- United States

- /

- Hospitality

- /

- NasdaqGS:BLMN

Should You Be Adding Bloomin' Brands (NASDAQ:BLMN) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Bloomin' Brands (NASDAQ:BLMN). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Bloomin' Brands

How Fast Is Bloomin' Brands Growing Its Earnings Per Share?

In the last three years Bloomin' Brands' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Impressively, Bloomin' Brands' EPS catapulted from US$1.17 to US$3.02, over the last year. Year on year growth of 158% is certainly a sight to behold.

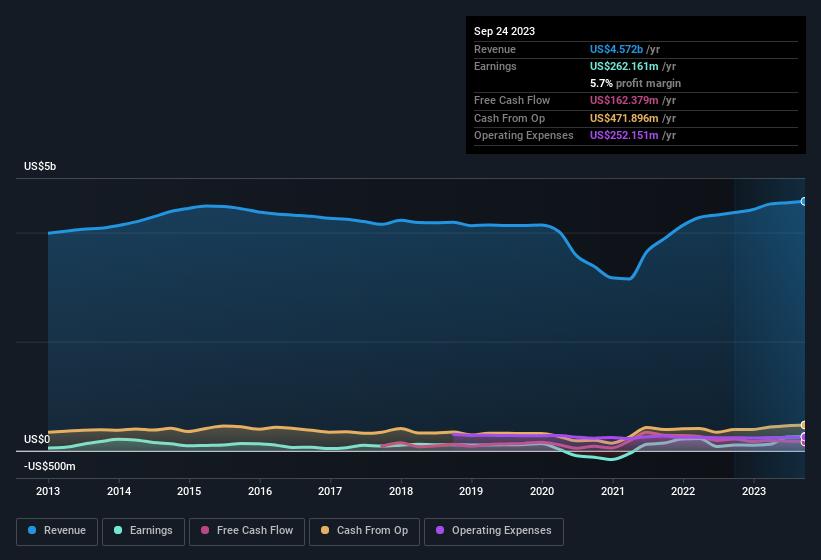

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Bloomin' Brands achieved similar EBIT margins to last year, revenue grew by a solid 4.7% to US$4.6b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Bloomin' Brands.

Are Bloomin' Brands Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Bloomin' Brands shares worth a considerable sum. Indeed, they hold US$38m worth of its stock. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 1.8%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Should You Add Bloomin' Brands To Your Watchlist?

Bloomin' Brands' earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Bloomin' Brands very closely. We don't want to rain on the parade too much, but we did also find 3 warning signs for Bloomin' Brands (1 is a bit unpleasant!) that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bloomin' Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BLMN

Bloomin' Brands

Through its subsidiaries, owns and operates casual, polished casual, and fine dining restaurants in the United States and internationally.

Undervalued slight.

Market Insights

Community Narratives