- United States

- /

- Luxury

- /

- NYSE:ONON

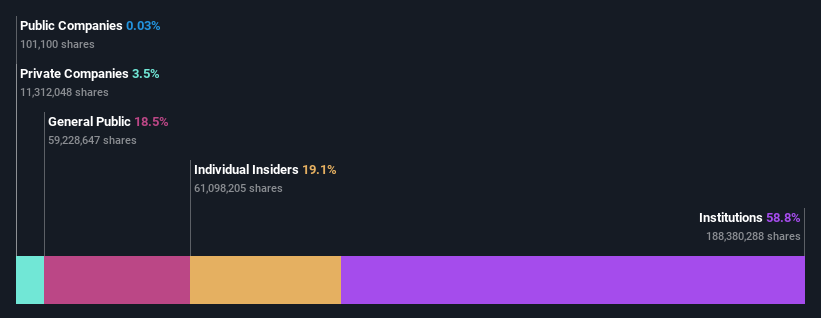

With 59% institutional ownership, On Holding AG (NYSE:ONON) is a favorite amongst the big guns

Key Insights

- Institutions' substantial holdings in On Holding implies that they have significant influence over the company's share price

- A total of 18 investors have a majority stake in the company with 50% ownership

- Insider ownership in On Holding is 19%

To get a sense of who is truly in control of On Holding AG (NYSE:ONON), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are institutions with 59% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

Since institutional have access to huge amounts of capital, their market moves tend to receive a lot of scrutiny by retail or individual investors. Hence, having a considerable amount of institutional money invested in a company is often regarded as a desirable trait.

Let's take a closer look to see what the different types of shareholders can tell us about On Holding.

View our latest analysis for On Holding

What Does The Institutional Ownership Tell Us About On Holding?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

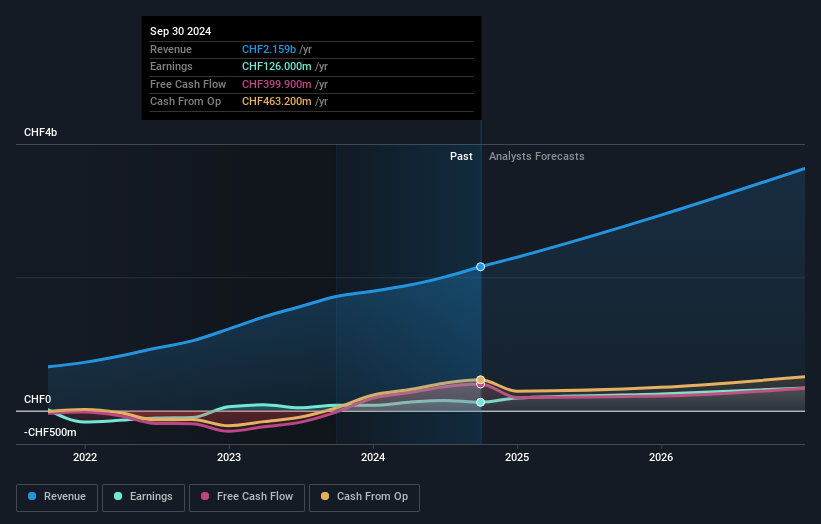

On Holding already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at On Holding's earnings history below. Of course, the future is what really matters.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. Hedge funds don't have many shares in On Holding. Looking at our data, we can see that the largest shareholder is FMR LLC with 8.9% of shares outstanding. With 5.6% and 5.3% of the shares outstanding respectively, Marc Lemann and AllianceBernstein L.P. are the second and third largest shareholders. Furthermore, CEO Martin Hoffmann is the owner of 0.6% of the company's shares.

A closer look at our ownership figures suggests that the top 18 shareholders have a combined ownership of 50% implying that no single shareholder has a majority.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of On Holding

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in On Holding AG. It is very interesting to see that insiders have a meaningful US$3.5b stake in this US$18b business. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

The general public-- including retail investors -- own 19% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

It seems that Private Companies own 3.5%, of the On Holding stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Exceptional growth potential with flawless balance sheet.