- United States

- /

- Residential REITs

- /

- NYSE:NXRT

3 Undervalued Small Caps With Insider Action Across Global Markets

Reviewed by Simply Wall St

As the Nasdaq reaches record highs driven by surging chip stocks and Apple, the broader market sentiment remains mixed with the S&P 500 slightly retreating amid concerns over tariffs and economic health. In this environment, small-cap stocks can offer unique opportunities for investors seeking growth potential, especially when insider action suggests confidence in their future performance.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Southside Bancshares | 9.9x | 3.3x | 40.88% | ★★★★★★ |

| First United | 8.8x | 2.6x | 49.72% | ★★★★★☆ |

| Tilray Brands | NA | 0.9x | 45.77% | ★★★★★☆ |

| Citizens & Northern | 10.7x | 2.6x | 45.83% | ★★★★☆☆ |

| S&T Bancorp | 10.6x | 3.6x | 42.14% | ★★★★☆☆ |

| Gentherm | 31.9x | 0.7x | 29.10% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 27.57% | ★★★★☆☆ |

| Lindblad Expeditions Holdings | NA | 1.0x | 19.43% | ★★★★☆☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 19.03% | ★★★★☆☆ |

| Shore Bancshares | 9.4x | 2.4x | -21.88% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

LTC Properties (LTC)

Simply Wall St Value Rating: ★★★★★☆

Overview: LTC Properties is a real estate investment trust that primarily invests in senior housing and healthcare properties, with a market capitalization of approximately $1.47 billion.

Operations: LTC Properties generates revenue primarily through its operations, with a notable focus on maintaining high gross profit margins, which peaked at 99.99% in Q3 2018 but have shown some variability since then. The company incurs costs related to operating expenses and depreciation & amortization, with general and administrative expenses reaching $30.86 million by Q1 2025. Non-operating expenses also play a significant role in the financials, impacting net income margins that have fluctuated over time.

PE: 19.7x

LTC Properties, a smaller player in the U.S. market, shows potential for growth despite challenges. Their recent earnings report highlighted a year-over-year revenue increase to US$60.24 million in Q2 2025, though net income declined to US$15.09 million from US$19.36 million previously. Insider confidence is evident with share purchases over the past year, and their revised guidance suggests optimism with projected GAAP net income per share rising slightly for 2025. The new credit agreement provides financial flexibility but also reflects reliance on external funding sources, which carries inherent risks due to higher borrowing costs compared to customer deposits.

- Unlock comprehensive insights into our analysis of LTC Properties stock in this valuation report.

Review our historical performance report to gain insights into LTC Properties''s past performance.

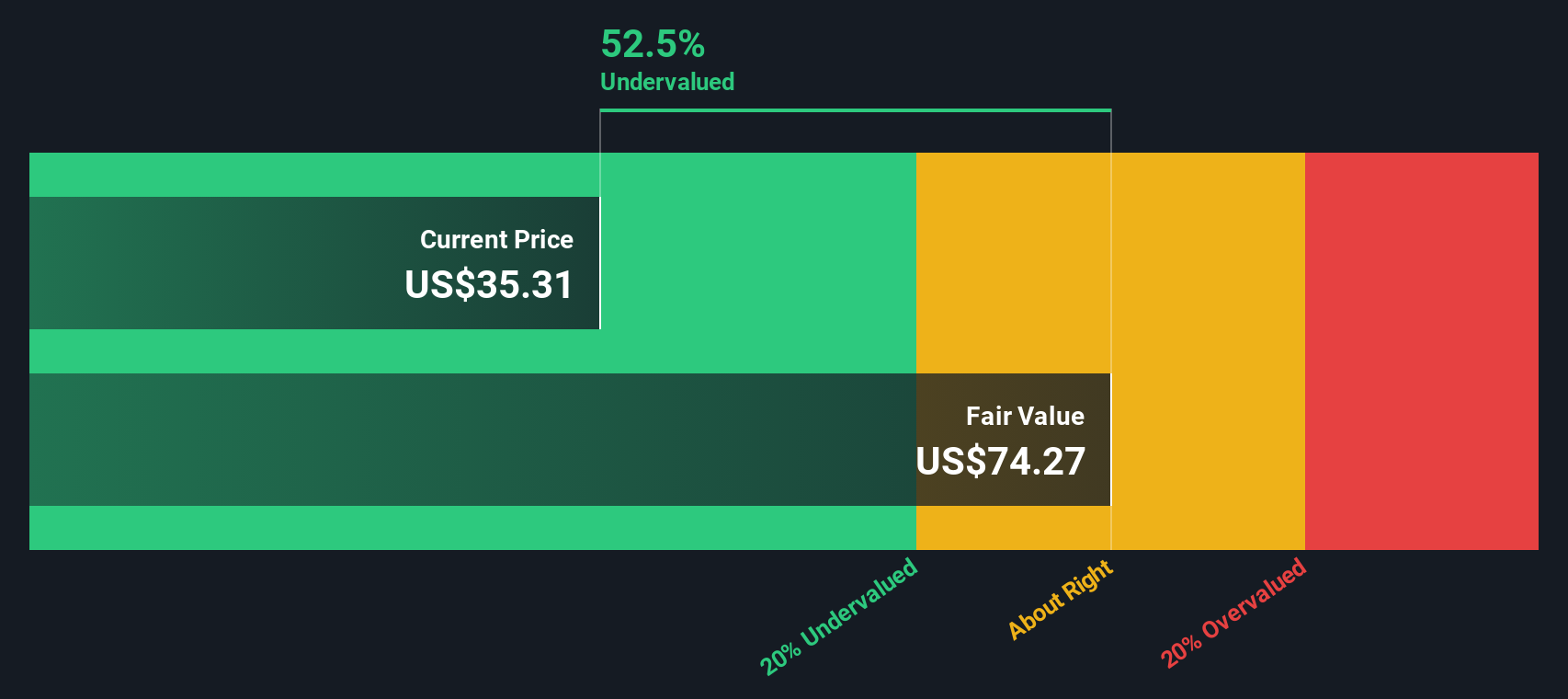

NexPoint Residential Trust (NXRT)

Simply Wall St Value Rating: ★★★★★☆

Overview: NexPoint Residential Trust focuses on acquiring, owning, and operating multifamily properties in the southeastern and southwestern United States with a market cap of approximately $1.05 billion.

Operations: NXRT generates revenue primarily through investments in real estate, with recent figures showing $254.45 million. The company has experienced fluctuations in net income margin, with a notable negative trend reaching -19.54% as of mid-2025. Gross profit margin has shown some stability around 60.10% during the same period, indicating efficiency in managing costs relative to revenue generation.

PE: -16.0x

NexPoint Residential Trust, a U.S.-based company, has been navigating a challenging financial landscape. Despite reporting a net loss of US$7.03 million for Q2 2025, they continue to show insider confidence with recent share repurchases totaling 223,109 shares for US$7.6 million between April and June 2025. The firm also secured a new credit facility to bolster its financial position amid muted revenue expectations for the latter half of the year.

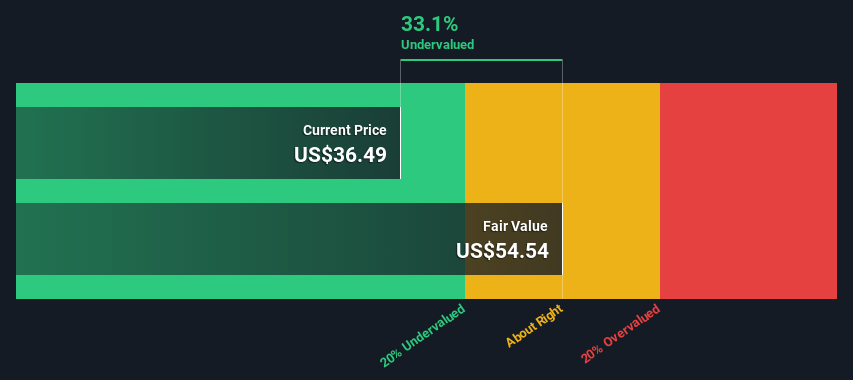

Oxford Industries (OXM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Oxford Industries is a lifestyle apparel company with a diverse portfolio of brands including Johnny Was, Tommy Bahama, and Lilly Pulitzer, and it has a market capitalization of approximately $1.76 billion.

Operations: The company's revenue streams primarily include Tommy Bahama, Lilly Pulitzer, Johnny Was, and Emerging Brands. Over the observed periods, the gross profit margin showed a notable range between 54.64% and 63.35%. Operating expenses are a significant component of costs, with general and administrative expenses consistently being the largest portion within this category.

PE: 7.2x

Oxford Industries, a smaller company in the U.S. market, has experienced recent shifts with its removal from several Russell Growth indices by June 2025. Despite this, insider confidence is evident as they have increased their holdings recently. The company repurchased 842,007 shares for US$50 million earlier in 2025. However, earnings are projected to decline slightly over the next few years due to higher interest expenses and external funding risks. Future sales guidance suggests a slight dip compared to last year’s figures of US$1.52 billion.

- Navigate through the intricacies of Oxford Industries with our comprehensive valuation report here.

Examine Oxford Industries' past performance report to understand how it has performed in the past.

Next Steps

- Access the full spectrum of 73 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NexPoint Residential Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NXRT

NexPoint Residential Trust

NexPoint Residential Trust is a publicly traded REIT, with its shares listed on the New York Stock Exchange and NYSE Texas, Inc.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion