposits worth US$5.9 billion against loans totaling US$4.6 billion, though it faces challenges with bad loans at 2.1%. Recent share repurchases amounted to 180,740 shares for US$14.99 million in the last quarter alone, reflecting strategic capital management amid competitive fintech pressures and compliance costs impacting its specialized market focus.

Make It Happen

- Dive into all 300 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CCHH

CCH Holdings

Operates as a chicken and fish head hotpot restaurant chain in Malaysia.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026