- United States

- /

- Tech Hardware

- /

- NasdaqCM:BOXL

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates rising Treasury yields and fluctuating tech shares, investors are closely monitoring economic data that could impact interest rate decisions. Amidst these broader market dynamics, penny stocks remain a compelling area of interest for those seeking opportunities in smaller or newer companies. Despite their old-fashioned name, penny stocks can offer substantial value and growth potential when backed by strong financials and a clear growth path.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.80 | $5.97M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.22 | $1.76B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $102.23M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.90 | $10.89M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3021 | $12.01M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.15 | $98.88M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.77 | $47.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.86 | $24.83M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.04 | $88.55M | ★★★★★☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Boxlight (NasdaqCM:BOXL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Boxlight Corporation designs, produces, and distributes interactive technology solutions for various sectors including education and healthcare across multiple regions globally, with a market cap of $4.52 million.

Operations: Boxlight generates revenue from its Office Equipment segment, totaling $150.71 million.

Market Cap: $4.52M

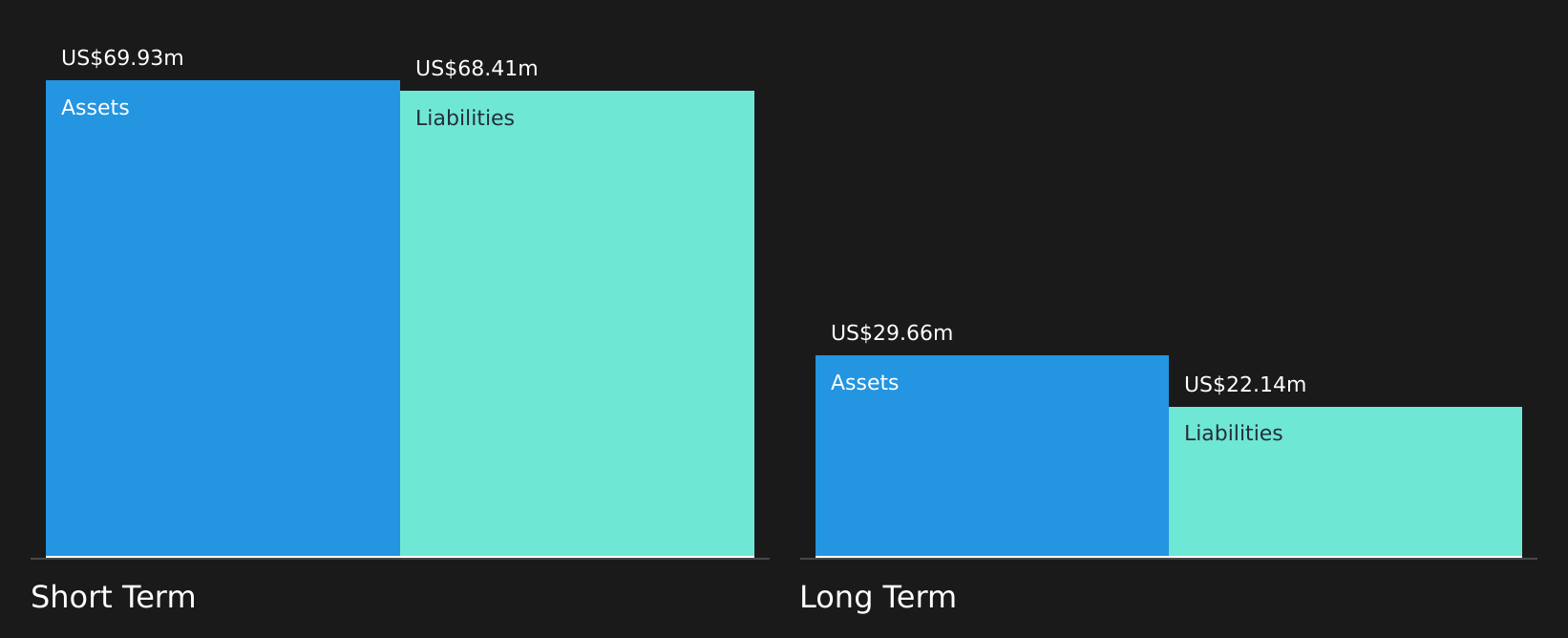

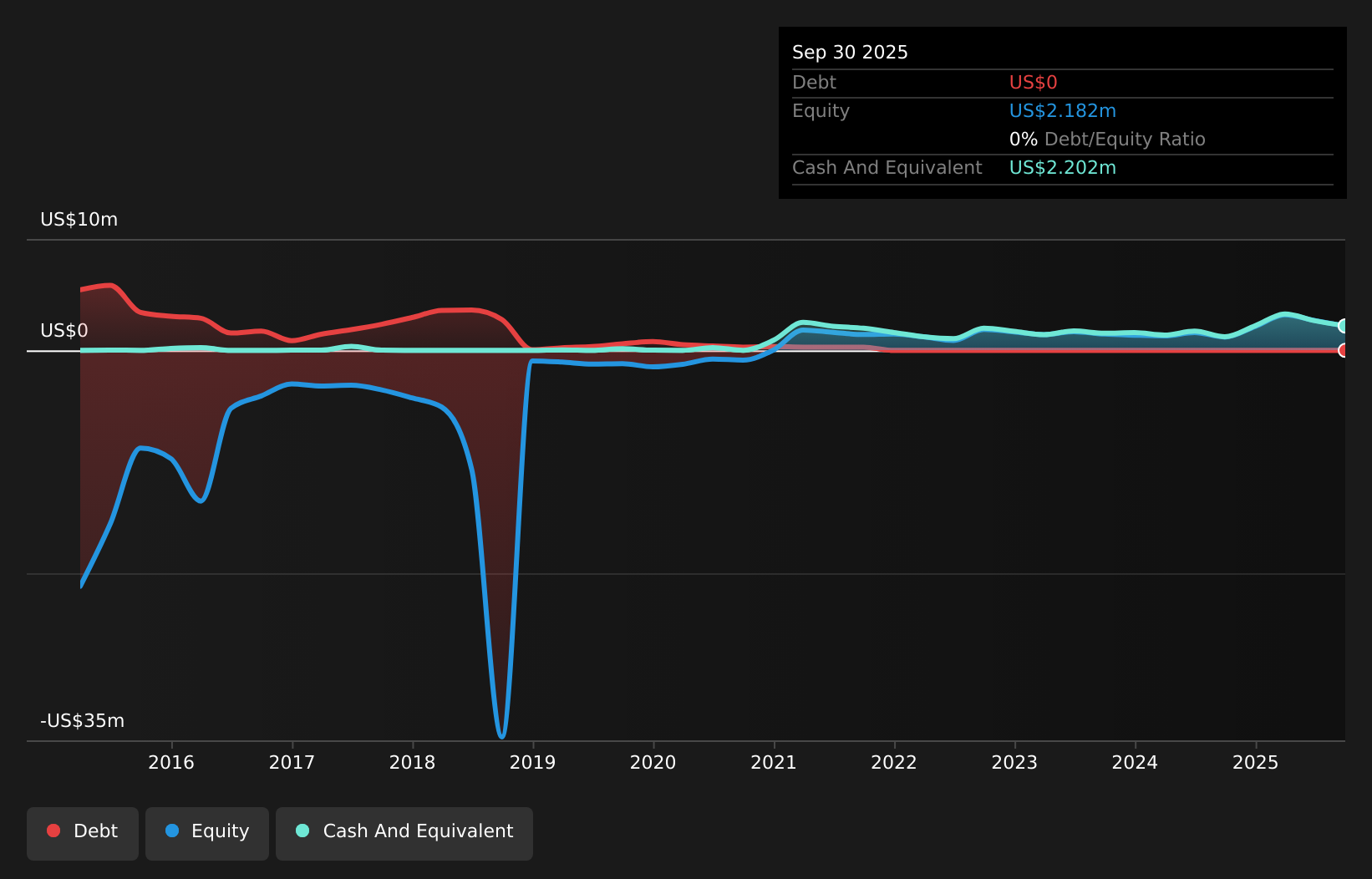

Boxlight Corporation, with a market cap of US$4.52 million, remains a high-risk investment due to its unprofitability and volatile share price. Despite generating US$150.71 million in revenue from its Office Equipment segment, the company reported declining sales for Q3 2024 at US$36.29 million compared to the previous year. While Boxlight's debt-to-equity ratio has improved over five years, it still holds a high net debt level at 80.7%. The company's short-term assets exceed both short- and long-term liabilities, offering some financial stability despite shareholder dilution and an inexperienced management team.

- Dive into the specifics of Boxlight here with our thorough balance sheet health report.

- Assess Boxlight's future earnings estimates with our detailed growth reports.

Baozun (NasdaqGS:BZUN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baozun Inc., with a market cap of approximately $167.07 million, offers comprehensive e-commerce solutions to brand partners in the People's Republic of China through its subsidiaries.

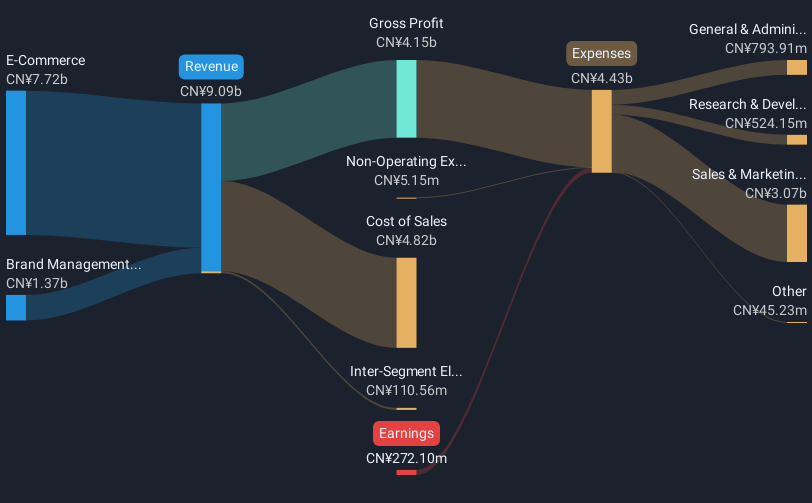

Operations: The company's revenue is primarily derived from its E-Commerce segment, which generated CN¥7.93 billion, and its Brand Management segment, contributing CN¥1.40 billion.

Market Cap: $167.07M

Baozun Inc., with a market cap of US$167.07 million, presents both opportunities and challenges for investors in penny stocks. The company has demonstrated financial resilience with short-term assets of CN¥7 billion exceeding both its short- and long-term liabilities, while maintaining more cash than debt. Despite trading at a significant discount to estimated fair value and completing a share buyback program, Baozun remains unprofitable with losses narrowing slightly in the recent quarter. Earnings are projected to grow substantially, yet the company's high volatility and negative return on equity highlight ongoing risks for potential investors.

- Click to explore a detailed breakdown of our findings in Baozun's financial health report.

- Review our growth performance report to gain insights into Baozun's future.

Vivos (OTCPK:RDGL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vivos Inc. is a radiation oncology medical device company that develops brachytherapy devices for treating non-resectable tumors in the United States, with a market cap of $49.07 million.

Operations: The company's revenue is derived from diagnostic kits and equipment, totaling $0.023 million.

Market Cap: $49.07M

Vivos Inc., a radiation oncology medical device company, is navigating the penny stock landscape with both potential and challenges. The company remains pre-revenue, generating only US$0.023 million in sales while incurring a net loss of US$1.89 million over nine months ending September 2024. Despite this, Vivos has made significant strides with its RadioGel® Precision Radionuclide Therapy™, initiating its first human clinical trial in India—a critical step towards FDA approval in the U.S. However, high volatility and shareholder dilution present risks, compounded by a cash runway of less than one year without significant revenue growth or funding influxes.

- Navigate through the intricacies of Vivos with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Vivos' track record.

Key Takeaways

- Navigate through the entire inventory of 720 US Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boxlight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BOXL

Boxlight

Designs, produces, and distributes interactive technology solutions for the education, health, corporate, military, and government sectors in the Americas, Europe, the Middle East, Africa, and internationally.

Moderate with adequate balance sheet.