- United States

- /

- Oil and Gas

- /

- NYSE:TNK

Discover 3 Leading US Dividend Stocks

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq hit record highs amidst a post-election rally, investors are increasingly turning their attention to dividend stocks as a means of securing steady income in an exuberant market. In such buoyant conditions, a good dividend stock is often characterized by its ability to provide consistent payouts and demonstrate resilience amid market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.23% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.71% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.52% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.75% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.24% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.48% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.52% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

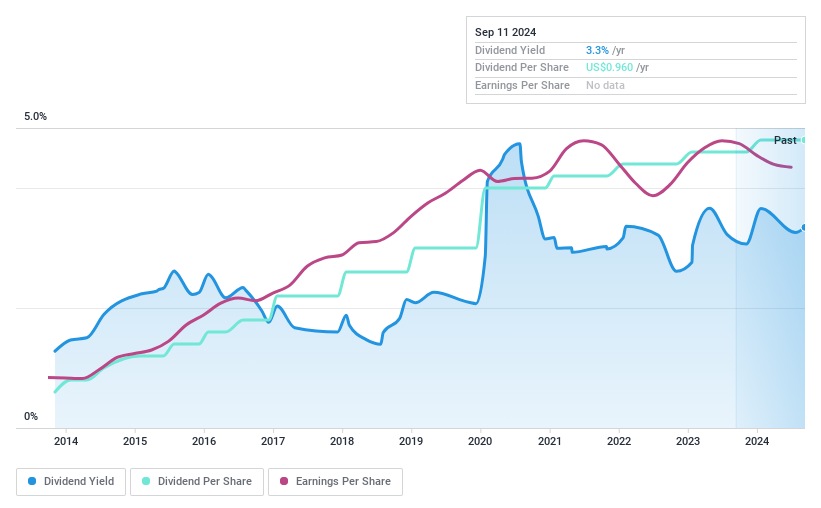

Timberland Bancorp (NasdaqGM:TSBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Timberland Bancorp, Inc. is the bank holding company for Timberland Bank, offering a range of community banking services in Washington, with a market cap of $265.79 million.

Operations: Timberland Bancorp generates its revenue primarily from community banking services, amounting to $74.15 million.

Dividend Yield: 3.1%

Timberland Bancorp's dividend payments have been reliable and stable over the past decade, with a recent 4% increase to $0.25 per share. The dividend yield of 3.05% is lower than top US payers, but a low payout ratio of 31.4% suggests sustainability. Trading at 54.9% below its estimated fair value enhances its appeal as a value investment, though recent earnings showed slight declines in net income and earnings per share compared to the previous year.

- Delve into the full analysis dividend report here for a deeper understanding of Timberland Bancorp.

- Our expertly prepared valuation report Timberland Bancorp implies its share price may be lower than expected.

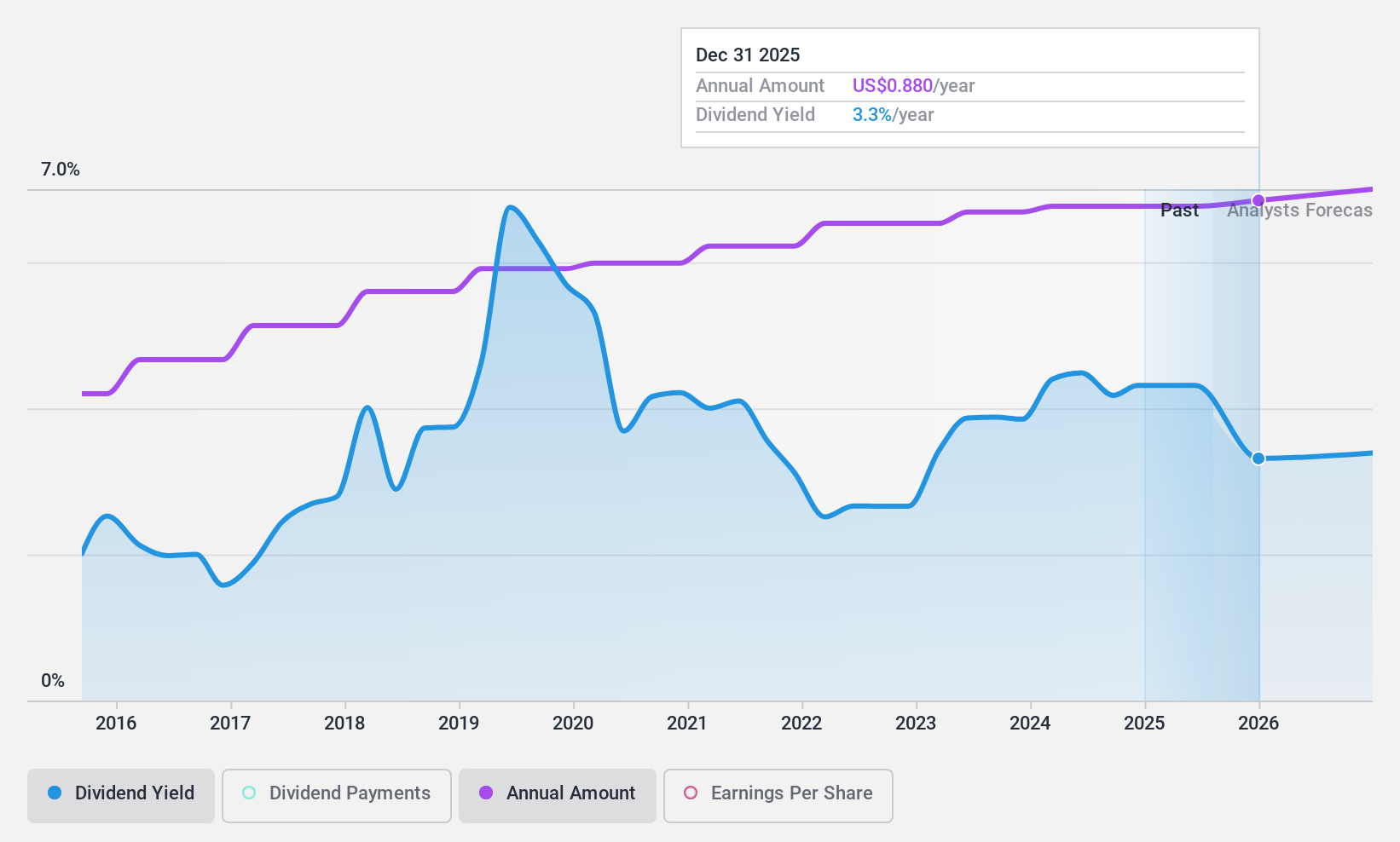

SpartanNash (NasdaqGS:SPTN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpartanNash Company distributes and retails grocery products in the United States, with a market cap of approximately $645.73 million.

Operations: SpartanNash generates revenue through its Retail segment, which accounts for $2.79 billion, and its Wholesale segment, contributing $7.93 billion.

Dividend Yield: 4.6%

SpartanNash's dividend yield of 4.56% ranks in the top 25% among US payers, with stable and reliable growth over the past decade. However, dividends are not well covered by free cash flows, raising sustainability concerns despite a reasonable payout ratio of 64.4%. Recent earnings showed slight declines in net income and sales, while a recent quarterly dividend of $0.2175 per share was affirmed for December payment amid ongoing share buybacks totaling $39.53 million since early 2022.

- Click to explore a detailed breakdown of our findings in SpartanNash's dividend report.

- Our comprehensive valuation report raises the possibility that SpartanNash is priced lower than what may be justified by its financials.

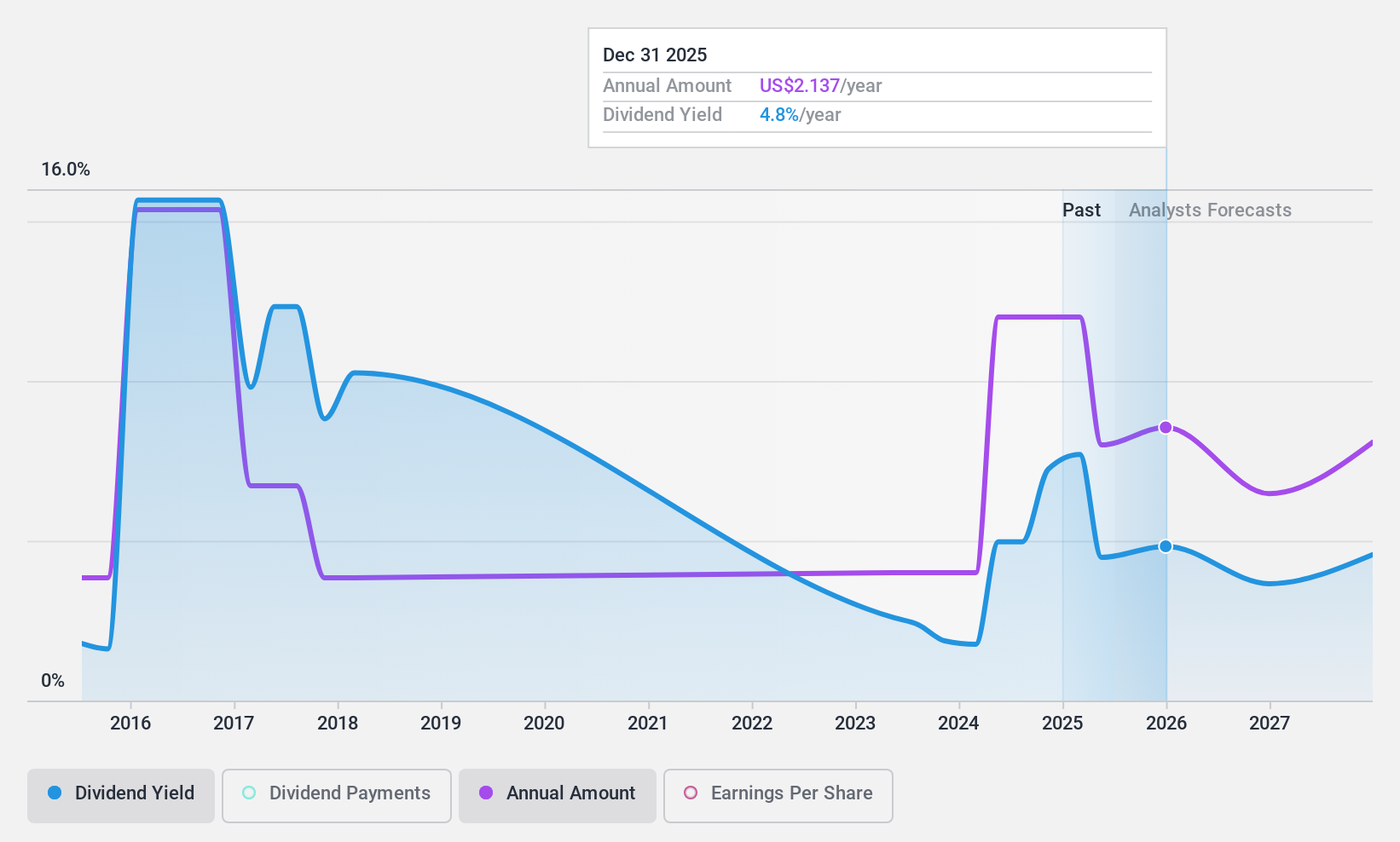

Teekay Tankers (NYSE:TNK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Teekay Tankers Ltd. is a company that offers crude oil and marine transportation services to the oil industry both in Bermuda and globally, with a market cap of approximately $1.37 billion.

Operations: Teekay Tankers Ltd. generates revenue primarily through its tanker segment, which accounted for $1.19 billion.

Dividend Yield: 7.2%

Teekay Tankers' dividend yield of 7.2% places it among the top 25% in the US, with dividends well-covered by earnings and cash flows, given a low payout ratio of 8.1%. However, its dividend history has been volatile over the past decade. Recent earnings showed declines, with Q3 revenue at US$243.28 million and net income at US$58.82 million compared to last year. A quarterly dividend of $0.25 per share was declared for November payment.

- Navigate through the intricacies of Teekay Tankers with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Teekay Tankers is trading behind its estimated value.

Next Steps

- Click this link to deep-dive into the 136 companies within our Top US Dividend Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides crude oil and other marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.