- United States

- /

- Oil and Gas

- /

- NYSE:TNK

US Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As 2024 comes to a close, the U.S. stock market has experienced a robust year overall, despite ending on a weaker note with the Dow Jones Industrial Average posting its largest monthly loss in over two years. With major indices like the Nasdaq Composite and S&P 500 achieving significant gains throughout the year, investors are now turning their attention to dividend stocks as a potential source of steady income amidst market fluctuations. In this context, selecting dividend stocks with strong fundamentals and consistent payout histories can be an effective strategy for navigating uncertain economic conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.55% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.33% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.71% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.02% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.50% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.79% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.85% | ★★★★★★ |

Click here to see the full list of 157 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

SpartanNash (NasdaqGS:SPTN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpartanNash Company distributes and retails grocery products in the United States, with a market cap of approximately $618.39 million.

Operations: SpartanNash generates revenue primarily from its Wholesale segment, contributing $7.93 billion, and its Retail segment, which adds $2.79 billion.

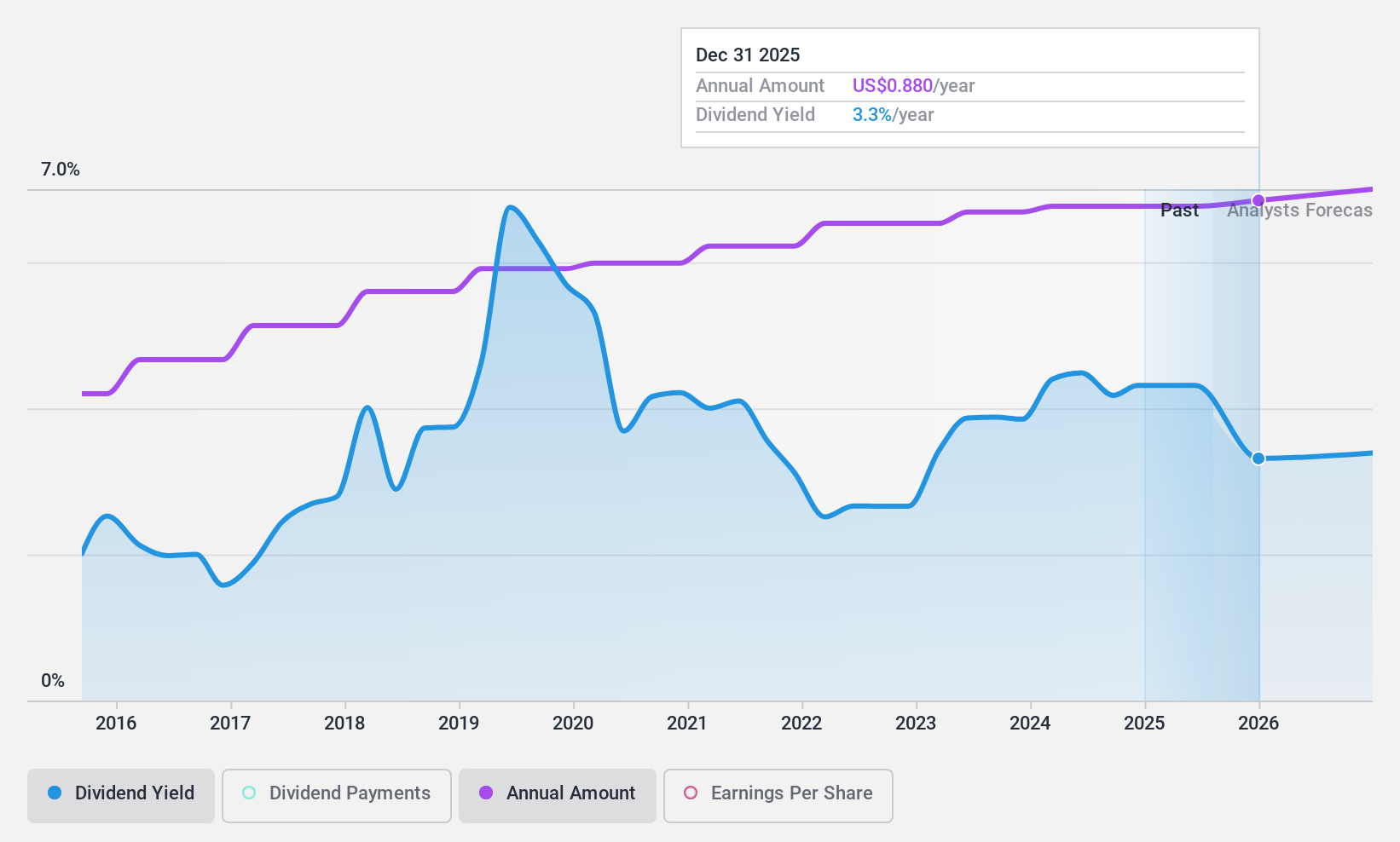

Dividend Yield: 4.7%

SpartanNash's dividend yield of 4.75% ranks in the top 25% of U.S. market payers, though it's not well covered by free cash flows and earnings, raising sustainability concerns. Despite stable dividends over the past decade, its payout ratio stands at a challenging 64.4%. Recent financials show slight declines in sales and net income, with Q3 sales at US$2.25 billion and net income at US$10.92 million, maintaining steady EPS year-over-year amidst strategic leadership changes.

- Dive into the specifics of SpartanNash here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that SpartanNash is trading behind its estimated value.

SunCoke Energy (NYSE:SXC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SunCoke Energy, Inc. is an independent producer of coke operating in the Americas and Brazil with a market cap of $899.79 million.

Operations: SunCoke Energy's revenue segments consist of Domestic Coke at $1.85 billion, Logistics at $102.80 million, and Brazil Coke at $35.60 million.

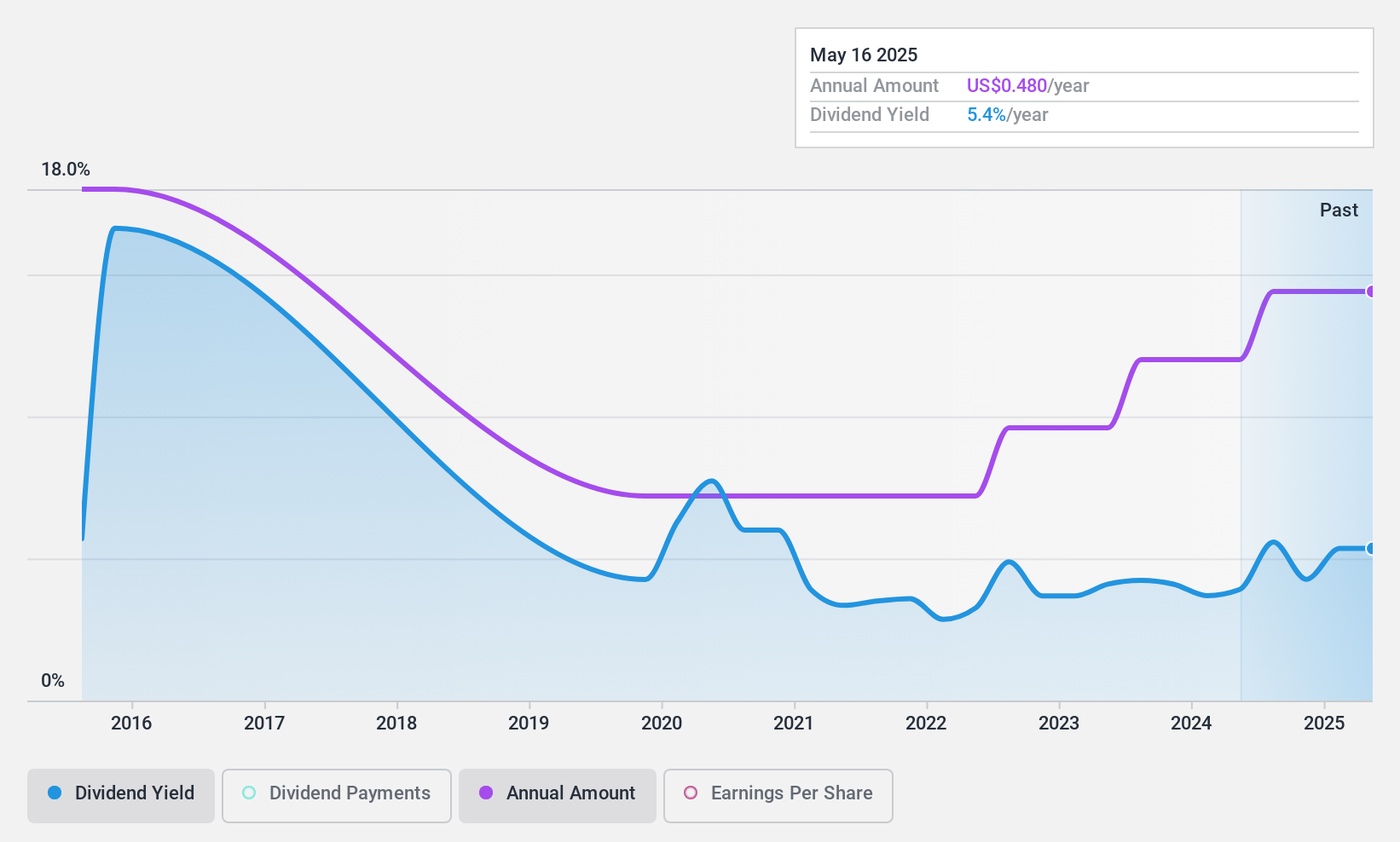

Dividend Yield: 4.5%

SunCoke Energy's dividend yield of 4.49% places it among the top 25% of U.S. market payers, with dividends well-covered by earnings and cash flows due to low payout ratios of 41.5% and 44.1%, respectively. However, its dividend history is marked by volatility over the past decade, raising sustainability concerns despite recent profit growth—net income for Q3 rose significantly to US$30.7 million from US$7 million year-over-year amidst declining sales figures.

- Click here to discover the nuances of SunCoke Energy with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that SunCoke Energy is priced lower than what may be justified by its financials.

Teekay Tankers (NYSE:TNK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Teekay Tankers Ltd. offers crude oil and marine transportation services to the oil industry both in Bermuda and globally, with a market cap of $1.37 billion.

Operations: Teekay Tankers Ltd. generates revenue of $1.19 billion from its tanker segment, providing marine transportation services for crude oil and related industries internationally.

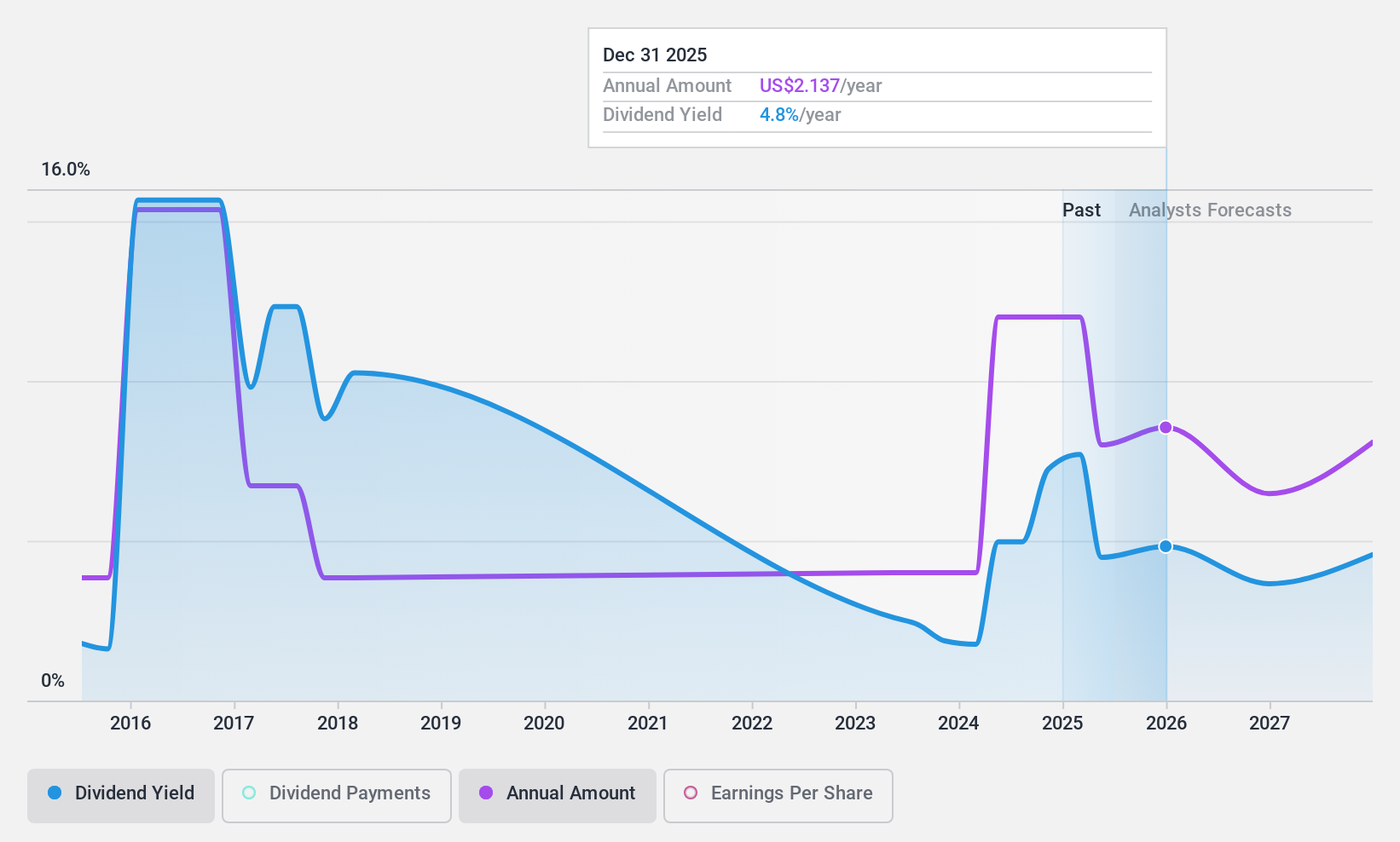

Dividend Yield: 7.5%

Teekay Tankers offers a high dividend yield, ranking in the top 25% of U.S. market payers, with dividends well-covered by its low payout ratios; earnings and cash flow coverage stand at 8.1% and 23.6%, respectively. Despite this, its dividend history is unstable and marked by volatility over the past decade. Recent board changes aim to streamline operations within the Teekay Group, but Q3 revenue and net income have declined compared to last year.

- Take a closer look at Teekay Tankers' potential here in our dividend report.

- Our valuation report unveils the possibility Teekay Tankers' shares may be trading at a discount.

Key Takeaways

- Gain an insight into the universe of 157 Top US Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives