- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

If EPS Growth Is Important To You, Costco Wholesale (NASDAQ:COST) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Costco Wholesale (NASDAQ:COST). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Costco Wholesale

How Fast Is Costco Wholesale Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Costco Wholesale grew its EPS by 15% per year. That's a pretty good rate, if the company can sustain it.

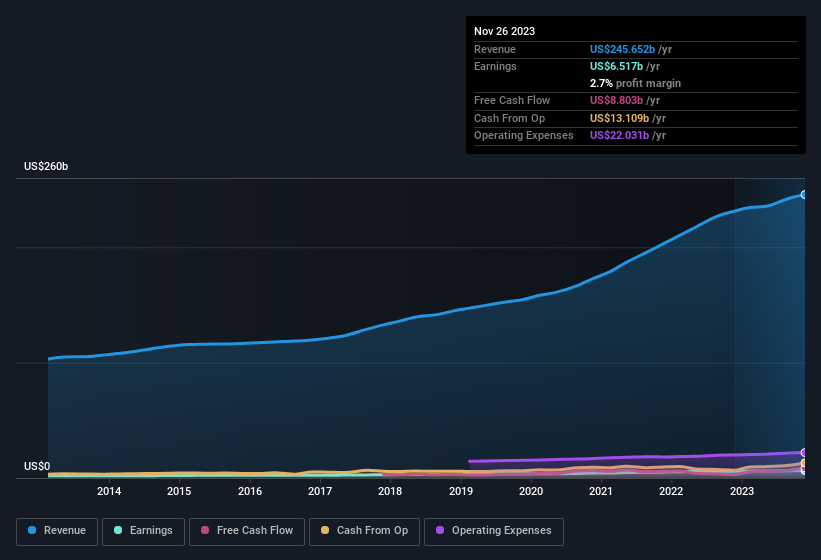

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Costco Wholesale maintained stable EBIT margins over the last year, all while growing revenue 6.2% to US$246b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Costco Wholesale's future profits.

Are Costco Wholesale Insiders Aligned With All Shareholders?

Since Costco Wholesale has a market capitalisation of US$317b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. We note that their impressive stake in the company is worth US$604m. We note that this amounts to 0.2% of the company, which may be small owing to the sheer size of Costco Wholesale but it's still worth mentioning. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations over US$8.0b, like Costco Wholesale, the median CEO pay is around US$12m.

Costco Wholesale's CEO took home a total compensation package worth US$8.5m in the year leading up to September 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Costco Wholesale To Your Watchlist?

One important encouraging feature of Costco Wholesale is that it is growing profits. The growth of EPS may be the eye-catching headline for Costco Wholesale, but there's more to bring joy for shareholders. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. We don't want to rain on the parade too much, but we did also find 1 warning sign for Costco Wholesale that you need to be mindful of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives