- United States

- /

- Hospitality

- /

- NasdaqGS:CBRL

The Bull Case For Cracker Barrel (CBRL) Could Change Following Halt to Modern Decor Rollout—Learn Why

Reviewed by Simply Wall St

- Cracker Barrel Old Country Store released its fourth-quarter fiscal 2025 results after the market closed, following a decision to halt its planned restaurant decor modernization after backlash over logo and design changes.

- This move highlights the strong influence of customer sentiment on Cracker Barrel's transformation initiatives as it balances operational innovation with preserving brand identity.

- We'll explore how the halt to restaurant decor changes might influence Cracker Barrel's investment narrative and outlook for future growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cracker Barrel Old Country Store Investment Narrative Recap

To be a shareholder in Cracker Barrel, you generally need to believe in its ability to refresh the guest experience and drive steady traffic through menu and operational innovation, despite ongoing macroeconomic challenges. The recent halt to restaurant decor modernization appears to have limited impact on immediate financial catalysts, such as earnings growth driven by menu innovation, but keeps brand perception and consumer loyalty as key short-term risks.

Among recent announcements, Cracker Barrel’s August fall menu campaign is especially relevant, as new and returning favorites could help offset potential headwinds from softer retail or in-restaurant traffic. In the context of ongoing transformation, menu offerings remain crucial as a lever for customer engagement and sales momentum, independent of store aesthetics.

By contrast, investors should also be mindful of supply chain risks, especially as unexpected events threaten cost stability...

Read the full narrative on Cracker Barrel Old Country Store (it's free!)

Cracker Barrel Old Country Store is projected to reach $3.6 billion in revenue and $86.3 million in earnings by 2028. This outlook assumes an annual revenue decline of 0.8% and a $28.5 million increase in earnings from the current $57.8 million.

Uncover how Cracker Barrel Old Country Store's forecasts yield a $55.43 fair value, a 8% upside to its current price.

Exploring Other Perspectives

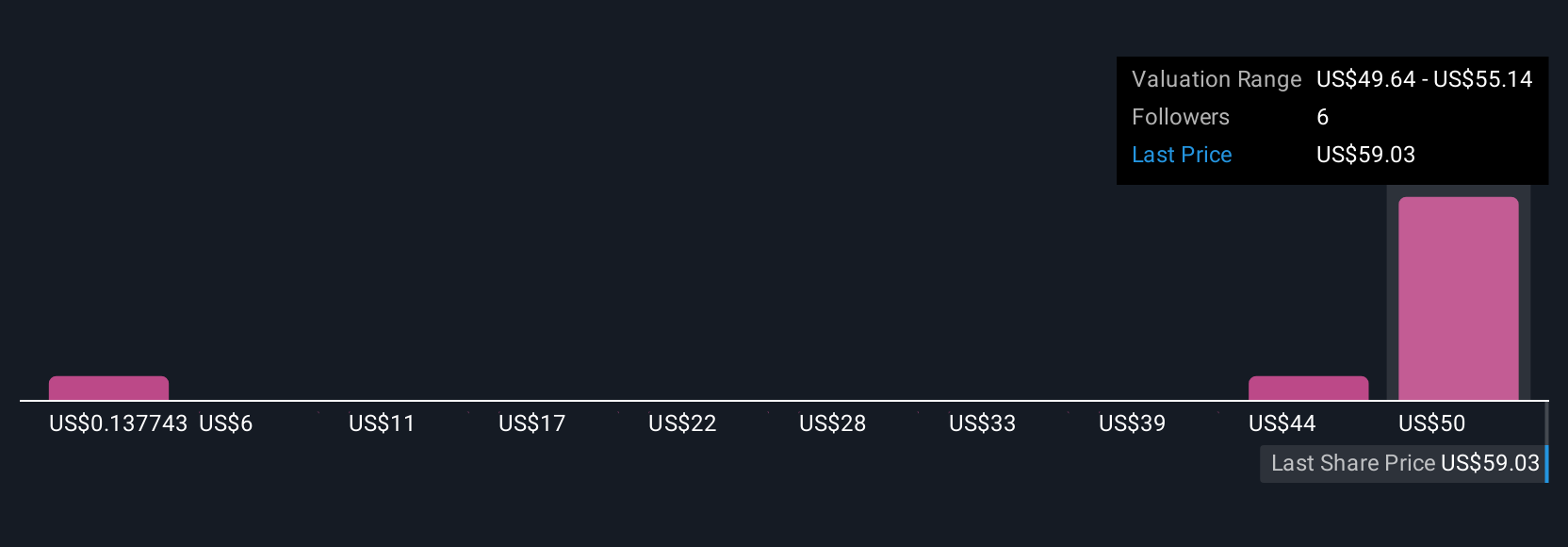

Five Community viewpoints set fair value estimates for Cracker Barrel from as low as US$0.13 up to US$92.81, reflecting strikingly different expectations for future performance. With customer sentiment now directly halting planned changes, it’s clear that investors see room for multiple scenarios and you can explore several alternative viewpoints here.

Explore 5 other fair value estimates on Cracker Barrel Old Country Store - why the stock might be worth as much as 81% more than the current price!

Build Your Own Cracker Barrel Old Country Store Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cracker Barrel Old Country Store research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cracker Barrel Old Country Store research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cracker Barrel Old Country Store's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CBRL

Cracker Barrel Old Country Store

Develops and operates the Cracker Barrel Old Country Store concept in the United States.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>