- United States

- /

- Luxury

- /

- NYSE:OXM

3 Reliable Dividend Stocks With Yields Up To 5.2%

Reviewed by Simply Wall St

The market has climbed 2.2% in the last 7 days and is up 8.2% over the past 12 months, with earnings forecasted to grow by 14% annually. In such a dynamic environment, selecting reliable dividend stocks can provide investors with steady income streams while potentially benefiting from market growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.09% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.35% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.04% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.55% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.04% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.94% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.13% | ★★★★★☆ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.46% | ★★★★★☆ |

Click here to see the full list of 152 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

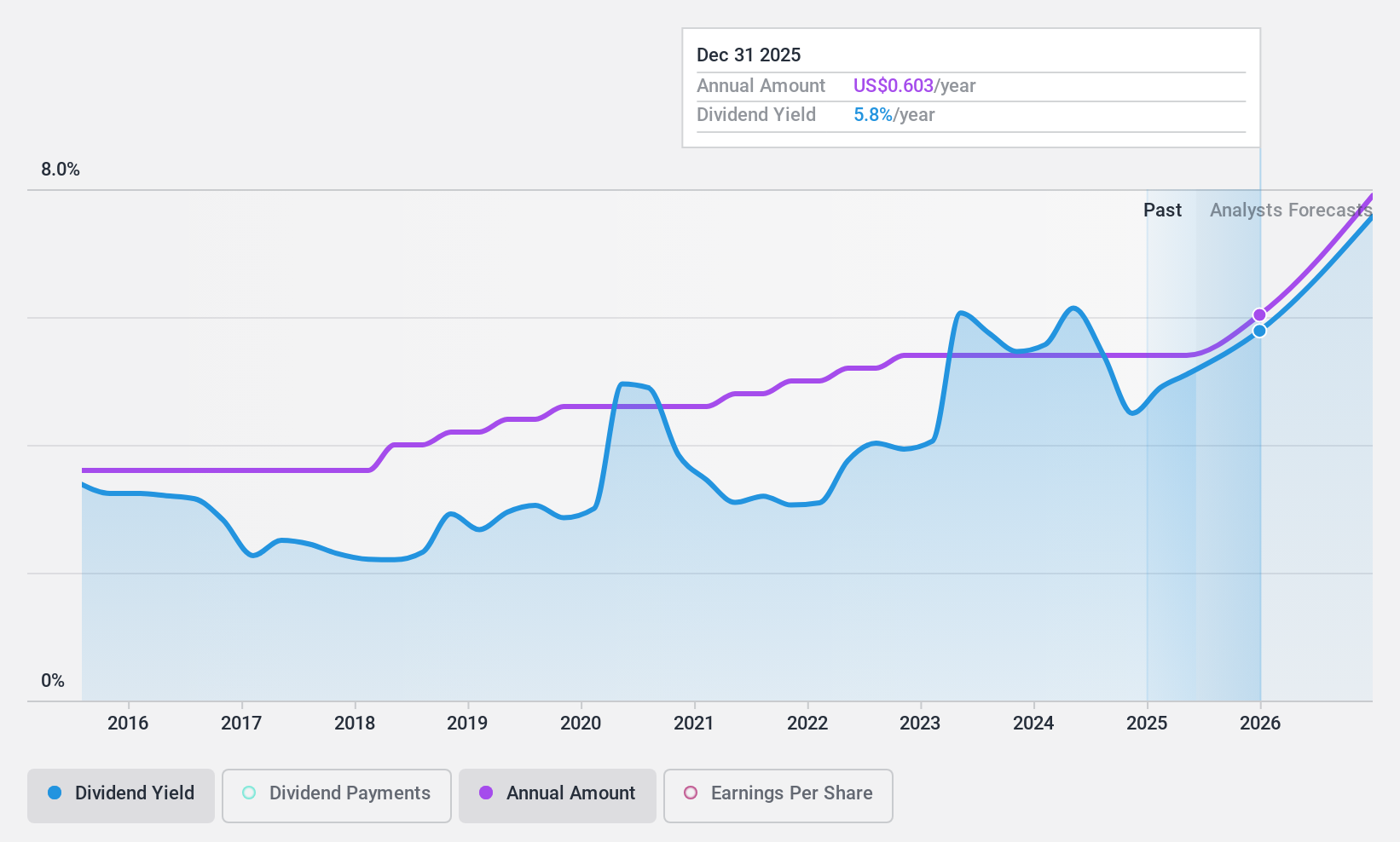

Brookline Bancorp (NasdaqGS:BRKL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brookline Bancorp, Inc. is a bank holding company for Brookline Bank, offering commercial, business, and retail banking products and services to corporate, municipal, and retail customers in the United States with a market cap of approximately $956.98 million.

Operations: Brookline Bancorp, Inc. generates its revenue primarily from its banking business segment, which amounts to $338.57 million.

Dividend Yield: 5%

Brookline Bancorp offers a compelling dividend yield of 5.02%, placing it in the top 25% of US dividend payers. The company has maintained stable and growing dividends over the past decade, supported by a reasonable payout ratio of 65.7%. Recent earnings showed growth, with net income rising to US$19.1 million from US$14.67 million year-over-year, underscoring its ability to sustain dividends despite recent charge-offs in commercial loans.

- Navigate through the intricacies of Brookline Bancorp with our comprehensive dividend report here.

- Our valuation report unveils the possibility Brookline Bancorp's shares may be trading at a discount.

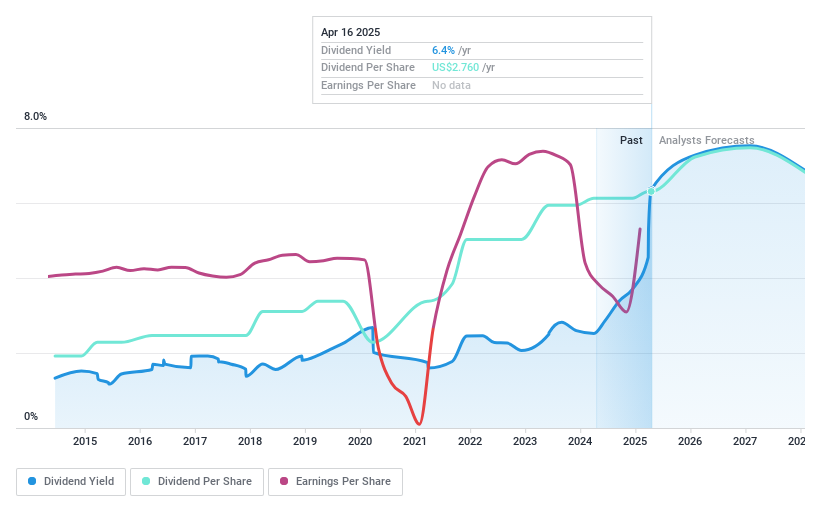

Oxford Industries (NYSE:OXM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oxford Industries, Inc. is an apparel company that designs, sources, markets, and distributes lifestyle products globally with a market cap of approximately $742.96 million.

Operations: Oxford Industries generates its revenue from several segments, including Johnny Was ($194.98 million), Tommy Bahama ($869.60 million), Lilly Pulitzer ($323.92 million), and Emerging Brands ($128.43 million).

Dividend Yield: 5.2%

Oxford Industries' dividend yield of 5.23% ranks in the top 25% of US dividend payers, with a recent 3% increase to $0.69 per share. The company's dividends are well-covered by earnings and cash flows, despite a historically volatile track record. Recent guidance indicates potential earnings challenges, with expected declines in EPS due to higher tariffs and tax impacts. A new $100 million share repurchase program could provide additional shareholder value amidst these challenges.

- Get an in-depth perspective on Oxford Industries' performance by reading our dividend report here.

- The analysis detailed in our Oxford Industries valuation report hints at an deflated share price compared to its estimated value.

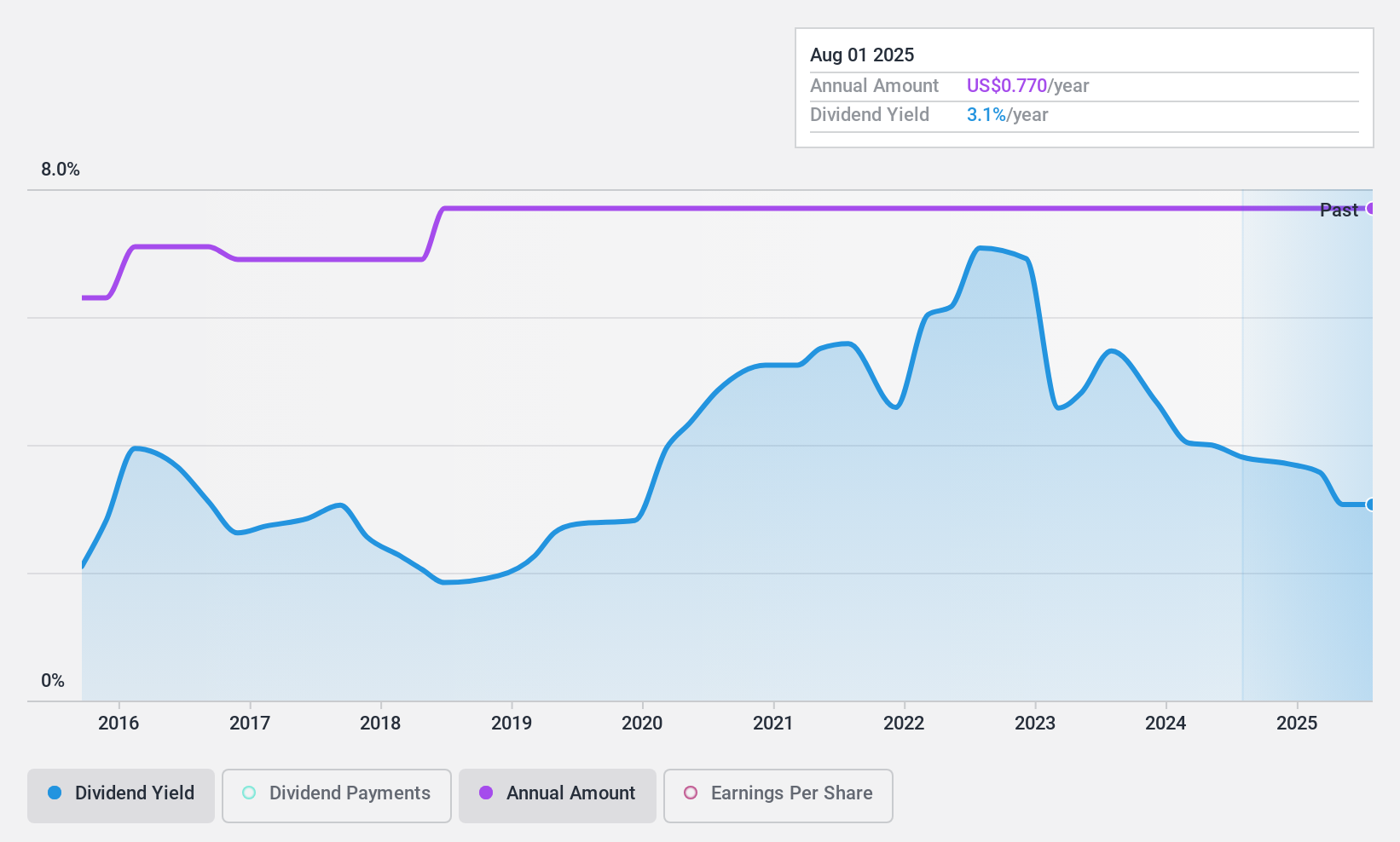

Universal Insurance Holdings (NYSE:UVE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Universal Insurance Holdings, Inc., with a market cap of $710.37 million, operates as an integrated insurance holding company in the United States through its subsidiaries.

Operations: Universal Insurance Holdings, Inc. generates revenue primarily from its Property & Casualty insurance segment, which amounts to $1.55 billion.

Dividend Yield: 3%

Universal Insurance Holdings offers a stable dividend yield of 3%, supported by a low payout ratio of 27.2% and cash payout ratio of 9.2%, indicating strong coverage by earnings and cash flows. The company's dividends have grown steadily over the past decade, although they remain below top-tier US dividend payers. Recent earnings show improved performance, with Q1 revenue at $394.87 million and net income at $41.44 million, alongside a new $20 million share buyback plan to enhance shareholder value further.

- Click here to discover the nuances of Universal Insurance Holdings with our detailed analytical dividend report.

- Our valuation report here indicates Universal Insurance Holdings may be undervalued.

Summing It All Up

- Explore the 152 names from our Top US Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Oxford Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXM

Oxford Industries

An apparel company, designs, sources, markets, and distributes lifestyle products worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives