Key Takeaways

- Many are anticipating the United States are hurtling towards a recession, which could signal continues struggles for capital markets.

- When recessions cause economies to contract and spending to tighten, businesses offering goods and services that are essential to our day-to-day lives should exhibit some resiliance.

- Retailers dealing in consumer staples , utilities companies and government contractors operate in industries that see little demand when the economy enters into a period of turbulence.

Recessions are difficult times for investors and capital markets. These periods are characterized by a sustained economic contraction caused by a drop in economic activity. Businesses are impacted as demand, capital investment and consumer spending decline as a response to difficult economic conditions.

When demand and the velocity of expenditure trend downwards, earnings are usually heavily impacted and the consequences are felt in a souring share price. While these conditions pose difficulty for all businesses operating in this environment, some businesses offer some resistance relative to the rest of the market during these periods. Here are our answers to the question: which stocks are the best to invest in during a recession?

Costco Wholesale - Wholesale Retailer of Consumer Staples

Thesis: Consumer staples like groceries, clothing and household goods will see very little change in their demand because they are vital to the lives of consumers. The top line of consumer staple retailers will be largely unaffected by economic recessions.

Why Costco Provides Opportunities in Recessions:

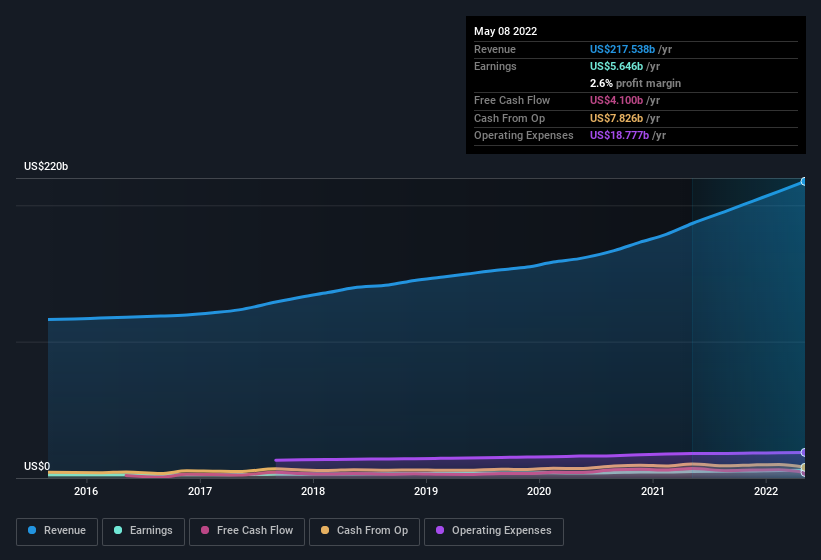

Costco’s (NASDAQ:COST) operations should be fairly resistant to the pressures of an economic recession, providing consumers with the necessities they need at wholesale pricing. This should be favorable to Costco as consumers become more price conscious as household budgets tighten. The business has remained favorable among investors over the recent market downturn, providing shareholders with +21.2% returns over the previous 12 months, compared to the -1.8% returns seen by the wider US Consumer Retailing industry.

The most recent example of a recession we can turn to was the COVID-19 recession where economies were plunged into economic turmoil owing to the precautionary measures taken to protect the population. During this period of tightening consumer spending, Costco remained largely unaffected.

Recent quarterly results for Costco have painted a rosy picture, net sales for the quarter increased 16.3 percent, to $51.61 billion, from $44.38 billion last year. Net sales for the first 36 weeks increased 16.4 percent, to $151.97 billion, from $130.61 billion last year.

As we look to the future, analysts are forecasting a 10.2% annual earnings growth for Costco, which outpaces the U.S. Consumer retailing segment. To find out more about what the next few years may hold for Costco, we encourage you to check out our Future Growth Analysis on our Costco Company Report.

Raytheon Technologies - Government Contractor for Defense

Thesis: Government expenditure on military is usually high and remains consistent during economic recessions. Companies with lucrative government contracts should out-perform the market due to relatively unchanged levels of customer expenditure.

Why Raytheon Provides Opportunities in Recessions:

Raytheon (NYSE:RTX) is one of the largest aerospace and defense companies servicing the United States and other Governments across the globe. In a time characterized by tense geo-political relations, Raytheon's position within the market as a leader in the defense sector will help ensure ongoing resistance and consistent demand throughout market turmoil.

Given global military spending has eclipsed US$2 trillion in real terms for the first time in history, countries will be hesitant to budge on defense expenditure even when pressure is placed on national budgets to ensure strategic advantage is not lost. This provides a large and growing addressable market for Raytheon's products.

Raytheon Missiles & Defense, a subsidiary of Raytheon Technologies, has continued to secure lucrative contract awards over the last few months which should provide revenue security into the near future. In the last 30 days alone, Raytheon has managed to secure a US$867M Missile Defense Agency contract to deliver SM-3 Block IIAs to the United States and partners and a US$624M U.S. Army contract to produce 1,300 Stinger missiles. This should give investors some peace of mind that the business remains strong in a tough economic climate.

One other important thing to note is that Raytheon has been continually paying a dividend to shareholders - a good sign of a mature and profitable business. With the current dividend yield of 2.4% forecasted to grow into the future, shareholders will be appreciative of the guaranteed capital return when the market is providing little else in the way of certainties.

Raytheon’s first quarter results were positive, detailing a 4% growth in Q1 sales to US$15.7B compared to the same quarter last year. Importantly, the company reported a 45% increase on earnings per share (EPS) to US$0.74, outpacing expectations. Operating profit margin increased to 12.1% in the first quarter, up from 7.6% in the first quarter of 2021, which is a great sign that profitability remains strong all while materials and logistics costs rise due to supply driven inflation.

Looking forward to the future, increasing interest rates put pressure on businesses with high levels of debt. Our analysis on Raytheon’s net debt to equity has yielded satisfactory results. To find out more about the quality of Raytheon’s balance sheet, head to the Raytheon Financial Health Analysis on Simply Wall St.

NRG Energy - Electrical Utilities Provider

Thesis: Much like consumer staples, electricity is a necessity for households regardless of the economic climate. The demand for electricity is relatively inelastic and so generators and suppliers will see relative strength compared to the rest of the market.

Why NRG Energy Perform Well During A Recession:

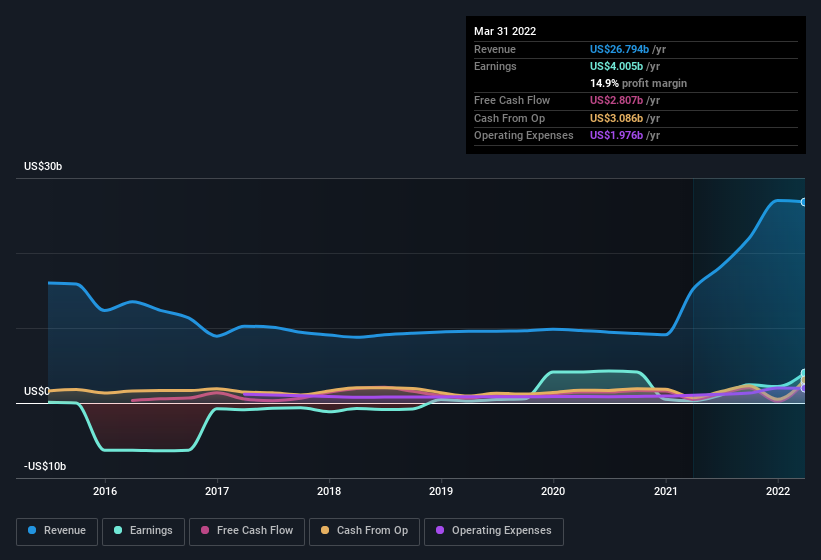

NRG Energy (NYSE:NRG) is one of the largest integrated utility companies in North America, providing electrical services to over 6 million customers throughout the United States and Canada. NRG Energy boasts a diverse generation portfolio of natural gas, coal, oil, nuclear and renewable operations which should help maintain relevance in an energy landscape that is shifting from fossil fuels.

If we take a look back at NRG Energy's income statement over the last few years, we can see relative resilience in the business, exhibiting no top-line decline throughout the COVID-19 recession. In fact, lockdown measures seemingly were a boon for the business, as earnings grew appreciably for the period.

Recently, analysts covering NRG Energy have actually improved their outlook for the remainder of 2022 , increasing revenue forecasts US$2B to US$28B for the year. A testament to the expectation of continued demand from customers irrespective of the economic stresses that look to impact household budgets.

In our analysis of NRG Energy's debts, we've noted that the company's net debt to equity ratio is quite high. Rising interests pose a potential risk to the business, but how well can NRG Energy cover their liabilities? Find out by checking out our analysis of NRG Energy's Financial Health.

Service Corporation International - Funeral Services Provider

Thesis: An unfortunate fact of life is that death is a certainty and this definitely does not change during recessions. Providers of funeral services and cemetery operators should not experience a noticeable change in overall demand for their offerings.

Why Service Corporation International Will Benefit:

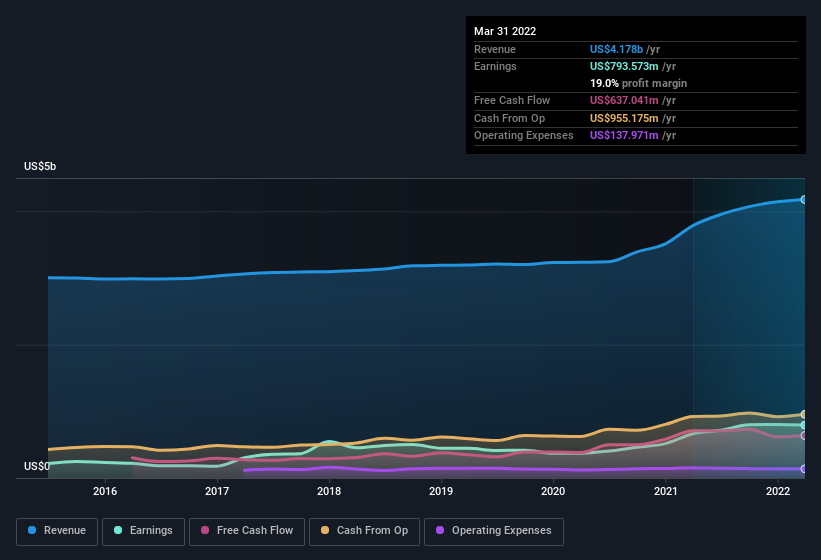

Service Corp (NYSE:SCI) is a leading provider of funeral, cremation and cemetery services throughout North America. The company is firmly the largest operator in the death-care industry, comprising of around 15% of the total market share by revenue across the United States and Canada.

Service Corp’s first quarter performance in 2022 has been robust, with the company growing its quarterly revenue to US$1.112B, up US$34M compared to this time last year. Importantly, Service Corp has experienced growth across its core revenue drivers, seeing average revenue per funeral service grow by 5%, pre-need funeral sales grow 17% and pre-need cemetery sales grow 11% since the first quarter of 2021.

Taking a step back and looking at Service Corp’s performance over the last 5 years yields positive results. The company’s annual earnings growth over the preceding 5 years of 14.8% outpaced both industry and market. This period does encapsulate the COVID-19 recession, however, the nature of the pandemic lead to a windfall as the increased mortality rates spurred growth for Service Corp in the face of difficult economic conditions.

It’s difficult to determine how the company will fair should a recession eventuate, but recent guidance from Service Corp expects that the remainder of the year will yield strong results, given the company raised the midpoint of its 2022 adjusted earnings guidance by 50 cents to $3.50 and the midpoint of its adjusted operating cash flow guidance by US$75M to US$775M. The company attributes this to more funeral services being performed and higher pre-need cemetery sales. It’s fair to say that the company expects to navigate the tightening economic conditions very well owing to continuous demand. If a recession occurs, revenue per funeral may decrease however this should be offset by the tailwinds of an ageing population and recent acquisitions bearing their fruit.

Despite the company’s strong guidance for the remainder of the year, our analysis on Service Corporation International’s ownership concludes that company insiders have only sold shares over the previous 3 months. To find out more about Service Corp’s ownership structure and what that means for shareholders, head to our Service Corp Ownership Breakdown on Simply Wall St.

3M Company - High Dividend Capital Goods Manufacturer

Thesis: During recessions, the stock market is volatile and capital appreciation is no guarantee. Companies that have a track record of stable and high dividends will provide investors with a buffer against volatility and some cash in hand.

Why 3M Provides Protection During A Recession:

3M Company (NYSE:MMM) is a diversified technology company that manufactures a range of products for commercial and consumer use. It operates through four main segments: Safety & Industrial, Transportation & Electronics, Health Care and Consumer. The company is truly diversified in every sense of the word, manufacturing things like abrasives and adhesives for industrial purposes, to large format graphic films for advertising and fleet signage on the side of car and buses, to even medical bandages and infection prevention solutions.

3M hasn’t escaped the tumultuous economics of the last few months. While performance throughout some of the sectors ebbed and flowed, a common theme was that the organic growth was offset by significant FX volatility. Rising costs due to inflation and supply chain disruptions hit the company’s bottom line, seeing a 3.6% hit to gross profit margin and an overall 7.5% decline in gross profit for the period compared to Q1 2022.

The first quarter of 2022 brought 3M sales of US$8.8B, down 0.3% from the same period in the prior year. Earnings per share (EPS) also took a hit, down 18% year on year to $2.26. Taking a look to the future, 3M now expects its full-year 2022 EPS to be in the range of $9.89 to $10.39, a slight downgrade from previous guidance of $10.15 to $10.65. An indication that inflated raw materials costs and supply chain issues will continue for the near term.

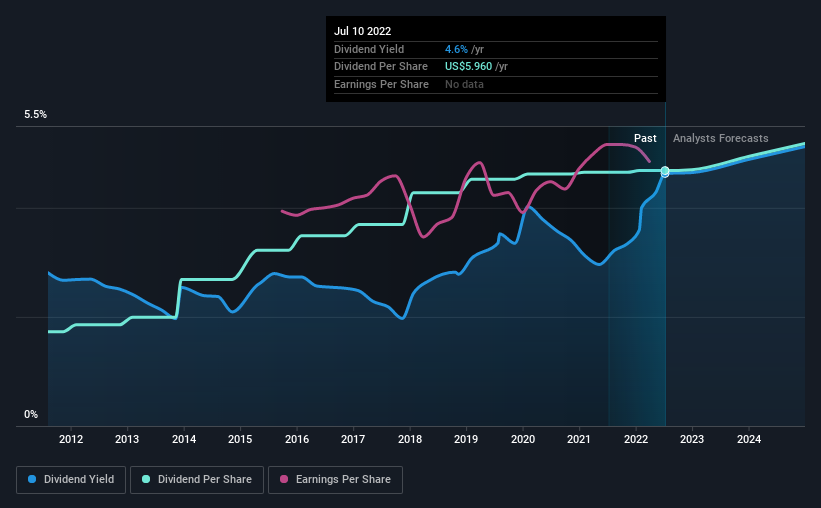

During recessions, capital appreciation becomes a rarity. Decreased economic activity generally leads to a fall in earnings across the board and share prices suffer as a result. Dividend stocks usually withstand economic shocks better than growth stocks and so a company with a stable dividend stable will be attractive option for investors seeking reduced share price volatility.

3M is what’s referred to as a ‘Dividend Aristocrat’, an S&P 500 company which has had 25+ consecutive years of dividend increases. It capped off the quarter with a total of US$1.63B in cash returned to shareholders, the company’s 64th straight years of annual dividend increases and illustrative of a 49% increase year on year. Dividends for the first quarter of 2022 totalled to $825M with share repurchases totalling $773M. Expectations for the remainder of 2022 are that share repurchases will reach close to $2B. When looked at in conjunction with an increasing dividend, it seems to indicate to management’s belief that cash levels are solid.

3M’s current dividend yield of 4.64% places it firmly in the top 25% of the market and well above the average of 3.2% for US Industrials. A look into the cash payout ratio for 3M reveals that these dividends are well covered, accounting for 67% of cash flows for the business .

A study from S&P Global into the Case for Dividend Growth Strategies revealed that the Dividend Aristocrat index provided greater downside protection in tougher economic conditions, with an average monthly return of -7.29% during the 15 worst months for the market, compared to the S&P 1500 Composite at -9.58%. So in theory, 3M’s high dividend yield should provide shareholders with a buffer against market volatility in economic downturns.

3M's high cash payout ratio is a good look for shareholders, but in the context of rising interest rates, increasing interest expenses can impact this figure. To find out more on 3M' financial health and how the compare may fare given its current debt levels, head to our Financial Health Analysis for the company on which can be viewed for free on our website .

The Bottom Line

Recessions are extremely volatile and uncertain times in capital markets. Slowing economic growth impacts businesses across the board and discovering investment opportunities becomes increasingly difficult - but not impossible. Businesses that provide households with the neccessities they need to survive, or businesses that operate in a segment with extremely inelastic demand offer the most resilience during recessions.

A recession may be on the horizon, but it's important to note that the macro-economic environment in which we find ourselves is quite different to previous recessions. Inflation is running hotter than it's been in the last 40 years and interest rates are on the rise to try and fight this. Investing in these times requires diligence and caution, but there are opportunities to be had. If you're interested in opportunities in this market, then we encourage you to check out our article on the best stocks to invest in as interest rates rise .

We are looking for feedback on this article. Click on this short survey HERE to let us know how we did.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives