- United States

- /

- Luxury

- /

- NYSE:ONON

How Investors May Respond To On Holding (ONON) New COO and Expanded Innovation Role

Reviewed by Sasha Jovanovic

- Swiss sportswear brand On Holding recently announced that Chief Operating Officer Sam Wenger will step down at the end of 2025, with Chief Innovation Officer Scott Maguire set to take over an expanded operations and innovation role from January 2026.

- This leadership transition comes as On continues to execute rapid international growth, strong multi-category sales, and gains attention amid sector-wide interest sparked by recent Nike earnings.

- We'll examine how the upcoming COO transition could impact On Holding's operational expansion and ongoing global momentum.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

On Holding Investment Narrative Recap

To own On Holding, investors must believe in the company’s ability to sustain rapid international expansion, innovation across multiple categories, and growing direct-to-consumer sales, while skillfully managing premium pricing and operational complexity. The recent COO leadership change appears unlikely to materially impact On’s short-term growth catalysts or immediate operational trajectory, as the transition is set for 2026 with existing strategies and senior leaders remaining in place. However, risks around brand momentum, margin pressure from ongoing expansion, and macroeconomic volatility remain areas to watch.

Among recent announcements, the company’s decision to raise its net sales guidance for 2025 after a quarter of strong sales growth is especially relevant. This signals management’s confidence in sustaining both top-line momentum and operational efficiency, supporting the underlying catalyst of expanding direct-to-consumer reach and product diversification, even as leadership changes approach.

By contrast, one factor investors need to be aware of is that aggressive global expansion and frequent product launches could lead to…

Read the full narrative on On Holding (it's free!)

On Holding's narrative projects CHF5.0 billion in revenue and CHF561.2 million in earnings by 2028. This requires a 22.9% yearly revenue growth and an earnings increase of CHF425.3 million from today's CHF135.9 million.

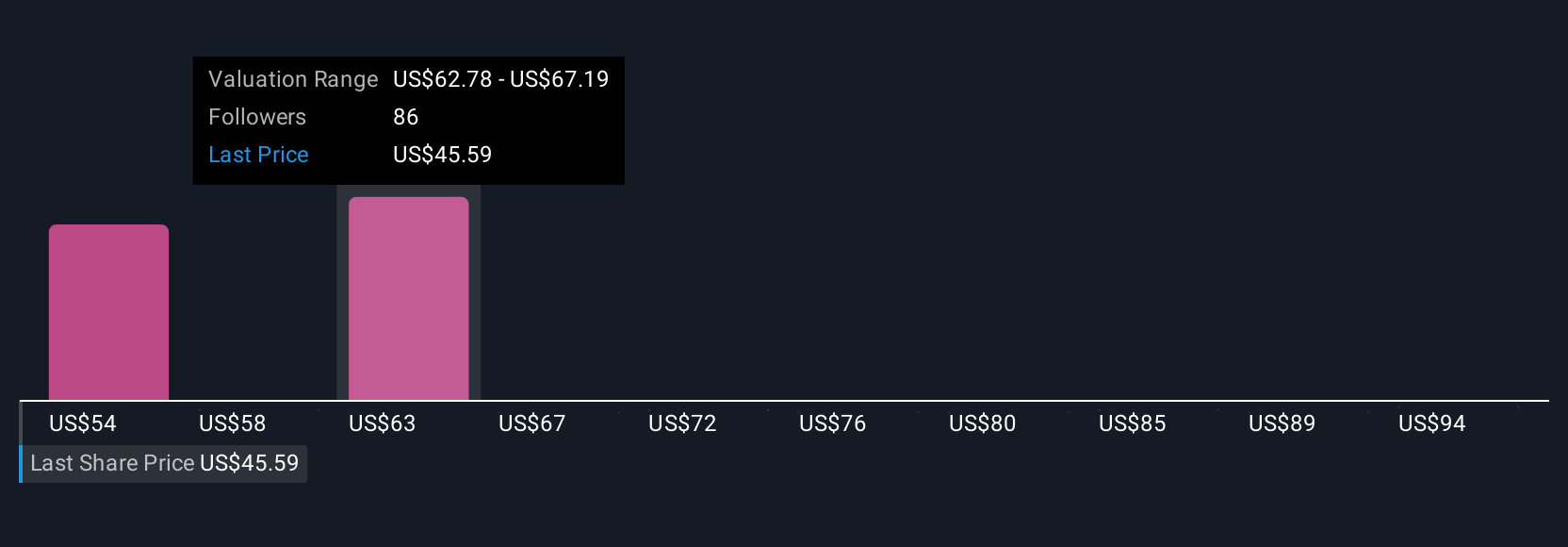

Uncover how On Holding's forecasts yield a $66.76 fair value, a 58% upside to its current price.

Exploring Other Perspectives

Fourteen individual fair value estimates from the Simply Wall St Community range from US$53.38 to US$95.79 per share, showing wide opinion gaps. While some see significant upside, the need for ongoing heavy investment in new markets and innovation could test the strength of On Holding’s profit margins over time, so consider a variety of perspectives before deciding.

Explore 14 other fair value estimates on On Holding - why the stock might be worth over 2x more than the current price!

Build Your Own On Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your On Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free On Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate On Holding's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives