Top Undervalued Small Caps With Insider Action In October 2024

Reviewed by Simply Wall St

In October 2024, global markets have shown varied performances, with U.S. small-cap indices like the Russell 2000 and S&P MidCap 400 outperforming their larger counterparts, reflecting a renewed investor interest in smaller companies amid easing geopolitical tensions and robust consumer spending. As economic indicators reveal mixed signals—such as strengthening retail sales but weakening industrial output—investors are keenly observing small-cap stocks that may be positioned to capitalize on these dynamics. In this context, identifying stocks with strong fundamentals and insider activity can be crucial for investors seeking opportunities in the evolving market landscape.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 17.4x | 0.5x | 39.15% | ★★★★★★ |

| Trican Well Service | 7.2x | 0.9x | 19.25% | ★★★★★☆ |

| Franklin Financial Services | 9.6x | 1.9x | 38.28% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -45.47% | ★★★★☆☆ |

| Essentra | 727.5x | 1.4x | 26.31% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 38.83% | ★★★★☆☆ |

| Robert Walters | 41.5x | 0.2x | 41.99% | ★★★☆☆☆ |

| Studsvik | 21.9x | 1.3x | 39.39% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Petra Diamonds | NA | 0.2x | -34.21% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

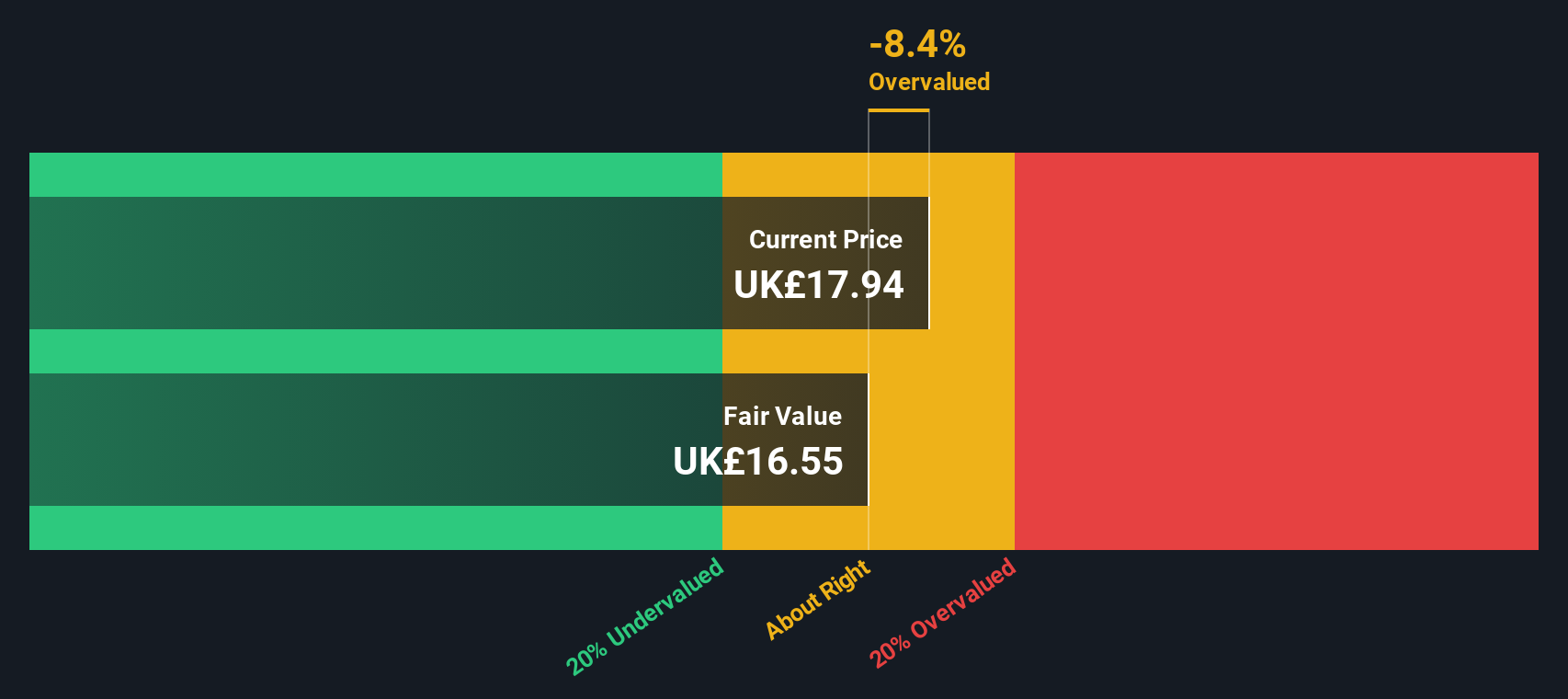

Oxford Instruments (LSE:OXIG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Oxford Instruments is a company that specializes in providing high-technology tools and systems for research, discovery, service, healthcare, materials analysis, and characterization with a market cap of £1.43 billion.

Operations: Oxford Instruments generates revenue primarily from three segments: Materials & Characterisation (£252.20 million), Research & Discovery (£142.10 million), and Service & Healthcare (£76.10 million). A notable trend is the net income margin, which has shown fluctuations over time, reaching 13.28% in September 2023 before declining to 10.78% by October 2024. The company faces significant operating expenses, including sales and marketing as well as research and development costs, which impact its profitability metrics.

PE: 24.1x

Oxford Instruments, a company known for its scientific instrumentation, has been actively participating in industry conferences, enhancing its visibility and networking opportunities. Despite relying entirely on external borrowing for funding—a riskier approach compared to customer deposits—the firm anticipates earnings growth of 10% annually. Insider confidence is evident with recent share purchases by executives since July 2024. As they prepare to release their first half 2025 sales statement, there is cautious optimism around their growth trajectory.

- Delve into the full analysis valuation report here for a deeper understanding of Oxford Instruments.

Gain insights into Oxford Instruments' past trends and performance with our Past report.

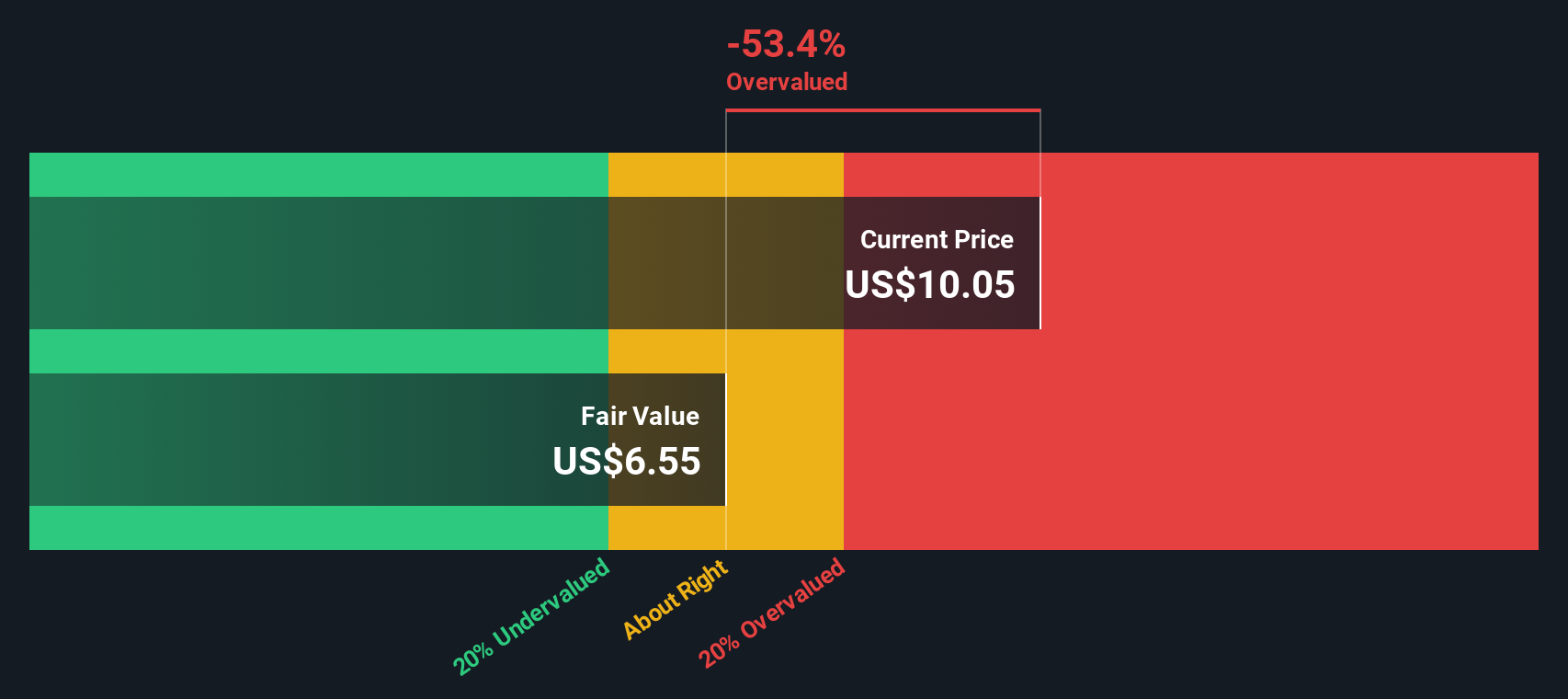

Bloomin' Brands (NasdaqGS:BLMN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bloomin' Brands operates a portfolio of casual dining restaurant brands, primarily in the United States and internationally, with a market capitalization of approximately $2.20 billion.

Operations: The company generates revenue primarily from its United States segment, contributing approximately $3.97 billion, while the international segment adds around $615.57 million. The gross profit margin has shown variability, with a recent figure of 17.52%. Operating expenses and cost of goods sold are significant components affecting profitability, with operating expenses recently recorded at $438.43 million and COGS at $3.77 billion.

PE: 43.2x

Bloomin' Brands, a small company in the restaurant industry, is experiencing financial challenges with declining profit margins and earnings. Despite this, insider confidence is evident as executives have been purchasing shares throughout 2024. The company recently increased its revolving credit facility to US$1.2 billion, extending maturity to 2029, indicating strategic financial maneuvering amidst high debt levels. New CEO Mike Spanos brings fresh leadership from Delta Air Lines, potentially steering future growth and operational improvements.

- Take a closer look at Bloomin' Brands' potential here in our valuation report.

Examine Bloomin' Brands' past performance report to understand how it has performed in the past.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre is a technology solutions provider specializing in software and services for the global travel and hospitality industries, with a market capitalization of approximately $1.31 billion.

Operations: Sabre's revenue primarily comes from its Travel Solutions and Hospitality Solutions segments, generating $2.70 billion and $315.74 million respectively. The company has experienced fluctuations in its net income margin, with recent figures showing a negative trend at -15.12%. Gross profit margin has been notable, reaching 59.47% in the latest period, indicating a strong ability to manage cost of goods sold relative to revenue despite operating losses.

PE: -3.1x

Sabre, a technology-driven company in the travel industry, has been attracting attention as an undervalued stock. Recent insider confidence is evident with share purchases over the past year, suggesting belief in its potential. The company is making strides with strategic agreements like those with Riyadh Air and Arajet, showcasing its innovative SabreMosaic platform powered by AI for personalized airline retailing. Despite facing net losses of US$69.76 million in Q2 2024, earnings are forecasted to grow significantly at 90% annually. The appointment of Eric L. Kelly to the board brings valuable expertise in technology and strategic business transformations, potentially enhancing future growth prospects amidst competitive challenges.

Key Takeaways

- Click this link to deep-dive into the 195 companies within our Undervalued Small Caps With Insider Buying screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OXIG

Oxford Instruments

Oxford Instruments plc provide scientific technology products and services for academic and commercial organizations worldwide.

Flawless balance sheet and good value.