- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

US Growth Stocks With High Insider Ownership In December 2024

Reviewed by Simply Wall St

As the U.S. stock market continues its post-election rally, with the S&P 500 and Nasdaq reaching record highs, investors are increasingly interested in growth companies that demonstrate strong insider ownership. In such a robust market environment, stocks with significant insider ownership can be appealing as they often indicate confidence from those closest to the company in its potential for future success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Coastal Financial (NasdaqGS:CCB) | 17.8% | 46.1% |

| Clene (NasdaqCM:CLNN) | 21.6% | 60.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 63.6% |

| Alkami Technology (NasdaqGS:ALKT) | 10.9% | 98.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

Let's explore several standout options from the results in the screener.

Atour Lifestyle Holdings (NasdaqGS:ATAT)

Simply Wall St Growth Rating: ★★★★★★

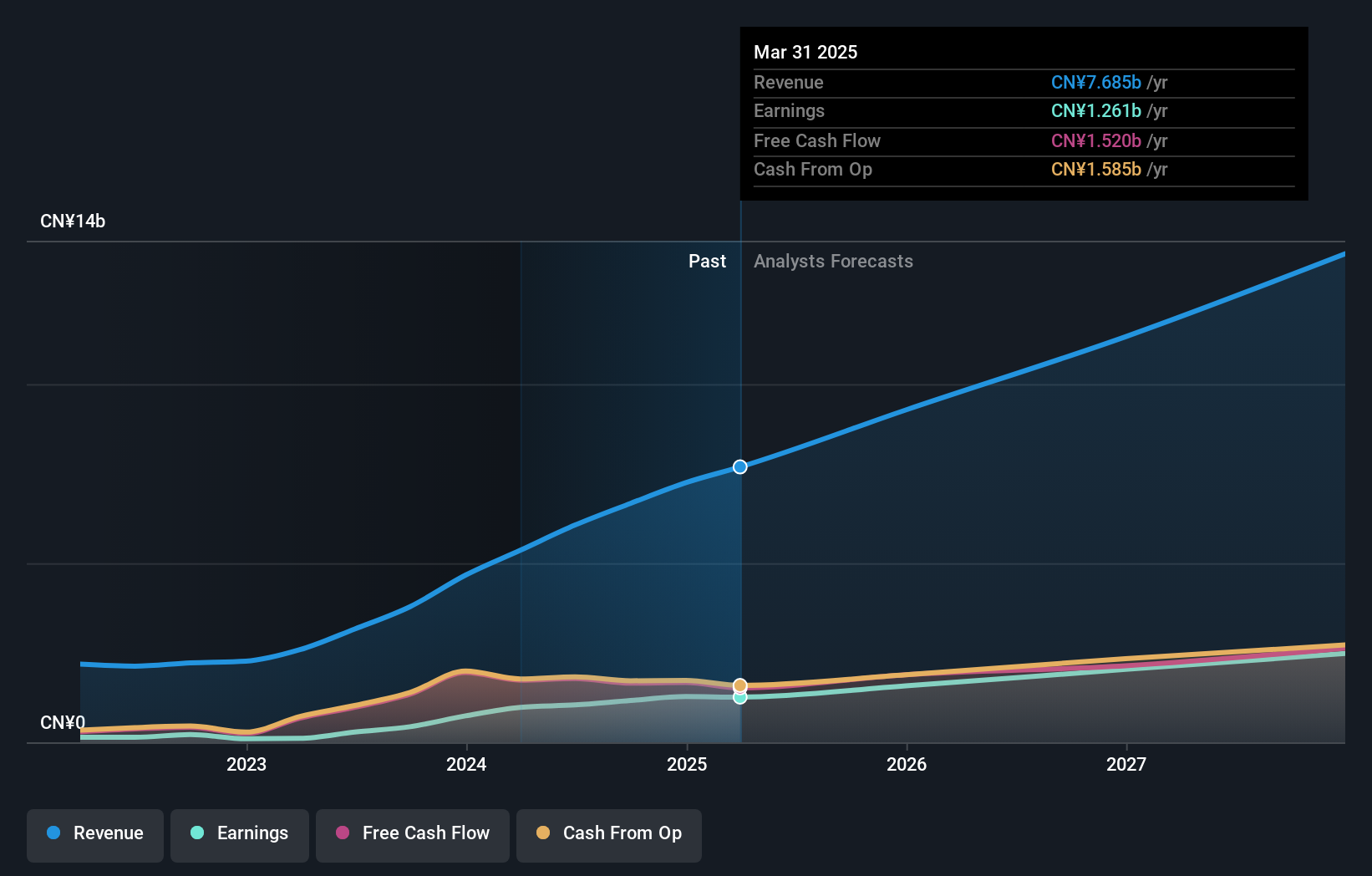

Overview: Atour Lifestyle Holdings Limited, with a market cap of $3.47 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People’s Republic of China.

Operations: The company's revenue segment, Atour Group, generated CN¥6.67 billion.

Insider Ownership: 26%

Revenue Growth Forecast: 21.1% p.a.

Atour Lifestyle Holdings demonstrates strong growth potential, with revenue forecasted to grow at 21.1% annually, outpacing the US market's 8.9%. Earnings are expected to rise by 25.7% per year, supported by a high forecasted return on equity of 44.4%. Despite past shareholder dilution and no recent insider buying or selling, the company trades below its estimated fair value and analyst price targets suggest a potential increase of 27.9%. Recent earnings reports show significant revenue and net income growth year-over-year.

- Click here and access our complete growth analysis report to understand the dynamics of Atour Lifestyle Holdings.

- In light of our recent valuation report, it seems possible that Atour Lifestyle Holdings is trading behind its estimated value.

KULR Technology Group (NYSEAM:KULR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KULR Technology Group, Inc., operating through its subsidiary KULR Technology Corporation, focuses on developing and commercializing thermal management technologies for electronics, batteries, and other component applications in the United States with a market cap of approximately $301.88 million.

Operations: The company's revenue primarily comes from its Superconductor Products & Systems segment, which generated $9.70 million.

Insider Ownership: 16.9%

Revenue Growth Forecast: 57.9% p.a.

KULR Technology Group is poised for significant growth, with revenue expected to increase 57.9% annually, far surpassing the US market average. Despite a volatile share price and past shareholder dilution, KULR trades at a substantial discount to its estimated fair value. Recent contracts with NASA and the U.S. Navy highlight its strategic role in aerospace and defense sectors, enhancing its position as a key partner in battery safety innovations and thermal management solutions.

- Navigate through the intricacies of KULR Technology Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of KULR Technology Group shares in the market.

Pinterest (NYSE:PINS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinterest, Inc. operates as a visual search and discovery platform both in the United States and internationally, with a market cap of approximately $20.57 billion.

Operations: The company generates revenue primarily through its Internet Information Providers segment, totaling approximately $3.47 billion.

Insider Ownership: 11.5%

Revenue Growth Forecast: 13.1% p.a.

Pinterest's recent earnings report shows a strong turnaround, with net income rising to US$30.56 million from US$6.73 million the previous year. The company forecasts revenue growth of 15%-17% for Q4 2024, aligning with its annual revenue growth forecast of 13.1%, outpacing the broader market's 9%. Despite trading significantly below estimated fair value, Pinterest is executing a substantial share buyback program worth up to US$2 billion, indicating confidence in its long-term prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Pinterest.

- The valuation report we've compiled suggests that Pinterest's current price could be quite moderate.

Seize The Opportunity

- Dive into all 210 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with outstanding track record.