- United States

- /

- Consumer Durables

- /

- NYSE:VZIO

High Insider Ownership Growth Stocks On US Exchange November 2024

Reviewed by Simply Wall St

As major U.S. indexes experience weekly losses amid a tech sector slump and cautious Federal Reserve policies, investors are increasingly focused on identifying resilient opportunities in the market. In this environment, growth companies with high insider ownership can present compelling prospects, as such ownership often aligns management's interests with shareholders and may indicate confidence in the company's future performance.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.5% | 31.5% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.5% |

| On Holding (NYSE:ONON) | 31% | 29.7% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 60.7% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Here we highlight a subset of our preferred stocks from the screener.

Pangaea Logistics Solutions (NasdaqCM:PANL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pangaea Logistics Solutions, Ltd. offers seaborne dry bulk logistics and transportation services globally to industrial clients, with a market capitalization of $295.48 million.

Operations: The company's revenue primarily stems from its Transportation - Shipping segment, generating $521.24 million.

Insider Ownership: 26.4%

Earnings Growth Forecast: 34.7% p.a.

Pangaea Logistics Solutions demonstrates potential as a growth company with high insider ownership, despite challenges. Earnings are forecast to grow significantly at 34.7% annually, outpacing the US market. However, recent earnings show a decline in net income from US$18.87 million to US$5.11 million year-over-year for Q3 2024, affecting profit margins and dividends sustainability. The stock is considered undervalued by analysts and expected to rise by 60.1%.

- Dive into the specifics of Pangaea Logistics Solutions here with our thorough growth forecast report.

- According our valuation report, there's an indication that Pangaea Logistics Solutions' share price might be on the cheaper side.

Bowman Consulting Group (NasdaqGM:BWMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bowman Consulting Group Ltd. offers real estate, energy, infrastructure, and environmental management solutions in the United States and has a market cap of $443.86 million.

Operations: The company's revenue primarily comes from providing engineering and related professional services, amounting to $406.31 million.

Insider Ownership: 19.2%

Earnings Growth Forecast: 131.5% p.a.

Bowman Consulting Group is poised for growth, with anticipated annual earnings growth of 131.46% over the next three years, surpassing market averages. Despite recent shareholder dilution and a net loss of US$2.87 million for the first nine months of 2024, Bowman remains undervalued at 74.5% below its estimated fair value. The company has secured significant contracts, including a US$500 million infrastructure project in Colorado and multiple engineering projects across Virginia, bolstering future revenue prospects.

- Navigate through the intricacies of Bowman Consulting Group with our comprehensive analyst estimates report here.

- The analysis detailed in our Bowman Consulting Group valuation report hints at an deflated share price compared to its estimated value.

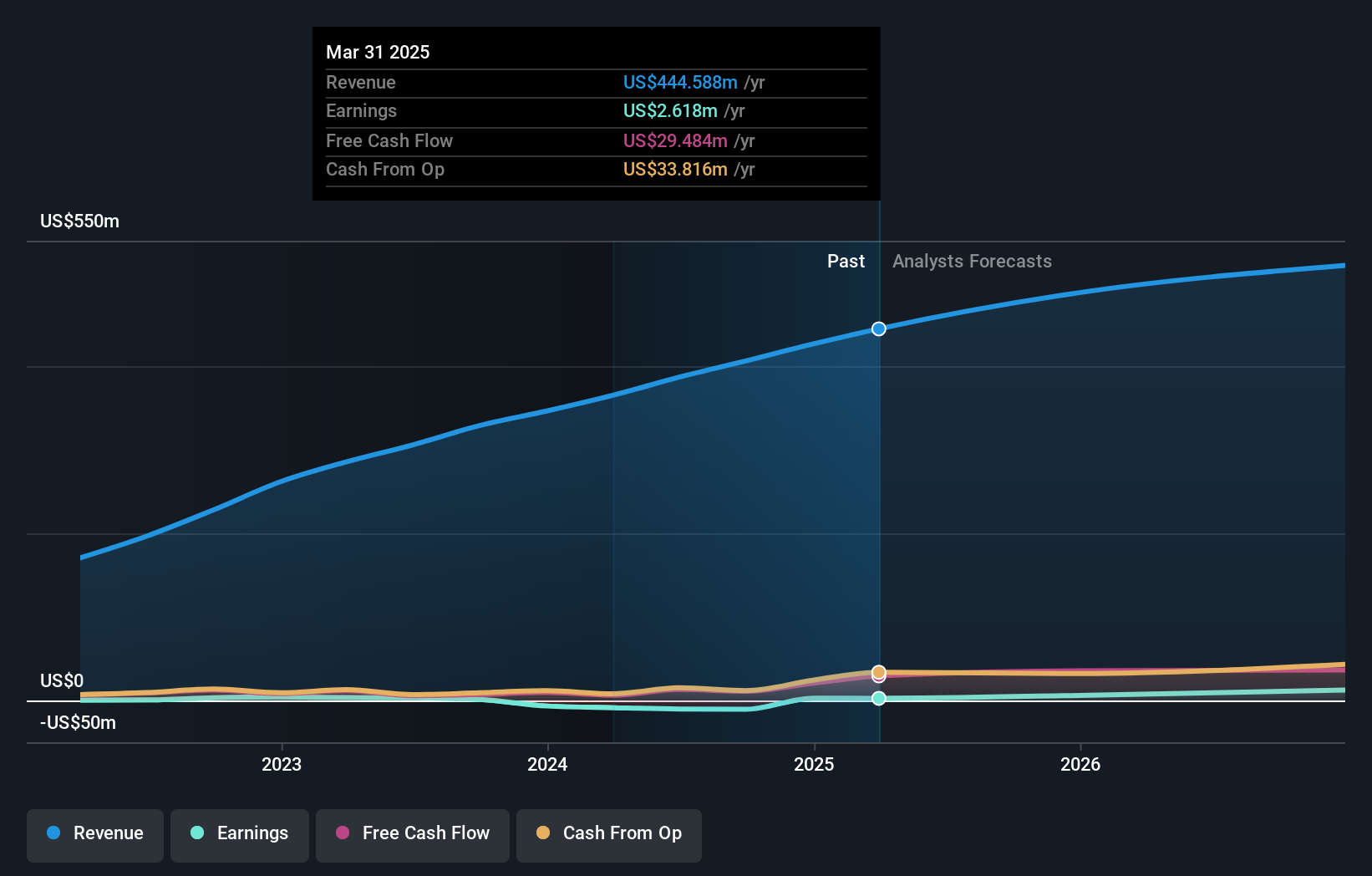

VIZIO Holding (NYSE:VZIO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VIZIO Holding Corp. operates in the United States, offering smart televisions, sound bars, and accessories, with a market cap of approximately $2.28 billion.

Operations: The company's revenue is primarily derived from two segments: Device, contributing $1.04 billion, and Platform+, contributing $700.30 million.

Insider Ownership: 37.8%

Earnings Growth Forecast: 58.2% p.a.

VIZIO Holding demonstrates potential for growth with forecasted annual earnings growth of 58.2%, outpacing the US market average. Despite a recent decline in net income, the company continues to innovate with new products like MicMe, enhancing its entertainment offerings. Although insider buying has not been substantial recently, VIZIO trades at 41.1% below its estimated fair value, suggesting it may be undervalued despite shareholder dilution and lower profit margins compared to last year.

- Click to explore a detailed breakdown of our findings in VIZIO Holding's earnings growth report.

- Upon reviewing our latest valuation report, VIZIO Holding's share price might be too optimistic.

Where To Now?

- Gain an insight into the universe of 210 Fast Growing US Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZIO

VIZIO Holding

Through its subsidiaries, provides smart televisions, sound bars, and accessories in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives