- United States

- /

- Consumer Durables

- /

- NYSE:TOL

How Toll Brothers’ (TOL) Strong Q3 and Expansion Efforts Have Changed Its Investment Story

Reviewed by Simply Wall St

- Toll Brothers, Inc. recently reported third-quarter earnings, posting US$2.95 billion in revenue and year-over-year growth in both revenue and earnings per share, while continuing to launch new luxury communities across major U.S. markets.

- Alongside exceeding analyst forecasts, Toll Brothers advanced its share repurchase program and expanded its presence with new home offerings, reflecting resilience even amid a shifting housing demand landscape.

- We’ll examine how Toll Brothers’ stronger-than-expected earnings and ongoing expansion shape the investment narrative for the months ahead.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Toll Brothers Investment Narrative Recap

To be confident as a Toll Brothers shareholder, you need to believe that affluent buyers will continue to drive demand for luxury homes, offsetting recent softness in broader housing demand. The latest earnings showed revenue and earnings per share growth, but also underscored a continued dip in backlog, signaling that sustaining future growth remains a key catalyst, while ongoing weakness in future orders is the biggest risk. In all, the results confirm the importance of backlog trends to near-term momentum, and the impact is material given the lower backlog levels reported.

Among recent announcements, Toll Brothers’ grand opening of seven model homes at The Station in Sunnyvale, California stands out. This expansion into a prime market continues the push for higher community count, a major catalyst, as it supports future delivery volumes, helps offset any regional slowdowns, and widens the company’s exposure to pockets of still-robust demand.

But equally important, and something investors should not overlook, is the growing risk if orders and backlog continue to decline from here...

Read the full narrative on Toll Brothers (it's free!)

Toll Brothers' outlook anticipates $12.7 billion in revenue and $1.6 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 6.1% and an earnings increase of $0.2 billion from the current $1.4 billion.

Uncover how Toll Brothers' forecasts yield a $140.81 fair value, a 7% upside to its current price.

Exploring Other Perspectives

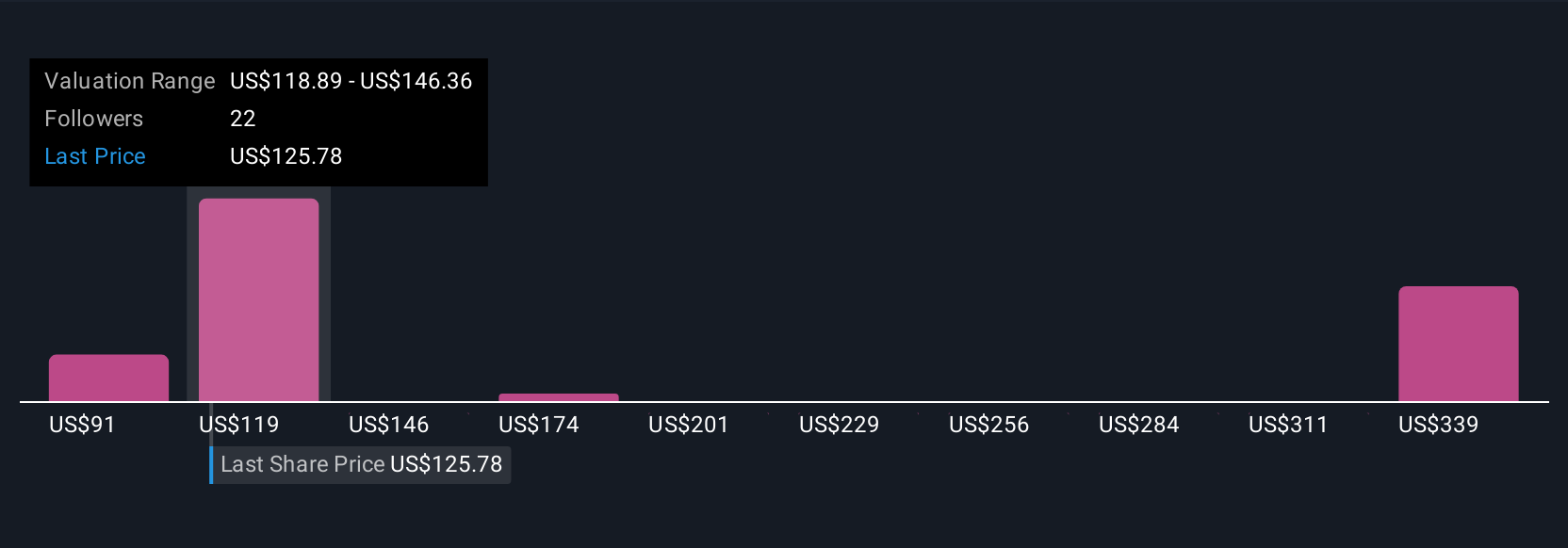

A dozen members in the Simply Wall St Community set fair values for Toll Brothers ranging from US$91.41 to US$368.18 per share. With ongoing declines in the order backlog posing a risk to future revenues, exploring multiple viewpoints is critical.

Explore 12 other fair value estimates on Toll Brothers - why the stock might be worth over 2x more than the current price!

Build Your Own Toll Brothers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toll Brothers research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Toll Brothers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toll Brothers' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toll Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOL

Toll Brothers

Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives