- United States

- /

- Software

- /

- NasdaqGS:WDAY

May 2025's Value Stocks Estimated Below Intrinsic Worth

Reviewed by Simply Wall St

As the U.S. stock market navigates mixed performances, with the S&P 500 and Nasdaq extending their winning streaks amid encouraging economic data, investors are keenly assessing opportunities in undervalued stocks. In this environment, identifying stocks that are estimated to be trading below their intrinsic worth can offer potential value plays for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Berkshire Hills Bancorp (NYSE:BHLB) | $26.56 | $51.80 | 48.7% |

| Valley National Bancorp (NasdaqGS:VLY) | $9.17 | $18.22 | 49.7% |

| KBR (NYSE:KBR) | $55.66 | $108.48 | 48.7% |

| Horizon Bancorp (NasdaqGS:HBNC) | $15.77 | $30.71 | 48.7% |

| Insteel Industries (NYSE:IIIN) | $37.01 | $72.18 | 48.7% |

| Bel Fuse (NasdaqGS:BELF.A) | $71.85 | $143.21 | 49.8% |

| Shoals Technologies Group (NasdaqGM:SHLS) | $6.11 | $11.89 | 48.6% |

| FinWise Bancorp (NasdaqGM:FINW) | $14.84 | $29.22 | 49.2% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $421.16 | $823.12 | 48.8% |

| Clearfield (NasdaqGM:CLFD) | $37.47 | $74.54 | 49.7% |

Here's a peek at a few of the choices from the screener.

Datadog (NasdaqGS:DDOG)

Overview: Datadog, Inc. provides an observability and security platform for cloud applications globally, with a market cap of approximately $40.51 billion.

Operations: The company generates revenue primarily from its IT Infrastructure segment, amounting to $2.83 billion.

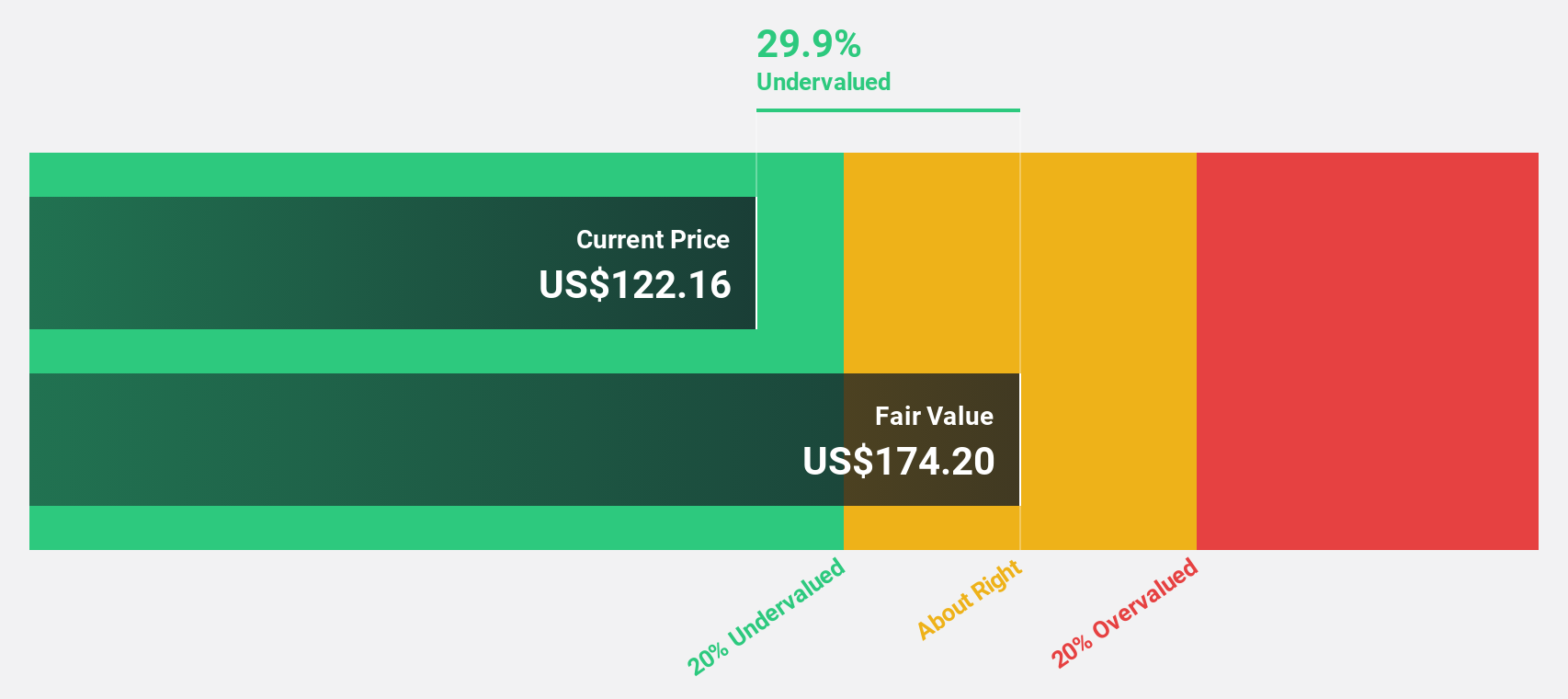

Estimated Discount To Fair Value: 32.2%

Datadog is trading at US$119.09, significantly below its estimated fair value of US$175.69, suggesting it may be undervalued based on cash flows. Despite a decline in net income for Q1 2025, revenue increased to US$761.55 million from the previous year. The company's earnings are forecasted to grow significantly at 24% annually, outpacing the broader U.S. market's growth expectations while maintaining a robust partnership with Chainguard for enhanced security solutions.

- Our growth report here indicates Datadog may be poised for an improving outlook.

- Click here to discover the nuances of Datadog with our detailed financial health report.

Workday (NasdaqGS:WDAY)

Overview: Workday, Inc. offers enterprise cloud applications globally and has a market cap of approximately $72.23 billion.

Operations: The company generates revenue from its cloud applications segment, which amounts to $8.45 billion.

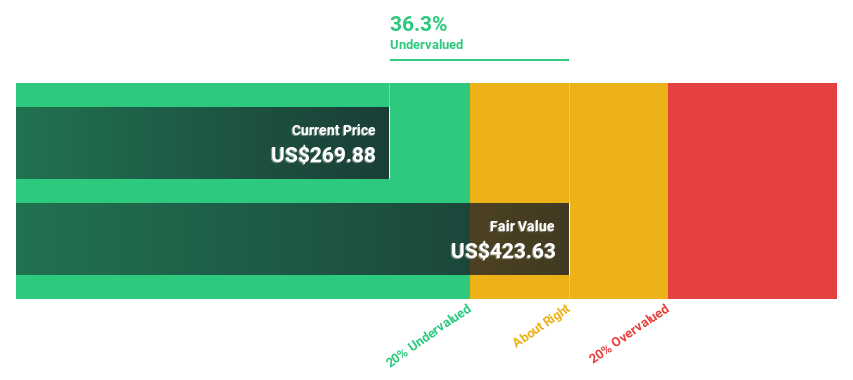

Estimated Discount To Fair Value: 26.7%

Workday, Inc. is currently trading at US$271.17, below its estimated fair value of US$369.83, indicating potential undervaluation based on cash flows. Revenue growth is expected to outpace the broader U.S. market at 11.5% annually, while earnings are projected to grow significantly at 27.2% per year. Recent strategic expansions and partnerships in AI and data integration enhance its service offerings, potentially improving operational efficiencies and financial performance despite a recent decline in profit margins.

- Our comprehensive growth report raises the possibility that Workday is poised for substantial financial growth.

- Get an in-depth perspective on Workday's balance sheet by reading our health report here.

On Holding (NYSE:ONON)

Overview: On Holding AG is involved in the development and distribution of sports products globally, with a market cap of approximately $18.58 billion.

Operations: The company generates revenue primarily from the Athletic Footwear segment, which amounts to CHF 2.54 billion.

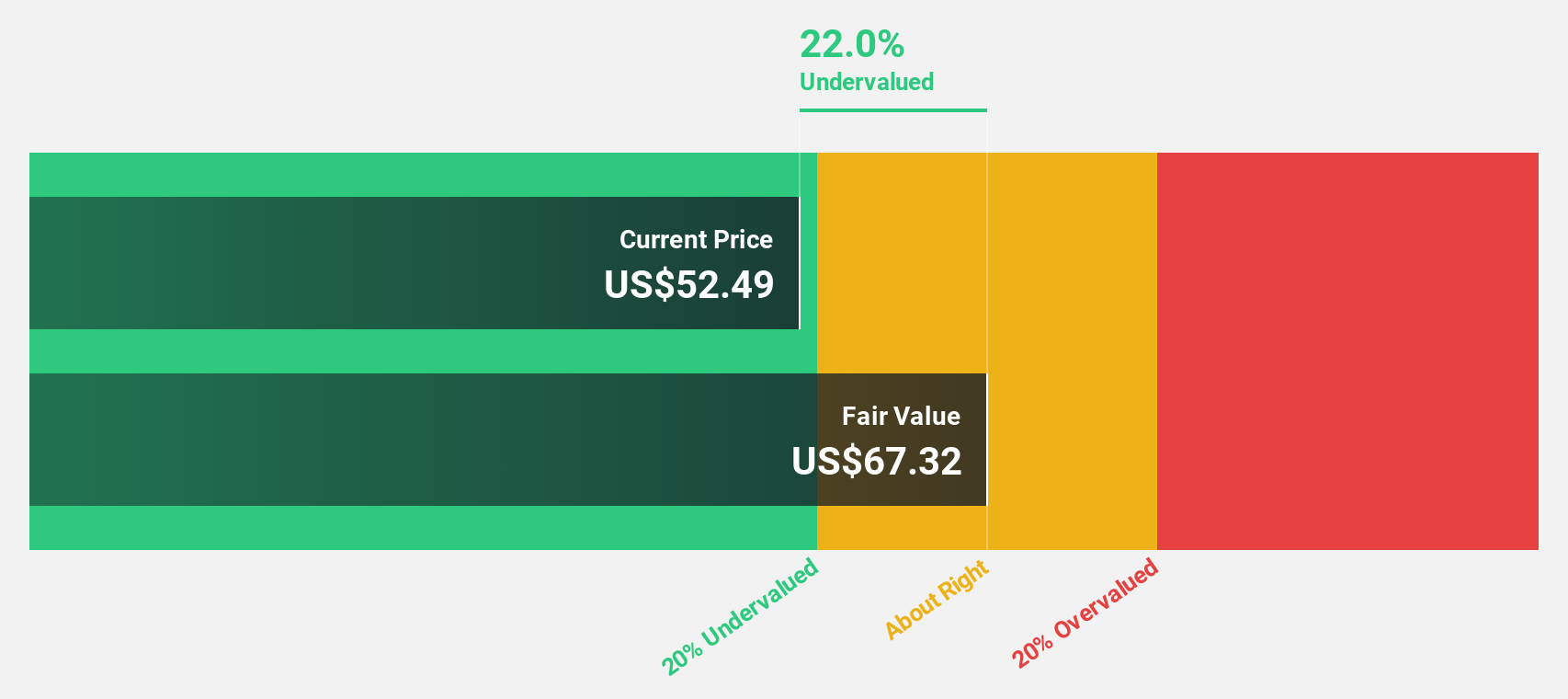

Estimated Discount To Fair Value: 10.5%

On Holding is trading at US$57.59, slightly below its fair value of US$64.34, suggesting it may be undervalued based on cash flows. The company forecasts revenue growth of 17.9% annually, outpacing the U.S. market average, with earnings expected to grow significantly at 22.9% per year. Recent guidance revisions project a strong sales increase for 2025 amid robust global demand, despite a dip in Q1 net income compared to the previous year.

- The analysis detailed in our On Holding growth report hints at robust future financial performance.

- Navigate through the intricacies of On Holding with our comprehensive financial health report here.

Where To Now?

- Click this link to deep-dive into the 173 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Workday, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives