- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

3 Stocks Estimated To Be Priced Below Their Fair Value In May 2025

Reviewed by Simply Wall St

The United States market has shown positive momentum recently, climbing 1.2% in the last week and rising 7.7% over the past year, with earnings projected to grow by 14% annually in the coming years. In this environment, identifying stocks priced below their fair value can offer potential opportunities for investors looking to capitalize on future growth prospects while minimizing risk.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $26.59 | $51.85 | 48.7% |

| MetroCity Bankshares (NasdaqGS:MCBS) | $28.17 | $55.08 | 48.9% |

| Super Group (SGHC) (NYSE:SGHC) | $9.07 | $18.05 | 49.8% |

| German American Bancorp (NasdaqGS:GABC) | $38.43 | $74.67 | 48.5% |

| DoorDash (NasdaqGS:DASH) | $176.99 | $353.76 | 50% |

| Ready Capital (NYSE:RC) | $4.41 | $8.67 | 49.1% |

| Pure Storage (NYSE:PSTG) | $47.64 | $93.60 | 49.1% |

| Amerant Bancorp (NYSE:AMTB) | $17.28 | $33.41 | 48.3% |

| HealthEquity (NasdaqGS:HQY) | $91.72 | $179.14 | 48.8% |

| Nutanix (NasdaqGS:NTNX) | $73.70 | $145.75 | 49.4% |

Here's a peek at a few of the choices from the screener.

Atour Lifestyle Holdings (NasdaqGS:ATAT)

Overview: Atour Lifestyle Holdings Limited, with a market cap of $3.52 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People's Republic of China.

Operations: The company generates revenue primarily from its Atour Group segment, amounting to CN¥7.25 billion.

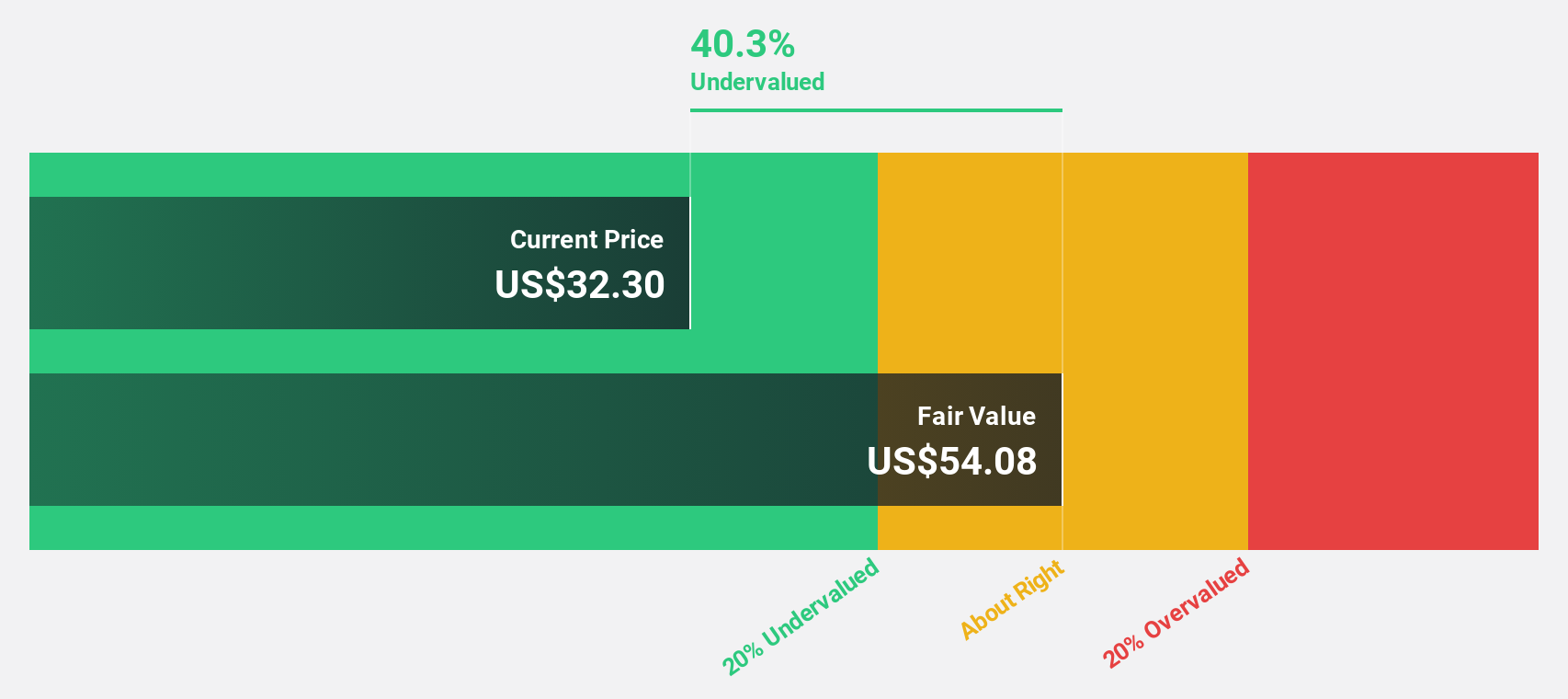

Estimated Discount To Fair Value: 48.7%

Atour Lifestyle Holdings is trading at US$26.59, significantly below its estimated fair value of US$51.85, suggesting it may be undervalued based on cash flows. The company reported robust revenue growth to CNY 7.25 billion from CNY 4.67 billion year-on-year and net income increased to CNY 1.28 billion from CNY 737 million, reflecting strong financial performance. Analysts expect earnings to grow by over 20% annually, outpacing the broader U.S. market's growth rate of 13.9%.

- The growth report we've compiled suggests that Atour Lifestyle Holdings' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Atour Lifestyle Holdings stock in this financial health report.

AeroVironment (NasdaqGS:AVAV)

Overview: AeroVironment, Inc. designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses globally, with a market cap of approximately $4.44 billion.

Operations: AeroVironment generates revenue through its segments, which include Maccready Works ($82.29 million), UnCrewed Systems ($372.88 million), and Loitering Munitions Systems ($287.39 million).

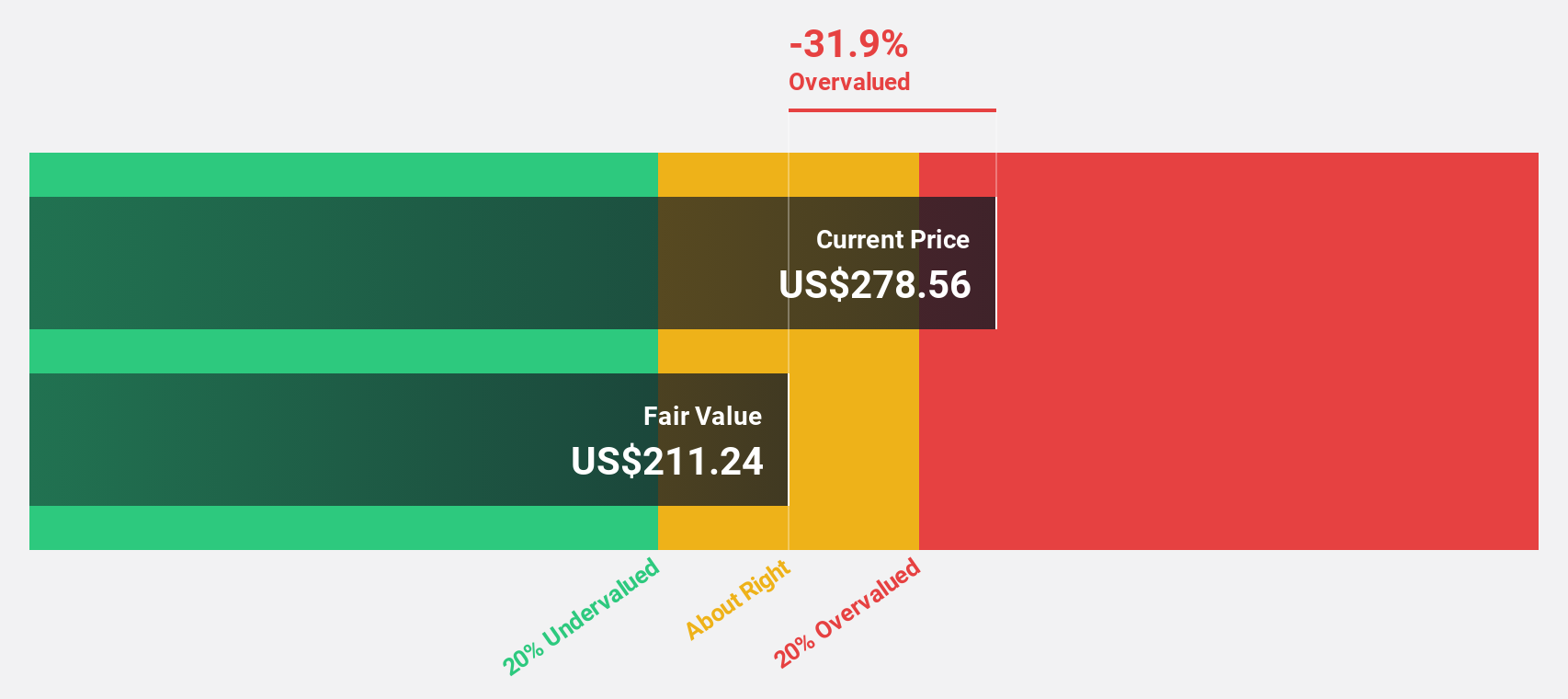

Estimated Discount To Fair Value: 20.6%

AeroVironment is currently trading at US$160.01, below its estimated fair value of US$201.54, indicating potential undervaluation based on cash flows. The company has introduced innovative products like Titan 4 and Red Dragon, enhancing its defense capabilities and market position. Despite a recent net loss of US$1.75 million for Q3 2025, revenue forecasts suggest growth exceeding the broader U.S. market rate, with earnings expected to increase significantly over the next three years.

- Our growth report here indicates AeroVironment may be poised for an improving outlook.

- Dive into the specifics of AeroVironment here with our thorough financial health report.

Super Group (SGHC) (NYSE:SGHC)

Overview: Super Group (SGHC) Limited is an online sports betting and gaming operator with a market cap of approximately $4.39 billion.

Operations: The company generates revenue through its Spin segment, contributing €674.24 million, and the Betway segment, which brings in €1.02 billion.

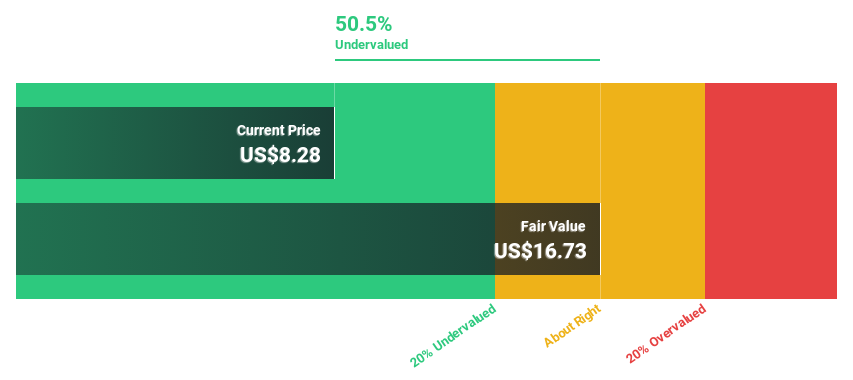

Estimated Discount To Fair Value: 49.8%

Super Group is trading at $9.07, significantly below its estimated fair value of $18.05, suggesting undervaluation based on cash flows. The company became profitable in 2024 with net income of €113.1 million and earnings per share turning positive from a loss the previous year. With projected double-digit revenue growth for 2025 and earnings expected to rise by over 20% annually, it presents a compelling case for investors focusing on cash flow valuation metrics.

- Our earnings growth report unveils the potential for significant increases in Super Group (SGHC)'s future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Super Group (SGHC).

Make It Happen

- Access the full spectrum of 174 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives