- United Kingdom

- /

- Oil and Gas

- /

- AIM:JOG

Discovering Opportunities: Jersey Oil and Gas Among 3 UK Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting companies closely tied to its economic fortunes. Amidst these broader market fluctuations, identifying promising investment opportunities requires a keen eye for stocks that demonstrate strong financial health and potential for growth. Penny stocks, though an older term, continue to represent smaller or less-established companies that may offer significant value; we've identified three such stocks in the UK market that combine balance sheet strength with potential upside.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £145.75M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.39 | £64.65M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.165 | £99.53M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.28 | £197.41M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.86 | £383.9M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.45 | $261.6M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.41 | £307.94M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Jersey Oil and Gas (AIM:JOG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jersey Oil and Gas Plc is involved in the exploration, appraisal, development, and production of oil and gas properties in the North Sea of the United Kingdom with a market cap of £15.84 million.

Operations: No revenue segments have been reported.

Market Cap: £15.84M

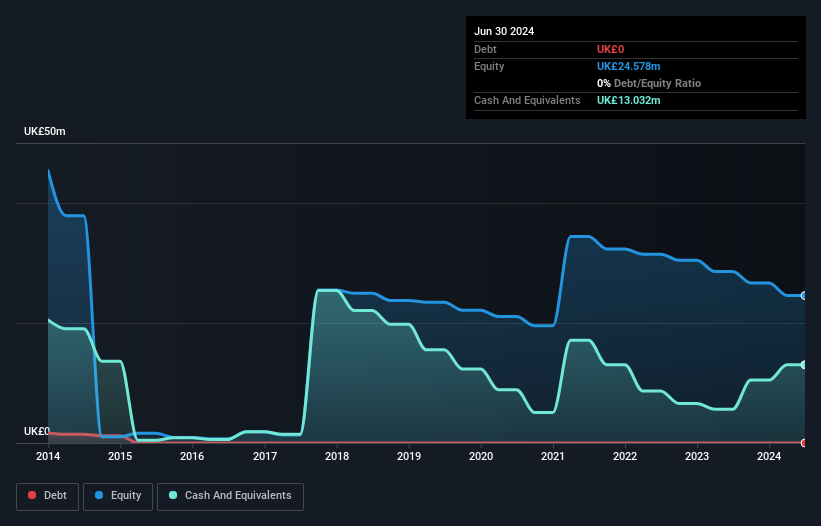

Jersey Oil and Gas Plc, with a market cap of £15.84 million, is a pre-revenue company engaged in North Sea oil and gas exploration. It remains unprofitable with increasing losses over the past five years. Despite this, the company benefits from being debt-free and has sufficient cash runway for more than three years under current conditions. Its experienced board and management team contribute positively to its governance structure. However, its share price has been highly volatile recently, reflecting investor uncertainty typical of penny stocks in speculative sectors like oil exploration without significant revenue streams yet established.

- Get an in-depth perspective on Jersey Oil and Gas' performance by reading our balance sheet health report here.

- Understand Jersey Oil and Gas' earnings outlook by examining our growth report.

Portmeirion Group (AIM:PMP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Portmeirion Group PLC is a company that manufactures, markets, and distributes ceramics, home fragrances, and associated homeware products across the United Kingdom, South Korea, North America, and internationally with a market cap of £24.08 million.

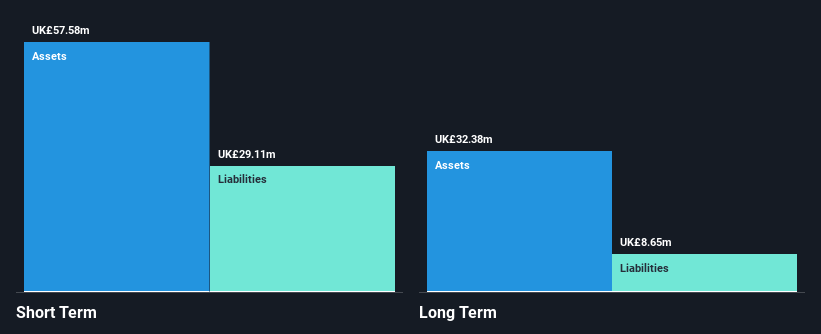

Operations: The company's revenue is primarily generated from the United Kingdom (£57.58 million) and North America (£42.68 million).

Market Cap: £24.08M

Portmeirion Group, with a market cap of £24.08 million, is currently unprofitable and has seen earnings decline by 47.1% annually over the past five years. Despite trading at 48.6% below estimated fair value, its negative return on equity (-21.04%) and insufficient interest coverage (1.6x) highlight financial challenges. The company's net debt to equity ratio is satisfactory at 25.7%, with short-term assets exceeding liabilities (£57.6M vs £29.1M). Revenue growth is forecasted at 5.12% annually, supported by an experienced management team averaging a tenure of 5 years, indicating potential for stabilization amidst volatility typical of penny stocks.

- Click to explore a detailed breakdown of our findings in Portmeirion Group's financial health report.

- Learn about Portmeirion Group's future growth trajectory here.

Panther Metals (LSE:PALM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Panther Metals PLC is a mineral exploration company with operations in Canada and Australia, and it has a market cap of £3.34 million.

Operations: Panther Metals PLC does not currently report any revenue segments.

Market Cap: £3.34M

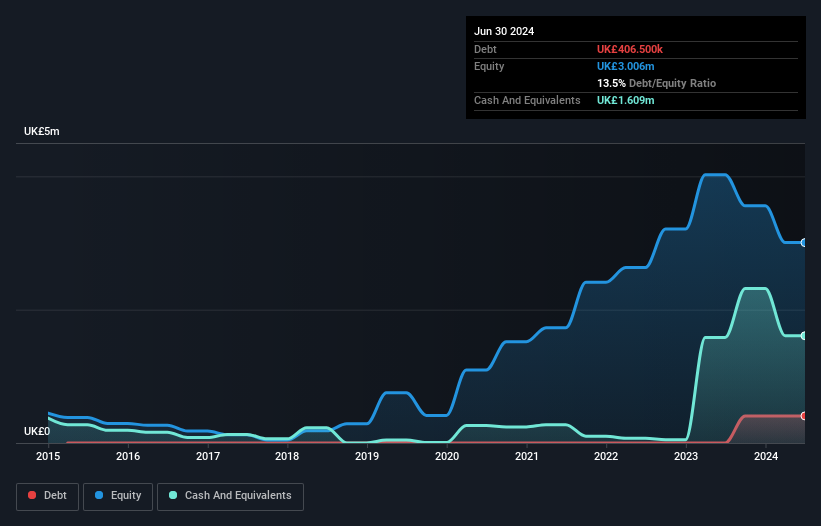

Panther Metals PLC, with a market cap of £3.34 million, is a pre-revenue mineral exploration company focusing on its Dotted Lake Project in Canada. Recent updates highlight progress in their Phase 1 Diamond Drilling Programme targeting nickel, cobalt, copper, gold, and platinum group elements. The drilling has intersected promising lithologies such as ultramafic intrusive complexes and quartz veins indicative of potential mineral deposits. Despite being unprofitable and experiencing shareholder dilution over the past year, Panther maintains more cash than debt and covers both short-term and long-term liabilities with its assets (£1.7M vs £560.4K short-term liabilities).

- Unlock comprehensive insights into our analysis of Panther Metals stock in this financial health report.

- Learn about Panther Metals' historical performance here.

Make It Happen

- Click this link to deep-dive into the 472 companies within our UK Penny Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JOG

Jersey Oil and Gas

Engages in the exploration, appraisal, development, and production of oil and gas properties in the North Sea of the United Kingdom.

Flawless balance sheet slight.