- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:ARBE

US Penny Stocks: Arbe Robotics And 2 More Promising Picks

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility marked by rising Treasury yields and shifting economic data, investors are increasingly exploring alternative investment avenues. Penny stocks, often representing smaller or newer companies, continue to attract interest due to their potential for value and growth that larger firms might overlook. Despite being an older term, penny stocks remain relevant for those seeking opportunities in under-the-radar companies with promising financial resilience and growth prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7975 | $5.81M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.39 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $105.8M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.9352 | $11.7M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.32 | $11.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.57 | $48.06M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.63 | $32.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.02 | $93.54M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.42 | $363.04M | ★★★★☆☆ |

Click here to see the full list of 724 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Arbe Robotics (NasdaqCM:ARBE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Arbe Robotics Ltd. is a semiconductor company offering 4D imaging radar solutions to tier 1 automotive suppliers and manufacturers across various countries, with a market cap of $340.27 million.

Operations: Arbe Robotics generates revenue of $1.02 million from its Auto Parts & Accessories segment.

Market Cap: $340.27M

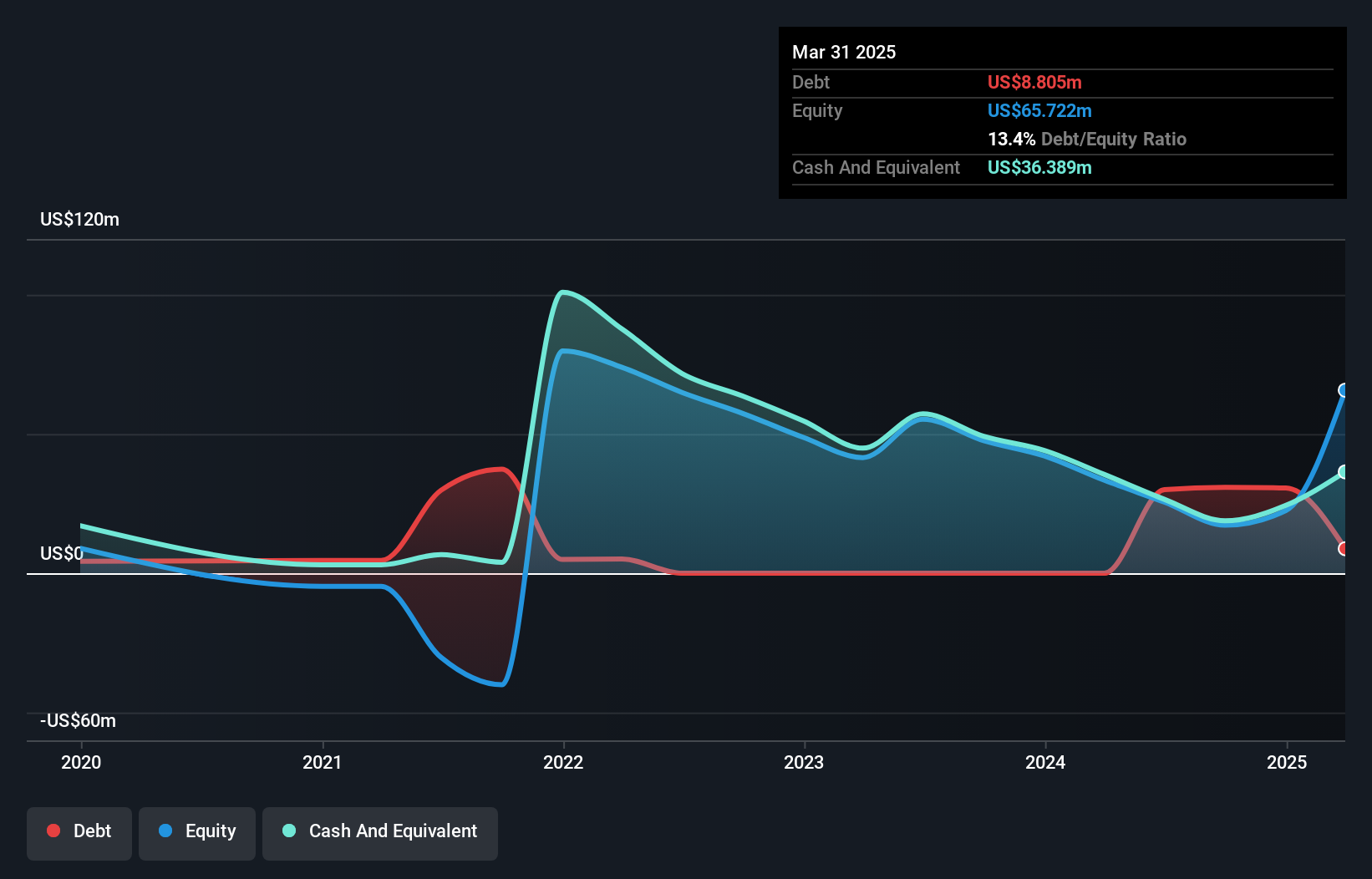

Arbe Robotics Ltd., a semiconductor company, is currently pre-revenue with sales of US$0.67 million for the first nine months of 2024 and a market cap of US$340.27 million. Despite its unprofitable status and high net debt to equity ratio (69.9%), Arbe has short-term assets exceeding both its long-term and short-term liabilities, providing some financial stability. Recent collaboration with NVIDIA enhances its advanced radar technology, positioning it as a potential innovator in vehicle safety and autonomy sectors. However, shareholder dilution remains a concern following recent equity offerings aimed at bolstering cash reserves amidst increasing losses.

- Dive into the specifics of Arbe Robotics here with our thorough balance sheet health report.

- Evaluate Arbe Robotics' prospects by accessing our earnings growth report.

Protalix BioTherapeutics (NYSEAM:PLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Protalix BioTherapeutics, Inc. is a biopharmaceutical company that develops, produces, and commercializes recombinant therapeutic proteins using its proprietary ProCellEx plant cell-based protein expression system across various countries including the United States and internationally, with a market cap of $164.20 million.

Operations: The company's revenue is derived from its biotechnology startups segment, totaling $45.67 million.

Market Cap: $164.2M

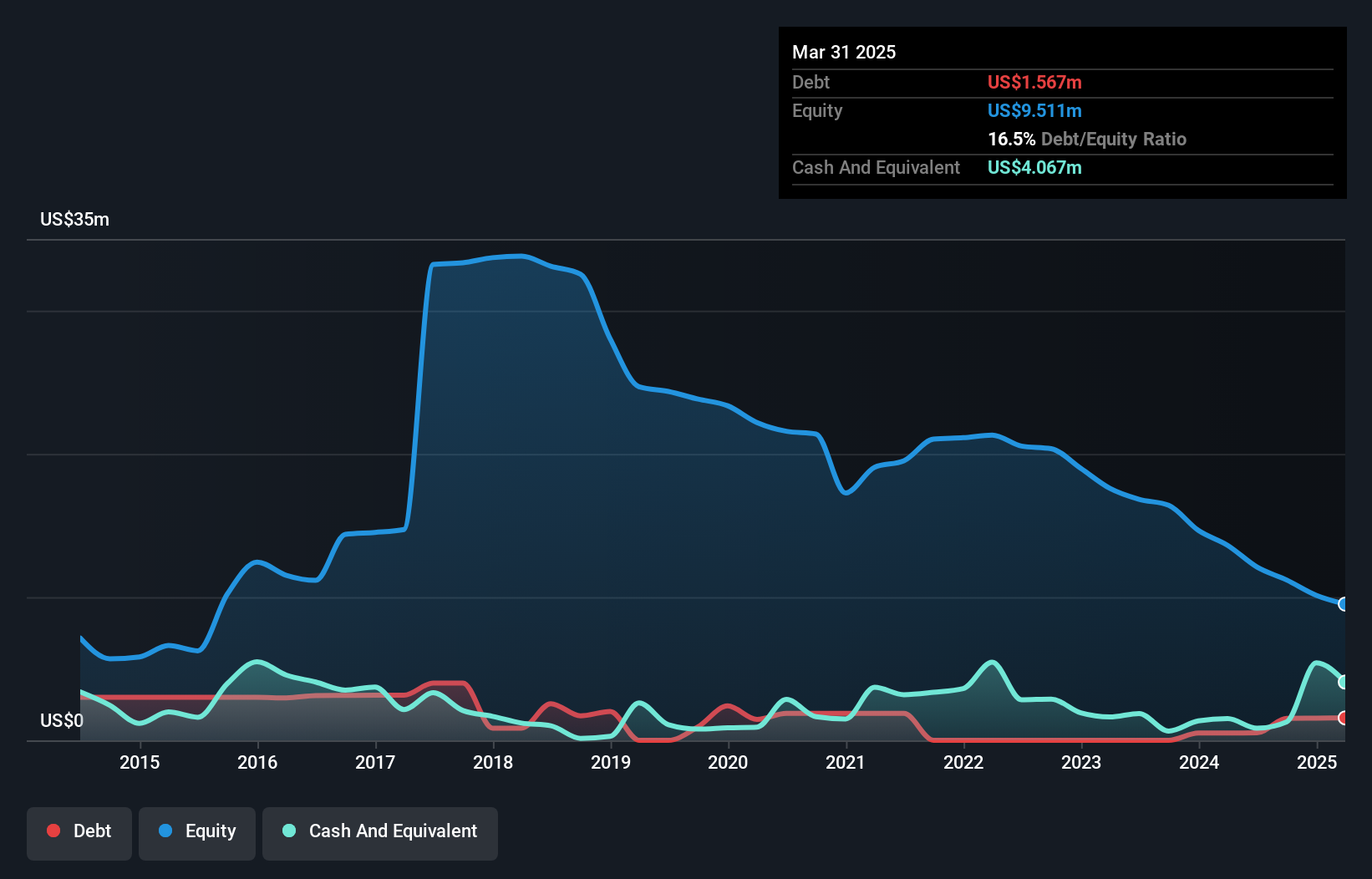

Protalix BioTherapeutics, with a market cap of US$164.20 million, is navigating the challenges typical of penny stocks in the biotech sector. Despite being unprofitable, it has shown improvement by reducing losses over the past five years and maintaining a stable cash runway for over three years due to positive free cash flow. The company's recent earnings report revealed a revenue increase to US$17.96 million in Q3 2024 from US$10.35 million year-over-year, marking progress despite an overall net loss for the nine months ending September 2024. Protalix's seasoned management and board bolster its strategic direction amidst industry volatility.

- Click to explore a detailed breakdown of our findings in Protalix BioTherapeutics' financial health report.

- Assess Protalix BioTherapeutics' future earnings estimates with our detailed growth reports.

Tecogen (OTCPK:TGEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tecogen Inc. designs, manufactures, markets, and maintains ultra-clean cogeneration products for various sectors primarily in the United States, with a market cap of approximately $46.47 million.

Operations: The company's revenue is derived from three main segments: Products ($4.77 million), Services ($15.95 million), and Energy Production ($2.09 million).

Market Cap: $46.47M

Tecogen Inc., with a market cap of US$46.47 million, faces challenges common among penny stocks, such as unprofitability and declining earnings over the past five years. Despite this, Tecogen's recent client announcements highlight potential growth opportunities through orders for cogeneration systems and chillers in key projects like the Las Vegas Convention Center. The company maintains a stable financial position with short-term assets exceeding liabilities and has sufficient cash runway for more than three years if free cash flow continues to grow. However, its high share price volatility and increased debt-to-equity ratio remain concerns for investors.

- Navigate through the intricacies of Tecogen with our comprehensive balance sheet health report here.

- Learn about Tecogen's historical performance here.

Turning Ideas Into Actions

- Get an in-depth perspective on all 724 US Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ARBE

Arbe Robotics

A semiconductor company, provides 4D imaging radar solutions to suppliers of parts or systems, autonomous ground vehicles, and commercial and industrial vehicles in China, Sweden, Germany, the United States, Israel, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success