- United States

- /

- Hospitality

- /

- NasdaqGS:CAKE

Cheesecake Factory (CAKE): Exploring Valuation After Fresh Concerns About Sales Trends and Leverage

Reviewed by Kshitija Bhandaru

If you have been watching Cheesecake Factory (CAKE) lately, you are likely wondering what to make of the recent headlines around soft same-store sales and overleverage. Reports about slowing demand and concerns about balance sheet risk have cast some new doubts over the company’s outlook. With investors now digesting the potential for shareholder dilution and weaker fundamental trends, CAKE’s recent price swing is drawing fresh scrutiny from both long-time holders and those circling for an entry point.

The stock has certainly seen some momentum shifts this year. Despite returning 39% over the past twelve months, shares pulled back by 14% in the past month and are down nearly 10% over the past three months. Even with solid net income and annual revenue growth, this latest dip seems to reflect a sharp change in risk perception as the broader market weighs the impact of business headwinds disclosed in recent news.

So the big question for investors now is whether this latest drawdown signals a real opening, or if the market is simply adjusting expectations for future growth at Cheesecake Factory.

Most Popular Narrative: 27% Undervalued

According to the narrative, Cheesecake Factory is considered significantly undervalued with a 27% discount to fair value. The narrative bases its assessment on a combination of long-term growth prospects, expansion plans, and the company's ability to leverage new restaurant concepts across brands.

This is one thing that I absolutely love about CAKE. Not only do they already have a large restaurant that is bringing in revenue for them, but they also have new concepts that are starting to spread nationally. They are continually working to create even more for future growth. Especially from FRC, that is one of the biggest benefits from that acquisition: the ability to continue to test out new concepts, find something that sticks, and then push it out nationally.

Ever wondered what’s really fueling this bullish outlook on CAKE? There’s a growth play quietly unfolding beneath the surface, and it hinges on a few bold fundamentals you might not expect. The real drivers behind these robust price forecasts? Unpack the narrative to discover the overlooked ingredients that just might reshape how investors value Cheesecake Factory’s long-term future.

Result: Fair Value of $73.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, softening same-store sales and debt concerns remain key risks. These factors could quickly challenge even the most optimistic growth story here.

Find out about the key risks to this Cheesecake Factory narrative.Another View: Discounted Cash Flow Signals a Very Different Picture

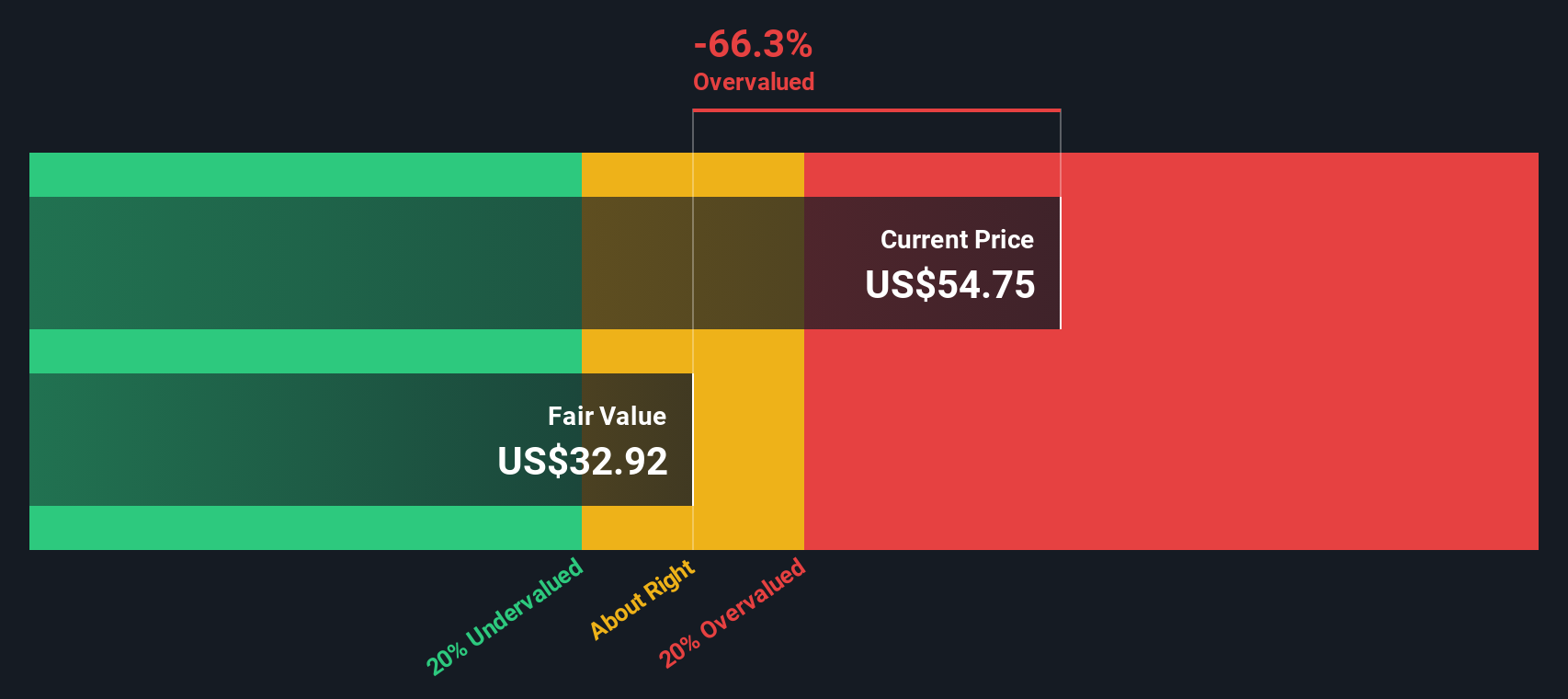

However, our SWS DCF model offers a sharply different take. It suggests Cheesecake Factory may actually be trading at a premium to its estimated value. With two respected approaches reaching opposite conclusions, which result should investors trust most?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cheesecake Factory Narrative

If you see things differently or want to dive into the numbers yourself, you can easily put together your own narrative in just a few minutes. Do it your way

A great starting point for your Cheesecake Factory research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't sit on the sidelines while new trends reshape the market. Unlock the next big winners by using our screeners tailored for forward-thinking investors:

- Spot the next wave of AI innovators shaking up multiple industries with our selection of AI penny stocks.

- Tap into high-yield income streams by targeting blue-chip opportunities through our dividend stocks with yields > 3%.

- Catch tomorrow’s market leaders early by searching for value among lesser-known companies using our curated list of penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAKE

Cheesecake Factory

Operates and licenses restaurants in the United States and Canada.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives