- United Kingdom

- /

- Media

- /

- LSE:FOUR

Undervalued Small Caps With Insider Action On UK Exchange In December 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China and broader global economic pressures. This environment highlights the importance of identifying small-cap stocks that demonstrate resilience and potential value, particularly those with insider actions that may signal confidence amidst uncertain market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 15.1x | 1.2x | 41.76% | ★★★★★☆ |

| NCC Group | NA | 1.4x | 21.09% | ★★★★★☆ |

| Warpaint London | 23.6x | 4.1x | 2.39% | ★★★★☆☆ |

| Sabre Insurance Group | 11.6x | 1.5x | 9.94% | ★★★★☆☆ |

| iomart Group | 24.8x | 0.7x | 31.99% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 48.70% | ★★★★☆☆ |

| Treatt | 21.7x | 2.0x | 42.99% | ★★★☆☆☆ |

| Gooch & Housego | 39.4x | 0.9x | 34.79% | ★★★☆☆☆ |

| THG | NA | 0.3x | -997.70% | ★★★☆☆☆ |

| Headlam Group | NA | 0.2x | -46.97% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

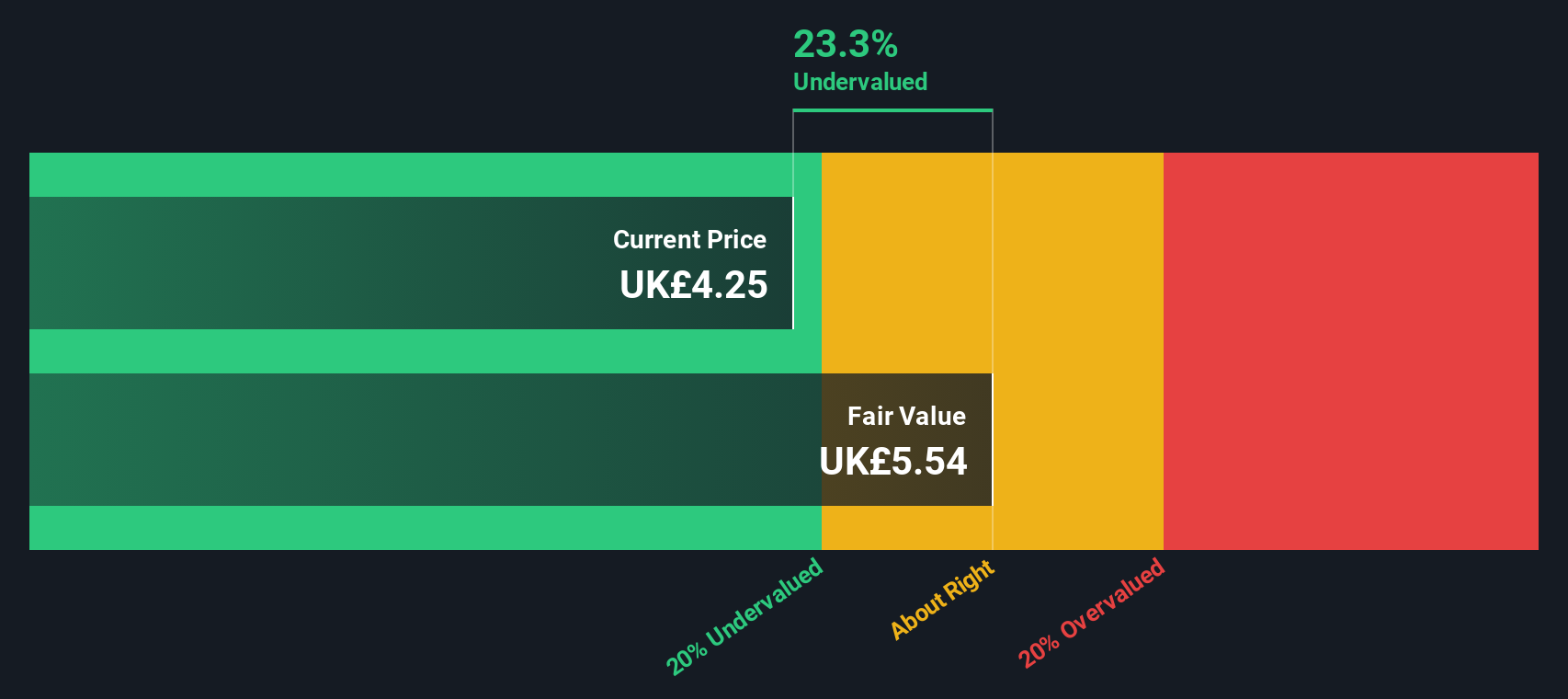

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Warpaint London is a cosmetics company specializing in the production and sale of its own brand makeup products, with a focus on affordable pricing, and has a market capitalization of £2.77 billion.

Operations: The company generates revenue primarily from its Own Brand segment, which significantly surpasses the Close-Out segment. Over time, the gross profit margin has shown an upward trend, reaching 41.80% by June 2024. Operating expenses have also increased, with general and administrative expenses being a major component.

PE: 23.6x

Warpaint London, a small company in the UK, shows potential with insider confidence as Eoin MacLeod purchased 49,019 shares worth £250K. Despite relying on higher-risk external funding and past shareholder dilution, earnings are projected to grow by 13.51% annually. Recent follow-on equity offerings raised £15 million at £5.1 per share, reflecting strategic capital maneuvers. Participation in the Small Cap Growth Virtual Investor Conference highlights their proactive engagement with investors and industry peers.

- Unlock comprehensive insights into our analysis of Warpaint London stock in this valuation report.

Understand Warpaint London's track record by examining our Past report.

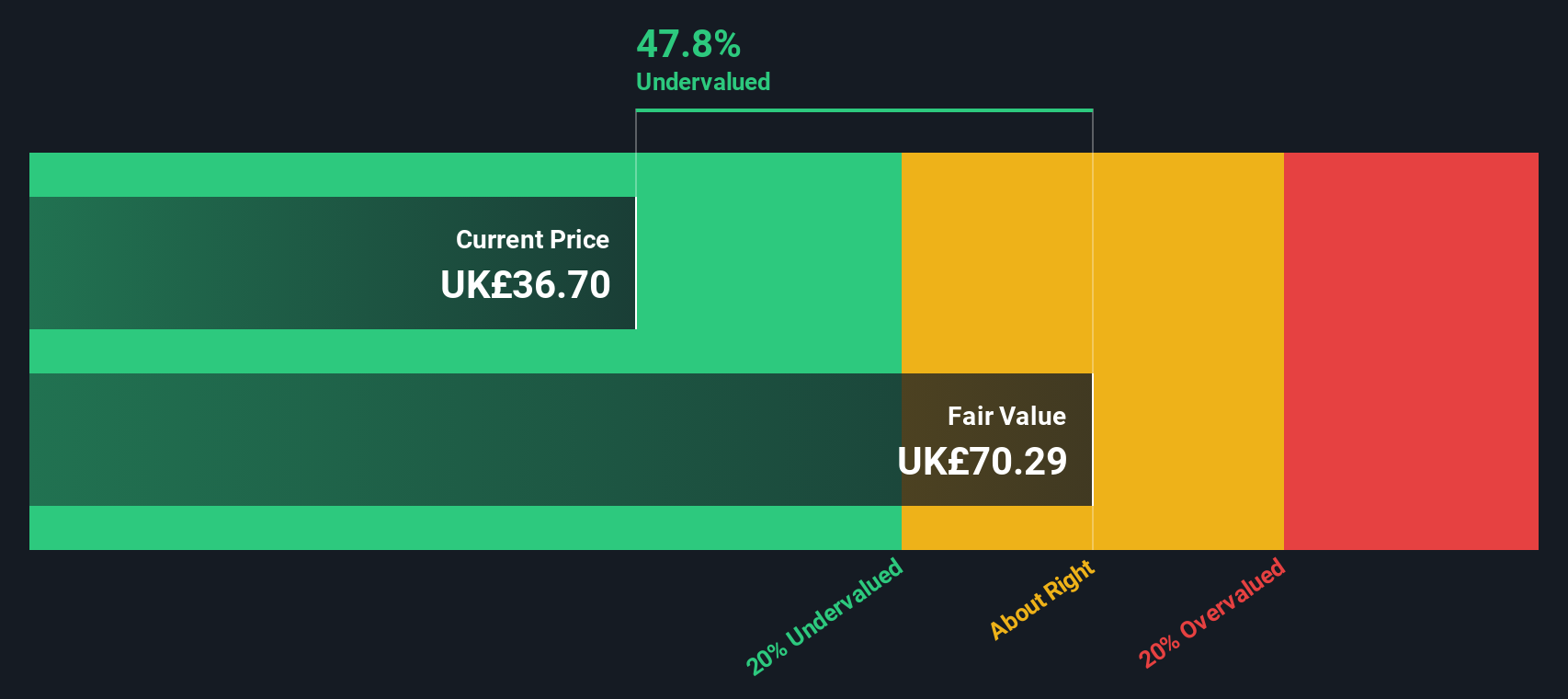

4imprint Group (LSE:FOUR)

Simply Wall St Value Rating: ★★★★★☆

Overview: 4imprint Group is a marketer of promotional products, primarily operating in North America with additional operations in the UK and Ireland, and has a market capitalization of approximately £1.41 billion.

Operations: The company generates revenue primarily from North America, contributing $1.33 billion, with a smaller portion from the UK & Ireland at $25 million. Its cost of goods sold (COGS) has been increasing alongside revenue, impacting gross profit margins which have shown fluctuations over time but reached 29.77% in recent periods. Operating expenses are significant and include notable sales and marketing costs, which have increased to $163.8 million by mid-2024. The net income margin has seen a gradual rise to 8.20%, reflecting improvements in profitability despite rising operating expenses and non-operating costs.

PE: 15.1x

4imprint Group, a UK-based company with a market focus on promotional products, recently updated its earnings guidance for 2024, anticipating group revenue to hit $1.37 billion. This aligns with insider confidence shown through share purchases over the past year, suggesting belief in the company's potential. The appointment of Michelle Brukwicki as CFO Designate adds strategic leadership amid expected annual earnings growth of 4.64%. Despite relying solely on external borrowing for funding, the company's trajectory remains promising.

- Click to explore a detailed breakdown of our findings in 4imprint Group's valuation report.

Gain insights into 4imprint Group's past trends and performance with our Past report.

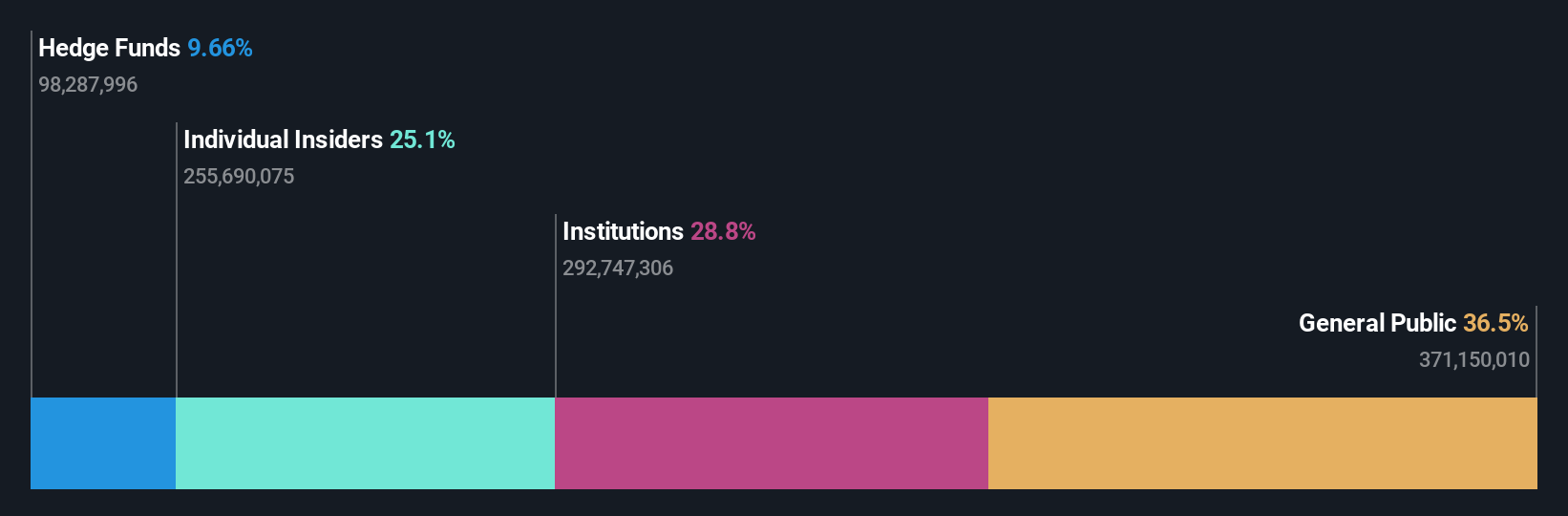

International Workplace Group (LSE:IWG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: International Workplace Group operates as a global provider of flexible workspace solutions, with a market capitalization of approximately £1.65 billion.

Operations: International Workplace Group generates revenue primarily from its operations in the Americas, Asia Pacific, and EMEA regions. The company has experienced fluctuations in its gross profit margin, with a recent increase to 29.83% as of June 2024. Operating expenses include significant allocations towards general and administrative costs.

PE: -10.8x

International Workplace Group, a small cap in the UK, shows potential as an undervalued stock with earnings expected to grow 119% annually. Despite funding primarily through higher-risk external borrowing, insider confidence is evident with recent share purchases. Leadership changes are underway as François Pauly steps down from key roles by year-end 2024, with Tarun Lal stepping in temporarily. These dynamics suggest a company poised for growth amidst strategic transitions and market positioning challenges.

Key Takeaways

- Navigate through the entire inventory of 37 Undervalued UK Small Caps With Insider Buying here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FOUR

4imprint Group

Operates as a direct marketer of promotional products in North America, the United Kingdom, and Ireland.

Flawless balance sheet, undervalued and pays a dividend.